ETFs, which track oil price as a commodity, offer direct access to the market. This is a different approach than investing in oil stocks portfolio funds. There are significant potential returns from investing in the oil sector. However, there is a growing probability of an economic slowdown or a recession. The Russian invasion of Ukraine has caused oil prices to soar in recent months.

United States Oil Fund

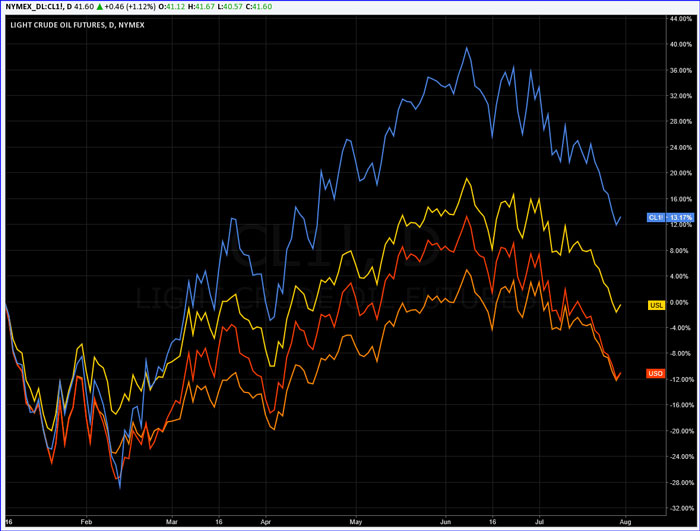

USO is one of the best ways for investors to gain exposure to oil as an important resource. The ETF aims to monitor the percentage change in spot prices of light sweet crude oil each day. The USO price should rise if oil prices rise. USO should fall when oil prices drop. Investors who don't want to invest directly in commodity investing but still desire exposure to oil can find this attractive. USO has a relatively high level of liquidity, with $2.6 billion in its fund as of February 2022. However, its expense ratio is at 0.83%, equivalent to $8.30 per $1,000 invested. Due to poor oil performance, the fund has lost almost 25% of its value in the last three years.

iShares U.S. Oil Equipment &'' Services ETF

It has less direct exposure to oil markets. This fund does not track the oil price directly but instead invests in companies that supply various oil-drilling tools and companies that provide services to oil producers. Investors have a chance to be exposed to oil as these companies' fates are tied to the success of oil businesses. It can help reduce the risk of unsuccessful exploration and volatility in oil prices. The only problem with the fund is it's $147.0 million under management. Shares may not be as a liquid or liquid as investors would prefer. The expense ratio is high at 0.41%, equals $4.10 per $1,000 invested.

SPDR S&''P Oil &'' Gas Exploration &'' Production ETF

It is a fund that focuses exclusively on companies directly involved in discovering and extracting oil. This is an indirect way to invest in oil. Instead of buying oil directly, you can purchase shares in companies that extract and sell oil. When oil prices rise, oil production businesses will experience higher returns. This means that the oil price can still play a part in your investment. These companies can still produce value by finding new resources, which can help protect your investment when oil prices drop.

This ETF has a high liquidity level, with $3.3 billion under management. The expense ratio is low at 0.35%. This means that it costs $3.50 per $1,000. It has also performed better than funds that invest more in oil as a commodity. Over the last three years, it has lost just 7.64%.

Vanguard Energy ETF

Vanguard Energy ETF does not solely focus on oil. This ETF tracks a benchmark index that includes businesses in the energy sector. This covers oil companies and businesses that focus on natural gas or coal. The fund invests a large amount in oil-and-gas-related businesses, such as those focusing on transportation and storage rather than extraction. This gives you greater exposure to the oil industry and may be attractive to investors looking to diversify their portfolios.

This fund has $8.4 billion of assets and is the largest. This fund is also the most affordable, with an expense ratio of just 0.1%, which equals $1 per $1,000 invested. This fund also has a higher performance than any other funds on our index, with a gain of 6.30% in the last three years.

Fidelity MSCI Energy Index ETF

The fund's portfolio includes major oil companies such as Exxon Mobil, Chevron, and other businesses that deal with oil equipment, storage, transportation, and services. The fund's assets total $1.2 billion, making it liquid enough to allow investors to purchase or sell shares without any hassle. It is the second-most expensive fund on our list due to its expense ratio of 0.56, which equals $5.60 per $1,000 invested. It is, however, the second-best performing fund, with a return of 6.08% in the last three years.