Before we start certified check vs cashier's check, lets learn about check. Check is the new form of payment that is also getting obsolete. Check fees are still widely popular, but their popularity is low every day. People nowadays use online methods to pay money. Business transactions also transfer to online strategies, and checks are getting old. Online forms are safer and faster, and people want to do things fast. That's why online methods are preferred over the old ways.

Check

A check is a document that tells the bank to pay a person money on whose name the statement is issued. Bank pays the person who has the check, and the money is produced from the account of the person who administers the check. Check mainly has dates, the amount in numerical and word formats, and signature—a statement issued by the person who has an account in the bank with the required money. If the money is not available to check is bounced.

There are several types of checks based on their executions. Each type of check has a different payment method, but they all do the same thing, providing an easy transaction. A check was the modern type of transaction method introduced after the invention of banks. Still, now it's also becoming obsolete, and people are going towards online transactions. There are several check types, but today we will only talk about certified and cashier's checks.

Certified Check

A certified check is a type of check that is very close to a personal statement, but in a certified check, a person's account is verified firsthand by the bank if it has the required fun or not. The bank verifies the amount inside the account and then verifies the person's signature. If the bank account doesn't have any money, the bank doesn't prove the signature.

A certified check is used because it is safer than a personal check. A personal check is given without any verification, and the person who gives the statement might not have any money in the account, and the bill might bounce. Therefore, a certified check guarantees that the person had a certain amount in his statement when issued the check.

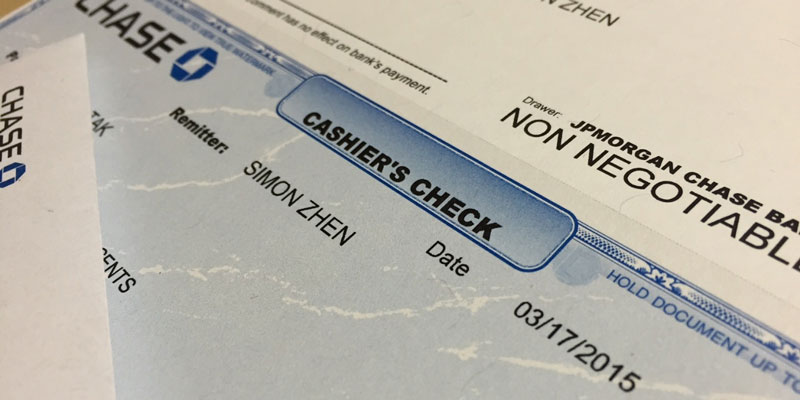

Cashier's Check

A cashier's check is issued with the guarantee of your financial institution. The bank verifies the account holder's signature after ascertaining the amount in his account. The bank guarantees to give money when the person comes in to collect the money. The bank guarantees this check, and if the account holder's account doesn't have money, it is the bank's responsibility to fulfill your request.

A cashier's check is very safe as it guarantees the person that he will receive the amount against the statement. Such a guarantee is not available in any other kind of check. Bank doesn't provide you any guarantee in any additional check, and it is only offered against a cashier's check.

Certified vs. Cashier Check

A certified check provides the guarantee of the account holder, but on the other hand, a cashier's check provides the guarantee of the bank that the check won't bounce. The fee on a cashier's check is higher than a certified check because it has more safety than the other one. The cashier check is the safest form of transaction, and most people recommend it. Against a cashier check, you have to pay $20, ad against a certified check, and you have to pay a $15 fee. A cashier's check is a guaranteed payment.

In most check-based business transfers, a cashier's check is recommended to guarantee the safety of both parties. It provides the person receiving the check a safety guarantee to receive the amount against the check. It reduces the risk factor of the check.

Conclusion

Each type of check has its value and is used for different purposes. If we look into the above discussion, we can say that a cashier's check is the safest form of transaction as it provides a guarantee to the check receiver that he will get the money in the end. You can use the type of check you want as every check has its purpose, but if we think about the most secure check for a transaction, it is a cashiers check.