Introduction

If you cause an accident with another vehicle, have your car stolen, or sustain some other damage, your auto insurance will cover the costs associated with the other driver's medical care and vehicle repairs. Policygenius's articles are always written with the utmost objectivity and honesty, thanks to the site's diligent editorial staff. Your auto insurance will pay for the repairs to the other driver's vehicle and medical bills if you cause an accident that results in either of those outcomes.

Several insurance plans include coverage for vehicle theft or damage. Getting financial support from your car insurance requires filing a claim. If you file a claim and are successful, you will receive payment up to the limit of your insurance. In many jurisdictions, as well as a common financing requirement, auto insurance serves as a regulatory and creditworthiness function.

What You Need to Know About Auto Insurance

In exchange for the insurer's promise to cover the policyholder's financial losses caused by insured events, the policyholder pays the insurer a premium. Customize your level of coverage within a price range that works for you, thanks to the flexibility offered by individually priced policies. Most policies are valid for six or twelve months and can be renewed if necessary. A policyholder will be notified by their insurance company when it is time to renew and pay a new premium.

Almost every state requires drivers to have bodily injury liability insurance, which pays for medical bills and funeral expenses related to injuries and deaths you or another driver cause while operating a motor vehicle. Property damage liability may also be required, which pays for repairs to other people's cars or other property if you or someone driving your car damages it.

Medical payments insurance, also known as personal injury protection (PIP) insurance, will cover the cost of medical care for you and your passengers if you are injured in a car accident. There are many places where this is legally mandated. Your lost wages and transportation costs will be covered. It is important to have uninsured motorist coverage in case you are involved in an accident with someone who does not have auto insurance. Underinsured motorist coverage will kick in to protect you from financial ruin when you're involved in an accident with a driver who only carries minimum liability insurance.

How to Compare Online Auto Insurance Quotes in Minnesota for the Best Rates

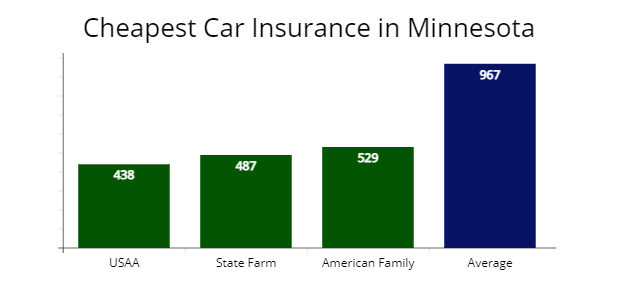

Many want to know, which zip code in Minnesota has the cheapest car insurance rates. Online auto insurance quotes are quick, simple, and accurate with most Minnesota insurance companies. When comparing prices, make sure you are using the same ranges. Consider purchasing $100,000 in bodily injury liability insurance and comparing rates. Use the same precise amount for all service providers when making comparisons. To get an idea of the going rate for auto insurance in Minnesota, you can use MoneyGeek's calculator without providing any further details about yourself. However, we'll need more details to provide you with a personalized quote. The cheapest car insurance in Minnesota for the basic minimum of coverage are USAA, AAA, and Farmers. Among these businesses, you'll find a wealth of information with which to begin your investigation.

Best Car Insurance Companies in Minnesota

Whats the cheapest car insurance in Minnesota? USAA and State Farm are Minnesota's best vehicle insurance companies because they offer competitive prices, a wide range of coverage options, and responsive, helpful customer service. We also consider the results of the Auto Insurance Claims Satisfaction Survey by J.D. Power and Associates. Since USAA only offers auto insurance to current and former military members and their families, this company is off-limits to the general driving public. Vehicle-Owners is another excellent Minnesota auto insurance company because of its low rates and helpful representatives.

It's important to consider both the quality of their customer care and the price of their policies when comparing auto insurance companies. Those who purchase the minimum required level of auto insurance in Minnesota do what the law requires. Collision and comprehensive coverage aren't included in liability insurance. Carrying more than legally required car insurance may be necessary, even though carrying less insurance would save money.

Minnesota Auto Insurance Requirements

In the state of Minnesota, drivers are required to carry the following forms of liability insurance:

- Liability caps for physical harm are $30,000 per victim and $60,000 per incident.

- Damage awards are capped at $40,000 per incident.

- Bodily injury liability per incident is $10,000 in court.

- We will pay up to $50,000 for any damage caused by an uninsured driver and up to $25,000 if their insurance policy does not cover them.

Although these minimums are mandated by law, you should consider increasing your car insurance coverage. Without adequate coverage, you could be responsible for paying costly medical bills following an accident.

Conclusion

Minnesotan drivers have access to a variety of low-cost auto insurance options. Minimal coverage costs less because the risk to the insurer is lower than for comprehensive protection. However, affordable full-coverage insurance is still available in Minnesota by contacting the following businesses. The average premium for car insurance in Minnesota is significantly higher than the rates offered by these businesses.