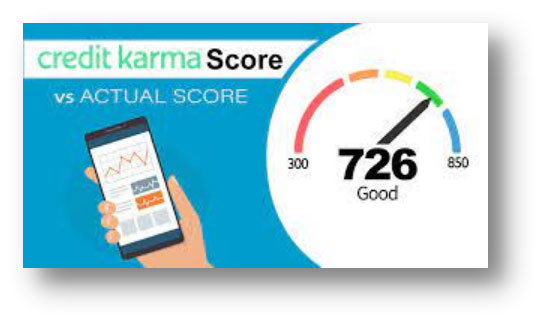

Credit Karma seems to be well for providing free credit ratings and other information to its users. Despite this, the site assures its users that they will have "the possibility to construct a stronger financial future." Personal information, such as your name and the last four digits of your SSN, are required in order to utilize Credit Karma's services (SSN). The Vantage Score provided by Credit Karma score requires access to financial records.

Which is better, the VantageScore or the FICO?

VantageScore is not a credit score like FICO. Fair Isaac Corporation (FICO) is the main competitor in the area of developing creditworthiness models. Even more confounding is the fact that lenders are continually tweaking both models, with varying results.

Both models should score the same. One of the models may priorities unpaid medical bills. Applying for a loan might take time.

Credit Karma also provides a variety of other services

Two main credit reporting organizations, TransUnion and Equifax. A VantageScore-based ranking will be created. Then you'll get your updated VantageScore and credit reports.

Credit Karma also provides related services like security monitoring and credit check alerts. Many of the finest credit monitoring firms provide comparable notifications and services.

Credit Karma lets you search for tailored credit card, vehicle, and mortgage offers without hurting your credit score. For example, "inquiries" include lender queries for your credit score report. Credit Karma limits your inquiries.

Who owns and operates Credit Karma?

Credit Karma was started by Kenneth Lin, Ryan Marciano, and Nichole Mustard in 2007. Lin now leads the company, while Marciano leads technology and Mustard leads sales.

Intuit, the maker of TurboTax, acquired Credit Karma for $8.1 billion in cash and equity in December 2020.

Karma Makes a Profit

Credit Karma's business strategy isn't entirely ethical. In return for your purchasing patterns and targeted advertising, your credit score is provided for free.

Credit Karma tries to get users to click on advertising. In certain cases, these sponsors may pay a commission to applicants.

Advertisers value your personal data. Credit Karma has nearly 100 million users.

In order to better understand VantageScore, what is it?

Despite the fact that the FICO score is definitely a most popular (and nearly every personal financial expert recommends monitoring it), FICO does not gather data. FICO is a credit rating system that takes information from the three main credit bureaus into account.

VantageScore was created by the credit bureaus in the same way. In comparison to other models, VantageScore says it has 30 million more individuals in its database.

It also helps those with a “thin” credit file. This is particularly true for newcomers to America.

How Reliable Is Your Credit Karma Report?

Credit Karma should be trusted for accurate credit ratings.

According to former Chief Consumer Advocate Bethy Hardeman, TransUnion and Equifax provide Credit Karma with ratings and credit report data.

Both credit bureaus use VantageScore. This transparent rating methodology established by the three main credit bureaus was picked by Credit Karma.

In addition, Credit Karma does not collect data from creditors. Credit Karma's ratings and reports are based on TransUnion and Equifax data. These scores are reliable since they are not credit estimates.

Restriction on the Use of Credit Karma

The very first question is whether or not your need Credit Karma's additional services. It also depends on how quickly you want accurate credit information. Remember:

- All three credit bureaus must give you with your credit score &'' report once a year.

- Several banks and lenders allow customers to see their credit ratings on demand. You may access your FICO score and history if you already have any American Express card.

That's usually plenty for most of us. If you're preparing to take out a mortgage, attempting to better your credit score, or want to use Credit Karma's associated services, you might need that access to credit card report.

Credit Karma might be a motivator for borrowing

Credit Karma makes money via advertising and commissions on loans obtained through the site. Despite posing as a trustworthy advisor, the site is incentivized to sell you more loans.

Keeping an eye on your credit score with Credit Karma, not getting advice on how to take on more debt.

Is Credit Karma Actually Free?

Yes. Credit Karma does not charge any fees. To use the site, you will be charged a fee by the company.

Score Range for the Credit Karma Score

Credit score range Karma has a score of 300-850. Their credit ratings are classified as follows:

- Poor: 300-600

- Quite good: 600s-700s

- Excellent/exceptional: 700s+

Is Credit Karma safe to use?

Yes. Credit Karma protects data transfer using 128-bit encryption, which really is virtually hard to hack. It also promises to not sell your data.

Can Credit Karma Be Harmful to Your Score?

No. Credit Karma does not harm your credit. For the credit bureaus, this is a "soft" enquiry. Inquiries that are "challenging" to record include credit checks when applying for a loan.