Collateralized loan obligations (CLO) are investment vehicles that are backed by a pool of loans. They are called "collateralized loans." They are loans that are repackaged and sold to investors as CLOs, which is what they are. In some ways, they are like a collateralized mortgage obligation (CMO), but the loans used as collateral are loans instead of mortgages.

What are collateralized debt obligations (CODs) is answered as CDO credit risk is unique in that it is usually assessed based on a probability of default (PD) that comes from the ratings of the bonds or assets that make up the CDO.

It takes a long time for the tranches that are safest and most senior to lose their money if someone else doesn't pay.

The CDO Process

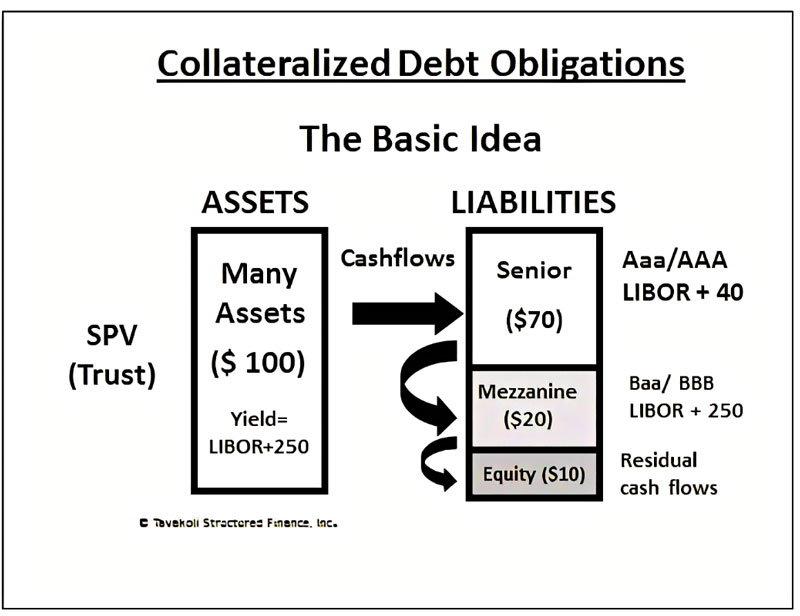

A CDO is a group of cash flow-producing assets that are repackaged by investment banks into separate classes, or tranches, based on the level of risk the investor is willing to take. They also make collateralized bond obligations (CBOs) and collateralized loan obligations (CLOs), which both make investments-grade bonds backed by a pool of high-yield but low-rated bonds, and they make single securities backed by that pool of debt.

- Securities firms, which choose the collateral, make the annotations into tranches as well as sell the others to investors.

- They are called "CDO managers." They choose the securities and often run the CDO portfolios.

- Rating agencies, which look at the CDOs and give them credit ratings, do this.

- Financial guarantors, who promise to pay back investors who lose money on tranches of a CDO in exchange for premium payments.

- In this case, people who own things like retirement funds and hedge funds.

CDO Structure

As a general rule, those who have the most money in a deal are safest because they can get their hands on all of the collateral first. Even though senior debt is normally rated higher than junior debt, it has lower coupon rates. The junior debt, on the other hand, has higher coupons (interest) because it has a higher risk of default. Because they are more risky, they usually have lower credit ratings.

The dangerous parts of synthetic CDOs are called different thingsThey are shown in the sample below with their Standard and Poor's (S&P) credit ratings. But the structure of each individual product is different.

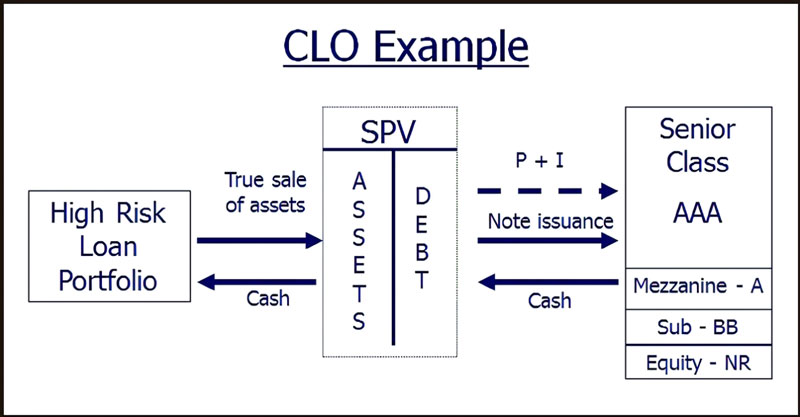

Collateralized Loan Obligations

Investors can choose which tranche fits their risk and reward profile. The better the tranche is rated, the less risky and the lower the return will be. Toward the other end of the scale, the equity tranche has the highest risk of defaulting and the highest rate of return.

The majority of the loans in a CLO are first-lien veteran bank loans. It's not the only type of loan you can find in a CLO. There are also second-lien and secured loans. Each time a borrower pays back a loan, the money is put together and given to investors, starting from the top of the tranche and going down until everyone has a share.

In a CLO, each tranche is a component of the company, and it tells which people will get paid first when the loans are paid. It also determines how risky the investment is because investors who get paid last have a greater chance of getting their money back from the loans that they invest in. They have less risk in general, but they get smaller interest payments. In the long run, investors in later tranches may get compensated last, but the interest costs are higher to make up for the risk of not getting the money.

Loans in a CLO

It is the distinction between how much your home is sold and how much you owe it. The reason it's so essential to make it clear that the short sale cancels all of your mortgage debt because the bank can hold you responsible for the difference if you don't.

You might be better off giving them the undertaking or going bankrupt instead of owing the bank a lot of money.

Conclusion

Many people think short selling is terrible because some short sellers have used unethical methods to make stocks lower in price. But when used in the right way, short selling can help the financial markets run smoothly. It is because short selling adds liquidity to the market.