Both lump sum and structured settlement payments are tax-free, but the latter grew more common due to several factors. The recipient didn’t have to bother about managing, investing, or controlling enormous sums of money because the payments were "guaranteed," and there were no taxes due on the income.

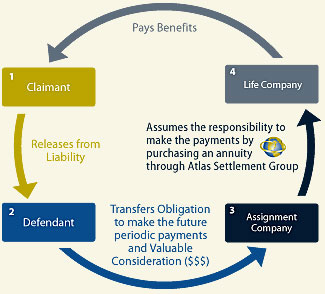

In a "structured settlement payment," an injured party, the family of a deceased worker, or the beneficiary of a workers' compensation award receives a series of tax-free quarterly payments.

Structured settlement payment working?

Legal structured settlement paymentcan either be paid out in a flat sum or through an annuity, a financial product that provides recurring payments. Long-term financial security and taxes are the two most important factors to consider when choosing a settlement.

To avoid losing the long-term financial security that future payments could give, a plaintiff might be tempted to blow their settlement money too quickly if they receive it in the form of a lump sum payout.

In addition, if the lump sum were invested, all interest or dividends earned would be taxed. Contrarily, on the other hand, an annuity is designed to give a steady stream of income to its beneficiary for the remainder of their lives, with any interest or taxes accrued during that time growing tax-free.

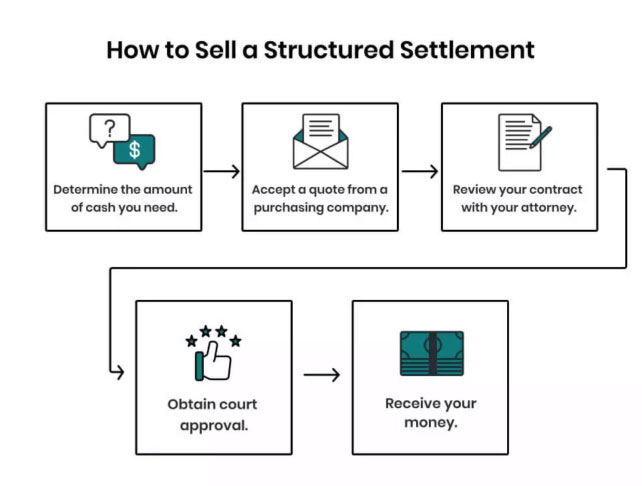

How to sell structured settlement payment:

To get the best price , you should consult with an attorney or financial advisor familiar with the secondary market for structured settlements. They will assist you in finding a reputable factoring firm that has a history of preserving its clients' long-term interests.

The Structured Settlement Payment Protection Acts are a set of state statutes enacted to safeguard those who have received structured settlement payments against predatory structured settlement buyers. Depending on the conditions of your structured settlement and the rules in your state, it may be possible for you to sell it. You must also get a judge's approval before anything of sale for your safety.

A court must approve every sale of a structured settlement payment. No matter if you're selling a piece of your structured payments, your entire structured settlement, or just some of them, the court will weigh the pros and disadvantages of the deal, including whether or not you'll be unable to make ends meet if the sale goes through.

What are the options for selling structured settlement payments?

Structured settlement payment can be factored or sold to a reputable factoring company. You must do your homework and get bids from as many reputable settlement purchasers as possible.

Pros &''' Cons of a structured settlement:

Many distinct situations are well-suited to a structured settlement payment. If you're going to make any financial investment, you should weigh the advantages and disadvantages of the many options.

Pros of Structured Settlements payment:

- Payments are not subject to taxation (tax-free).

- If the recipient dies, the beneficiary can still receive tax-free payments.

- Payments can be set up to begin immediately or be postponed for an unlimited number of years. Future lump sum payments or benefit increases can be included.

- While significant purchases can be tempting, spread-out payments ensure that there will be money in the bank for future purchases. If the recipient has a long-term medical condition, this is extremely useful.

- Structured settlement payments, unlike stocks, bonds, and mutual funds, are not affected by market fluctuations.

- A structured settlement is often more advantageous than a lump-sum payment because of the interest your annuity may accrue over time.

Cons of Structured Settlements payment:

- You will be powerless to change the terms once they have been agreed upon. There is no way to change the terms of your financial status or the general economy.

- Emergency funds cannot be accessed immediately, and recipients cannot invest a lump-sum payment in other assets with more excellent rates of return.

- You can sell your structured settlement paymentpayments if you need immediate cash, but these payments will be discounted. Therefore, the money you get from selling the prices is less than you would have earned from future costs in terms of cash.

- The costs of establishing a structured settlement or lump-sum annuity may not be disclosed in all states.