Markets operate in cycles, and it is axiomatic that a bull run will ultimately lead to, at the very least, a bear market decline or a market catastrophe. In November of this year, the current bull market set records for the most extended duration and the highest performance since World War II. A brief market downturn known as the Coronavirus Crash occurred in early 2020. A global epidemic, a tumultuous election season, the second impeachment of the president, and a mob takeover of the U.S. Capitol were all forgotten by early April.

CAPE Has Certain Drawbacks

The CAPE ratio forecasts both precisely after the Great Crash of 1929 and the dot-com crash. Even if it did, investors can't build trading rules based on the CAPE value that tell them exactly when to buy or sell stock. It may be proven correct once more. Or perhaps not.

Forecasting after the fact is one thing; doing so before data arrives is quite another, according to Morningstar's vice president of research, John Rekenthaler. 3 In addition, Shiller himself stated in the early days of December 2020 that stock prices "may not be as ludicrous as some people assume." Shiller 4 His argument was based on the fact that low-interest rates have made equities more appealing at higher prices compared to bonds.

Upward Trend of CAPEs

However, the CAPE for the S&''P 500 has been steadily climbing for over a century, and some argue that this may be a good thing in the long run. According to Arnott, this increasing trajectory made sense to investment manager Rob Arnott of Research Associates when the United States advanced from being essentially a developing market to the world's primary economy.

He says that the earnings multiple for U.S. companies might rise only because of this, he says. According to Arnott's extensive research work, CAPE is currently above its long-term trend line, although the difference is far more negligible than it was in 1929.

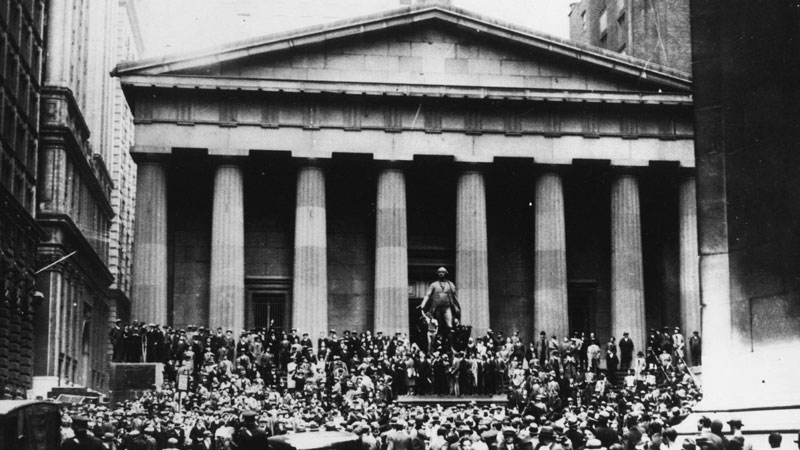

The Crash of 1929

We now know that Robert Shiller's CAPE ratio would have put equities at a record high of 30 immediately before the 1929 crash, even though he wasn't born. In other words, a bull market of around ten years came to an end when the market was trading at a 5:1 ratio. When the dust had settled in 1930, they had returned to this level.

On Oct. 28 and 29, 1929, known as Black Monday and Black Tuesday, respectively, when the Dow Jones Industrial Average dropped 13% and 12%. There has been a bear market for quite some time before this double-whammy. Several explanations were claimed for the Great Crash, some of which are still valid now as they were in 1929.

A rush of investors' irrational excitement boosted the price of stocks to unsustainable heights. There was a belief that the economic boom would never stop. When it came to buying on margin, the most daring investors went all out. On the other hand, interest rates lowered the cost of borrowing, which encouraged speculation.

'Unintended and Unwanted Results'

Starting in 1928, the Federal Reserve aggressively tightened its monetary policy in response to stock market speculation. According to reports, the Fed believed that by doing so, it would be able to keep the speculative bubble in check without causing too much damage to the markets. A current analysis by the Federal Reserve found that it may have contributed to the Great Crash.

After the crash, the Federal Reserve kept money tight, which may have exacerbated and prolonged the financial crisis. In addition, the Fed's strategy in 1929 was to refuse credit to banks that made loans to stock speculators, which contributed to the Great Depression.

The Federal Reserve found that stock market speculation drained money from productive applications that benefitted American industry and trade. According to the Fed's history of the 1929 disaster, identifying and deflating financial bubbles is a challenging task. Restricting investor enthusiasm by monetary policy might have widespread, unforeseen, and unwanted repercussions.

A Guide to Minimizing Crash Damage

The Federal Reserve Bank of New York aggressively injected money into New York's central banks in the aftermath of the worst days of the crisis in October 1929. This included the purchase of government assets in the open market and a reduction in the discount rate on bank loans.

At the time, their acts were widely criticized. President George L. Harrison of the New York Fed has been accused by the Federal Reserve Board of Governors and the presidents of numerous other regional Federal Reserve Banks of exceeding his authority.

In Addition to The CAPE Ratio and Other Stock Market Crash

On September 15, 2008, in response to the financial crisis, the Federal Reserve started an aggressively expansionist economic strategy under the leadership of Ben Bernanke. According to this technique, which relies on enormous purchases of government bonds to bring interest rates down to near zero, the term "quantitative easing" is often used. On the other hand, Greenspan is among those who now claim that the Fed's strategy of loose money has spawned fresh financial asset bubbles.