It's hardly surprising that teenagers and young adults nowadays use banking applications, given how much more tech-savvy they are than we were at their age. But how can you be sure that your youngster is mature enough to manage financial matters independently? Teaching responsibility while yet encouraging individuality may be challenging. Teaching young people about personal finance and budgeting is crucial to their future financial security. Using a banking app tailored for young people is one approach to teaching kids about money management skills like budgeting, saving, and spending. This post will explain some of the most widely used banking applications for children and briefly discuss their features and advantages.

How Kid-Friendly Mobile Applications And Debit Cards Operate

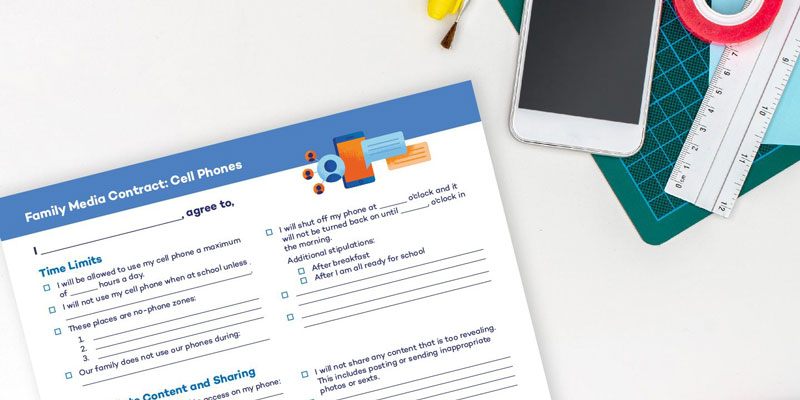

Apps for young people's banking mirror those designed for adults. Both parents and children have internet access to accounts, with the latter having their restricted-access accounts. Most have debit cards that parents may load with money from their accounts. The smartphone applications also allow parents to keep tabs on their children's spending and even put a cap on it, such as $20 per week for eating out. Many applications also provide a place for kids to save money, which may be a significant first step in teaching them how to establish solid savings habits. You may learn more about these four popular applications below:

Greenlight

To help young people manage their money, Greenlight has created a debit card and accompanying mobile software. Having started in 2016 with humble beginnings in Atlanta, Georgia, it has grown to serve millions of households throughout the country. This software was designed to be a pleasant and engaging tool for parents to use while instructing their children in the fundamentals of personal finance. Greenlight's parental controls allow parents to monitor their children's activity, restrict their access to certain features, and more. Automatic allowance payments, goal setting, and fast alerts let parents keep tabs on their child's spending and savings using the app in real-time. Greenlight's primary goal is to make parents feel safe and secure while assisting their children and teenagers in developing financial literacy.

Gohenry

The goHenry Debit Card and accompanying app are a prepaid debit card and kid-oriented mobile banking applications in mind. It's a convenient way for parents to monitor their children's spending, set spending restrictions, and establish guidelines for card use. Additionally, the app features instructional materials that teach young people about financial management and literacy. The option for parents to create and maintain their child's goHenry account is a significant selling point. This includes limiting their child's spending and selecting alternatives for them to use. The app has features like fast alerts and automated allowance payments so that parents can track their child's spending and savings in real-time. goHenry's primary goal is to teach children and teenagers about financial responsibility while giving their parents a sense of safety and stability. Sutton Bank, the issuing institution for the debit card, is an FDIC member, meaning your funds are safe.

Roostermoney

One such software is RoosterMoney, which helps young people (aged 13 to 17) manage their finances. Parents may use it to establish and monitor their children's allowance, chore, and savings targets. Teens and young adults may use the RoosterMoney games and quizzes to learn about personal finance.

Famzoo

The FamZoo software helps parents set up and manage digital bank accounts for their children. To assist kids and teenagers in learning about money management, FamZoo provides tools, including an allowance tracker, goal setting, spending limitations, and instructional materials.

Conclusion

Young people may benefit from learning about financial management and literacy with banking applications designed just for them. These applications are designed to teach children and teenagers about money management by including features like allowance monitoring, spending limitations, and goal setting. Greenlight, goHenry, RoosterMoney, and FamZoo are other popular alternatives. To choose the software that would work best for your family, it is essential to compare its features and costs. Parents interested in teaching their children about financial responsibility may use a modern resource in the form of kid-oriented mobile banking applications, many of which include customized debit cards. Allowances may be easily administered, and children can learn to save and spend (under their parents' watchful eyes, of course). There is no need to physically visit a bank office since they are not your parents' accounts.