Introduction

No matter how many exemptions and credits a taxpayer claims, they owe more taxes than the alternative minimum tax (AMT), which sets a floor on their tax burden. Currently, Americans with incomes above specific criteria are subject to an alternative minimum tax in the United States. The AMT Alternative Minimum Tax definition recalculates taxable income using a modified adjusted gross income (MAGI) formula. The amount of taxable income is determined differently from that used for other forms of income. To determine the taxpayer's alternative minimum taxable income, income is increased by the amount of any preferential deductions claimed (AMTI). The amount that is taxable after the AMT exemption is deducted.

What Is the AMT?

This tax applies to those with a high income who may owe little or little tax under the conventional U.S. system. The concept's core is implementing a parallel fiscal system to the existing legal framework. Both determine income tax. Whichever amount is higher, the taxpayer is responsible for paying it.

Reason ForEnacting The Alternative Minimum Tax

In 1986, provisions for the Alternative Minimum Tax were enacted to make Canada's tax system more equitable. Its goal was to limit the number of tax breaks and incentives that helped high-income individuals and trusts pay as little as possible in taxes. Taxes had to be figured out the old-fashioned way for a long time before they became mandatory for individuals. With the implementation of AMT, taxpayers are now forced to calculate their tax responsibilities using both AMT and conventional procedures.

AMT Exemption Amounts

In 2022, a single filer can make up to $75,900 before paying any Alternative Minimum Tax. The amount is $118,100 for married couples filing jointly. The single filing threshold for 2023 is $81,300, while the joint filing threshold is $126,500. To determine if taxpayers owe AMT, Form 6251 must be completed. They begin by reducing their revenue by the exemption amount. In this case, they are excused from AMT payment because their AMT is lower than the exemption. It's vital to note that taxpayers having AMTI exceeding a particular threshold do not qualify for the AMT Alternative Minimum Tax exemption. When filing as a single person in 2022, the phase-out starts at $539,900; filing as a married couple starts at $1,079,800. The phase-out starts for single filers at $578,150 in taxable income in 2023 and joint filers at $1,156,300.

How the Alternative Minimum Tax Works

To calculate a taxpayer's AMT tax liability, start by subtracting his AMT exemption from his taxable income. We get the proposed minimum tax rate (TMT) through this calculation. Suppose the preliminary minimum tax is larger than the taxpayer's annual tax liability. In that situation, they must pay the standard tax and the additional amount required by the law because of the higher preliminary minimum tax. That is, the whole amount of the estimated minimum tax is due from the taxpayer.

AMT rates range from 26% to 28%. Excess alternative minimum taxable income in 2022 of $206,100 or more ($103,050 for married couples filing separately) is subject to the 28% rate. Those with alternative minimum taxable income in 2023, over $220,700, will be subject to the top rate of 28 percent. All earnings above such thresholds will be taxed at 26%. Under the conventional rules, a high-income taxpayer who takes advantage of numerous tax benefits may end up owing a lower tax rate. This would necessitate a recalculation of the taxpayer's tax liability under the alternative minimum tax system, resulting in the loss of some tax deductions.

How to Calculate Alternative Minimum Tax

To determine if you're subject to the AMT, you can either utilize tax software that does the calculation for you or fill out IRS Form 6251. By factoring in things like medical expenses, mortgage interest, and other optional deductions, this form can assist taxpayers in determining if they would exceed an IRS threshold for itemized deductions. The form requests information regarding capital gains or losses associated with the sale of property in addition to certain types of income, including tax refunds, investment interest, and bond interest. For purposes of calculating AMTI, the IRS uses a variety of formulas. To determine what share of this income and these deductions taxpayers must report on Form 6251, it employs a series of specific calculations.

Conclusion

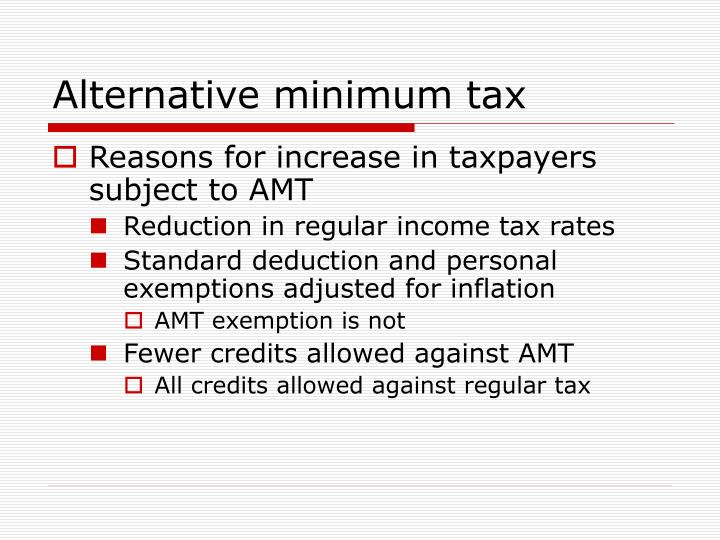

Because of their potential to engage in tax avoidance tactics, the wealthy are a primary target of the Alternative Minimum Tax (AMT) definition. Despite this, the AMT was increasingly impacting taxpayers in the middle class. This is because there was no built-in adjustment for inflation. One of the few things that can be said in favor of the AMT is that Congress did a good job of making it difficult to avoid this tax. To avoid paying the AMT, you must be familiar with how it differs from regular taxation.