The Affirm app allows customers to buy at over 11,500 participating businesses online or via the app. Shoppers may use the Affirm app to generate virtual credit card numbers that can be used to make purchases online or in-store at any merchant that accepts Visa credit cards. Customers may complete their purchase by selecting from several payment plans ranging from 4 months to 36 months instead of the typical Pay in 4 option that other rival BNPL applications provide. Continue reading to know about affirm loans review.

The Process of Setting Up an Affirm Account

Affirm accounts can be created and used by any citizen or resident of the United States. When establishing an Affirmaccount, you'll be asked for your phone number, which will be used for verification during future logins. Affirm does soft credit checks to process loan requests, which have no impact on your credit score.

They further claim that your credit score and credit report will have no impact on your chances of being approved for the loan. However, Affirm considers a variety of additional characteristics, such as your payment history and the length of time you've had an Affirm account. In the United States, over 6,500 retailers have partnered with Affirm to provide consumer financing to their customers. It is possible to use your Affirm account from any location on the internet, thanks to the Virtual card function.

Working

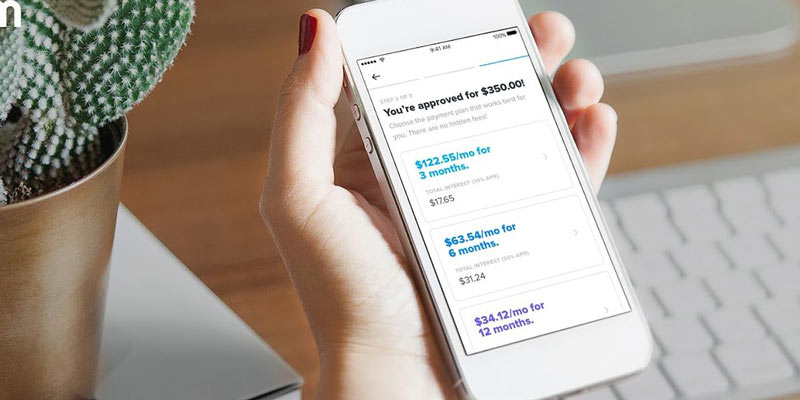

The loan conditions offered by Affirm vary per merchant, which means that your repayment choices and annual percentage rate will differ depending on where you purchase. The majority of repayment plans may be divided into three categories: three-, six-, and 12-month payback plans. In certain cases, shorter periods of one to three months and lengthier terms of up to 48 months may be offered, depending on the amount of your transaction and your credit score. Before you accept a loan, Affirm will show you all of the available conditions.

After your purchase has been completed, your first monthly payment will be due one month later, and the remaining payments will be due on the same day of each month afterward. If you do not qualify for the entire loan amount, you may be required to make an initial payment at the time of checkout. Various interest rates are available on Affirm loans, ranging from 0 percent to 30 percent. The interest rate on most point-of-sale loans is set, and it will not compound over time as it does on credit cards. Because Affirm does not impose fees, there are no prepayment penalties if you pay off your loan early or late penalties if you miss a payment. If you do not make your payments on time, Affirm may report your late payments to the credit bureau Experian, resulting in a worse credit score.

How to Submit an Application for a Loan

You'll know whether you've been accepted or declined for a loan fairly immediately after providing Affirm with some basic information about yourself. Affirm will not alter the terms and conditions to which you have agreed. You should carefully study the small print to determine whether or not you will be able to make your monthly payments throughout the loan's length. You may be authorized for a loan, but you may be required to put a down payment on it in certain instances. If you are refused a loan, you will get an email explaining the reason for your rejection.

Consumers who are undecided about whether or not to apply for a loan may 'prequalify' for one via Affirm, which enables them to see the amount of money they would qualify for if they were to apply. Prequalification for a loan may be done in two ways: either via the app or through the merchant's website. The fact that you have been prequalified does not affect your credit score.

Methods of Payment

Using Affirm, you have the option of paying with your debit card, bank account, or a personal cheque. Additionally, you may set up automatic payments, which is a convenient option if you don't want to remember when your payments are due. You will only be notified if you are late with your payments since Affirm does not impose late fees; therefore, you will only be alerted by emails or text messages if you are ever late with a payment. Affirm may reject you a loan in the future based on your past payment history or default on your loan. This information may be reported to credit bureaus, which may result in a reduction of your credit score.