To our great good fortune, however, in today's hyper-connected world, numerous tools are available that make it simpler to prepare for retirement. In most cases, they will come complete with guidance, targets, and updates on your progress at your fingertips.

1. Retirement Planner App

This planning app is for Android, which is completely free to download, might serve as a helpful guide. This tool allows you to evaluate different predictions for investing in a conventional IRA, Roth IRA, regular 401(k), or Roth 401(k). The Retirement Planner App also demonstrates how the amount you save now will affect the amount of money you have in retirement. Finally, it enables you to determine if you are progressing toward your retirement objectives or whether you need to reconsider your strategy for the long run.

2. Mint

You may use this well-known and popular free financial tracking application online or on devices running iOS or Android to assist you in establishing and monitoring your objectives for retirement. It is usual to practice using Mint to keep tabs on one's expenditures and budget. In addition, Mint displays one's net worth along with long-term trends and keeps track of one's assets in one area.

In addition, Mint makes it simple to establish monetary objectives, such as targets for retirement savings, by notifying you every month about the status of your savings and assisting you in keeping a visual record of your advancement through graphical illustrations and other visual aids. Although a retirement app could be helpful, it's always a good idea to speak with a professional financial advisor if you have any concerns or questions about the investments in your retirement portfolio.

3. A Strategist for Financial Engines and Social Security

This application may be downloaded from Financial Engines' website at no cost. You are required to submit a very straightforward set of facts, which will then provide suggestions for increasing the amount of money you get from Social Security. The application makes use of mathematical algorithms to remove part of the element of chance involved in determining the appropriate time to begin submitting claims for benefits. It is to your advantage if you or your spouse are willing to be flexible about the time you will begin receiving benefits from Social Security.

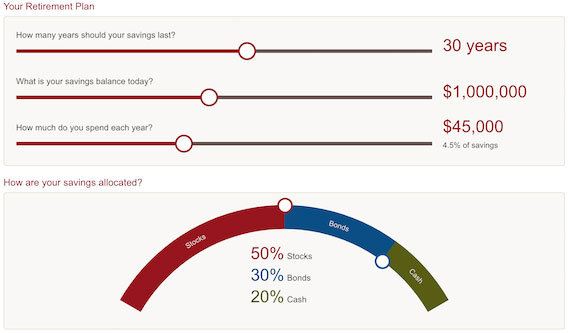

4. Vanguard Retirement Nest Egg Calculator

People who are about to enter retirement or who have already done so may use this no-cost application available online to discover whether or not their savings will be sufficient to pay their expenses for the whole number of years they anticipate spending their retirement. It is rigorously statistical and does a Monte Carlo study to evaluate whether or not the user's retirement savings and portfolio will be adequate to endure for the whole of the user's retirement.

5. A Goal-Oriented Approach to Planning For Retirement

When it comes to the difficult task of preparing for retirement, this free iPad software that relies on behavioral economics may assist you in understanding your preferences and those of others. It dissects the issue into a series of "thinking stages." You will emerge from the program with a customized list of retirement objectives, which you may use to construct your retirement plan or discuss with a financial adviser when you have completed the program.

6. Retirement Outlook Estimator

The process of preparing for retirement may be made more enjoyable with the help of this simple online or free iOS app. After you have provided some basic information, the application will do a "weather report" study of your savings plan and offer you a projected dollar amount for retirement income. Depending on the results, your outlook may be rainy, overcast, partly cloudy, or sunny.

7. ING STRUCT App (For U.K. Residents)

This program stands out from others because, rather than being designed as a tool, it takes the form of a game. The STRUCT board game's objective is to teach players about the ideas of risk, diversification, goal-setting, and progress over the long run. The player can play the game as a risk-averse investor, a moderate investor, or a conservative investor, with the game's components representing cash, bonds, and stock investments.

It is possible that those who are interested in tracking their retirement investments will not find this app useful; however, it helps understand the concepts behind retirement planning, and in assisting people in determining the types of investments and risks they are interested in taking for their financial futures. This software may be downloaded for free on iOS devices. However, it is only accessible in the app store in the United Kingdom.