Bank of America is a very good lender for obtaining a personal loan. Before agreeing to a loan, it is essential to investigate all available alternatives. bank of america personal loan alternatives may provide better rates and conditions. This essay will examine many of these options so that you may make an educated choice. Online lenders are an alternative to personal loans from Bank of America. Several internet lenders provide personal loans that may be sought for and financed wholly online, often at cheap rates and with flexible payback options. Credit unions provide cheaper interest rates but more flexible terms than conventional banks. Peer-to-peer lending platforms are also advantageous since they link borrowers with investors seeking a return on their investment.

Conventional banks, such as Wells Fargo, may also provide personal loans featuring flexible terms and no origination costs. Advances in credit cards are another option, but they carry hefty interest rates and costs. Home equity loans or lines of credit may provide reduced interest rates, but they also include the danger of foreclosure if the debt is not repaid. Finally, borrowing from family or friends is a possibility, but it is essential to have a repayment plan in place to prevent harming relationships. There are other options for Bank of America personal loans to consider. It is essential to evaluate the rates, conditions, and fees of numerous lenders to obtain the best offer and even to consider your credit score as well as financial status when determining which lender is the best match for your requirements.

Internet Lenders

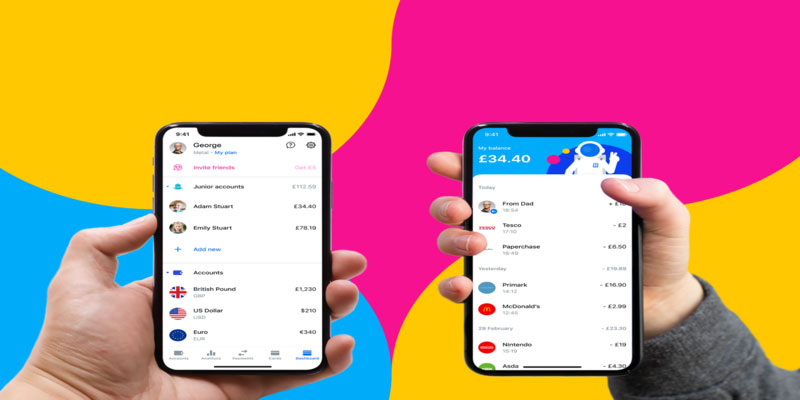

SoFi, LendingClub, as well as Marcus by Goldman Sachs, are examples of online lenders who provide personal loans that may be applied for and financed fully online. Often, these lenders provide reasonable interest rates and flexible payback arrangements. In addition, they may not have the same stringent credit standards as major banks like Bank of America, making them an excellent alternative for consumers with imperfect credit.

Credit Unions

Credit unions are cooperative financial institutions owned by their members that provide a range of financial goods, including personal loans. Credit unions, like internet lenders, often provide cheaper loan rates and much more flexible terms than conventional banks. Also, credit unions may be better ready to deal with borrowers with less-than-perfect credit since member satisfaction is often prioritized before profits.

Peer-To-Peer Lending Platforms

Platforms for peer-to-peer lending, such as Prosper as well as Upstart, link borrowers with investors seeking a return on their capital. These platforms can provide lower interest rates than conventional banks due to their reduced operating expenses. In addition, they may be more ready to engage with borrowers with less-than-perfect credit since investors on these platforms concentrate more on the possible returns of a loan than on the borrower's creditworthiness.

Conventional Banks

Other conventional banks provide personal loans since Bank of America may not be the ideal choice for everyone. For instance, Wells Fargo provides personal loans with flexible payback options and no origination costs. To discover the best offer, it is essential to check rates and conditions from several institutions.

Advances On Credit Card Balances

You might get a cash advance to meet your bills if you have a credit card. While cash advances on credit cards might be handy, they sometimes come with exorbitant interest rates and fees. In addition, interest begins to accrue immediately on a cash advance, making it costly if not repaid fast.

Home Equity Loans And Credit Lines

With a home equity loan or a line of credit, you can tap into your home's equity if you are a homeowner. Although your property secures these loans, the interest rates are often lower than those of personal loans. Yet, they also carry the danger of foreclosure if the loan is not repaid.

Friends Or Relations

This might be a viable choice if a trustworthy friend or relative is prepared to lend you money. Nonetheless, it is essential to have a clear repayment program in place to prevent relationship damage.

Conclusion

While looking for a personal loan, Bank of America is just one of several options. By researching alternatives to Bank of America's loans, you can discover better rates and conditions that meet your financial circumstances. Several choices are available, including internet lenders, credit unions, peer-to-peer lending platforms, conventional banks, or even credit card cash advances and home equity loans. Consider your credit score and financial position while comparing rates, terms, and fees from several lenders to decide which loan is the best option for you.