When it comes to maintaining receipts in the event of an audit, numerous individuals are aware of the need to do so. Paper receipts have the disadvantage of being easily misplaced. Instead of having to go through a box full of invoices at tax time, just upload them to an expenditure tracker app and forget about them. Now are a lot of expenditure monitoring applications out there that do more than just track receipts. Create a budget, issue bills, and keep track of your expenditures and miles by using these features. You may also check your credit report. Almost all of these applications are free or extremely inexpensive. Account transactions need to be able to be synced and categorized in each application. The cost should be affordable, and reporting features should be available to help you better manage your personal and company finances. Below are the Best Expense Tracker Apps:

Best Expense Tracker Apps

Personal Capital

You may use Personal Capital if you’ve got a decent handle on your finances but want to see better graphical representations. As an investment advisor for hire, it has a packed personal financial dashboard that is accessible to anybody who joins up.

Personal Capital records and categorizes every transaction you make on a connected credit or debit card, making it easy to keep track of your spending. The program then displays charts displaying your monthly cash flow, with the opportunity to break down costs by category and dive further into any spending patterns that may be a problem. You can use it to keep tabs on your assets and other aspects of your entire finances, but it’s not the best tool for creating a budget.

QuickBooks

In order to keep track of both your private and corporate spending, many small-enterprise owners use a single expenditure tracking software. Messy records and outcomes are the consequence, as is a lack of comprehension of your financial situation on both sides. Furthermore, if your company is ever sued, having your personal and corporate money mixed up might result in tax issues and affect your personal finances.

Intuit, with its well-known QuickBooks application, is the obvious leader in this market, much as Mint is. Based on the computer and organization demands, QuickBooks has a variety of versions and editions. It’s not flawless, but for the time being, it’s the most popular and finest alternative for consolidating all aspects of your company administration, including accounting, contract administration, and payroll.

Wally

Wally is a comprehensive cost tracker tool that syncs with your bank accounts to understand your spending better. While Wally offers a lot of information about your spending, it also features a social function that allows you to discuss costs with your friends. For instance, if you and a roommate divide the cost of utilities, Wally can keep track of it. Millennials will like the app’s attractive visuals and social features. Please be aware that Wally is only available on iOS.

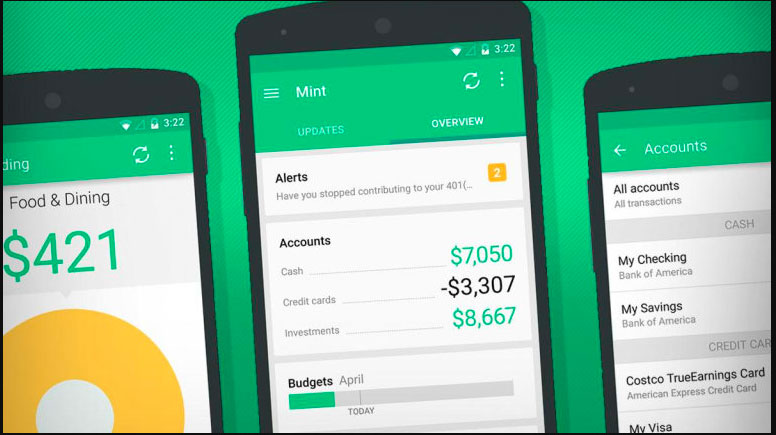

Mint

Mint, one of the top prominent personal finance applications, is a must-have on any list of spending tracker apps. As Mint is completely free, it can be used with a wide variety of banks & lenders, and it’s developed by one of the most reputable brands in financial software, Intuit; it’s an excellent option. Budgeting, cost tracking, credit tracking, and bill paying are all made easier with this application. Even while Mint is a well-established and feature-rich spending tracking program, it isn’t ideal. Since Intuit purchased the program in 2009, there have been a few issues, and new functionalities have been sluggish to come out. It might be difficult to receive help when you uncover a bug or an issue with your account.

YNAB

The acronym YNAB, which means “You Need a Budget,” was coined by Dave Ramsey. The developers of this app put in a lot of effort to create an app that is only dedicated to managing budgets and expenses. The software approaches budgeting from an unusual angle. When a user earns a dollar, they are compelled to give it a job, regardless of whether the money is saved, spent, or invested. It’s for sure a good app to start with.

Mvelopes

How much cash do you have for coffee this month? What about some new clothing? Budgeting and cost monitoring applications are often designed to show you where your money goes after you spend it. To protect you from overspending on your next trip to the shopping center, or Amazon, or anywhere else you prefer to spend extra income, Mvelopes gives expenditure estimates and tips.

In envelope financing, you place money in envelopes at the beginning of every month, and you may spend till the envelopes are empty. Mvelopes bring this experience to the virtual world, allowing customers to save their monthly spending funds in digital envelopes.

Final Words

We looked at a wide range of possibilities before making our final decision on the top expenditure tracker apps. We looked at things like price, compatibility, functionality, the ability to establish goals, and convenience of use, among other things. Finally, we selected these applications for their relevant genres because they provided a good customer experience that distinguished them from rivals.