Introduction

A 401(k) is a tax-advantaged retirement plan set up by an employer. You can put money into this account by putting a certain amount of your paycheck into it. One of the best things about a 401(k) plan would be that employers can match what you put into your account to a certain point. The IRS limits how much you can put into your 401(k) each year, but employer games do not count toward that limit. But there is a higher yearly cap on contributions as a whole, including contributions from employers.

When your employer matches your 401(k) contributions, they add a certain amount to your retirement account based on how much you put into it each year.

Depending on the rules of your contractor's 401(k) plan, your employer may match your donations to your retirement savings in several ways. Most of the time, employers match a certain percentage of what employees put in, up to a certain amount of the total salary. Employers may sometimes choose to match employees' contributions up to a certain dollar figure, no matter how much the employee makes.

Employer Match Explained

There are several ways to know that: does my employer's 401(k) match count toward my maximum contribution? Even though the word "match" can make it sound like they give the same amount as you, that's usually not the case. Sometimes, they'll decide to put in only a certain amount of what you put into your 401(k) (k)—for example, matching only half of the money you give. Even if they match 100% of what you put in, they may only do so up to a certain amount, which could be a dollar amount or a percentage of what you put in or make.

Employers use one plan to match your contribution 100 percent, but only up to a certain proportion of your salary. For example, you make $40,000 a year, and your employer will match up to 6% of your salary, or $2,400, of your contributions. For your company to put in the maximum, they would need you to put in at least $2,400. Remember that your employer won't match the extra if you put in more than that.

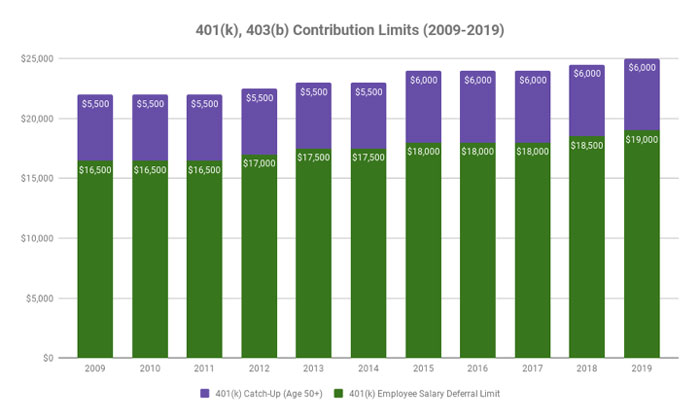

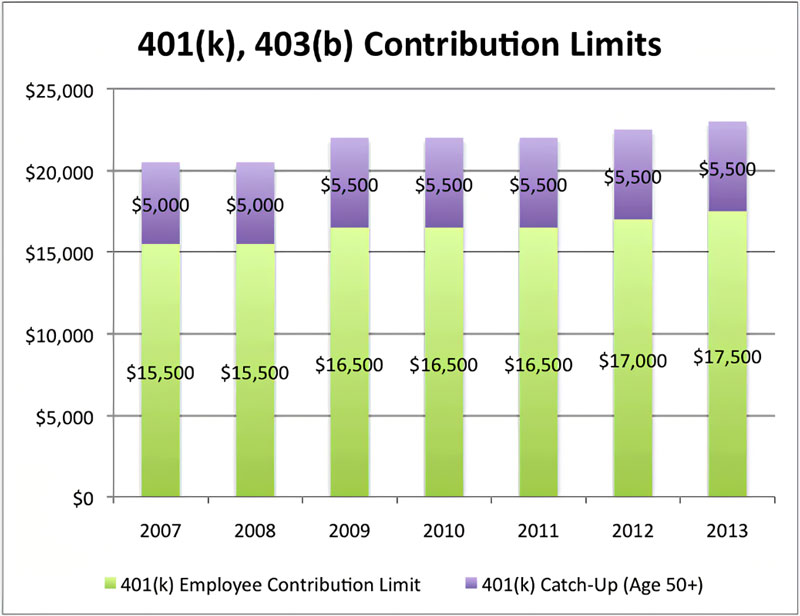

Understanding 401(k) Plan Contribution Limits

The 401(k) plan and its variants are lengthy savings plans that help people save for retirement. The IRS says they are qualified plans, which means that the worker, the employer, or both can get some tax breaks from them.

Employees usually get a tax break because their contributions are taken out of their gross income, not their net income. That makes less money available for spending. Less take-home pay implies lower taxes, which softens the blow, and the cash goes into such an investment portfolio week after week, constructing long-term net worth.

How Matching Works

Let's say your employer will match all of your contributions, up to 3% of your annual salary, dollar for dollar. If you make $1 million a year, the most your employer will put in is $1,800. To get the most out of this benefit, you must also put in $1,800 if you put in more than 3% of your salary.

Most of the time, people use a partially perfectly matched scheme with an upper limit. Let's say that your employer matches 50% of what you put in, which could be up to 6% of your annual salary. If you make $60,000 a year, the government will match your contributions up to 6%, or $3,600. But your employer only compares half of what you put in, so the maximum amount they can match is still $1,800. To get the full benefit of an employer match, you must put in twice more to your retirement account.

401(k) Vesting Schedules

Besides looking over your 401(k) plan's matching requirements, you should also learn about your plan's vesting schedule. A vesting schedule tells you how much of your employer's contributions you own based on how long you've worked there. Even if your company has a very generous matching plan, you may lose some or all of your contributions if you leave your job before a certain number of years have passed, whether you leave on your own or are fired.

Remember, though, that any money you put into your 401(k) account will always be 100% vested and can never be lost.

Conclusion

Traditional 401(k) plans let people who work for big companies invest and save money before taxes are taken out. Some employers match what their employees put up to a limit. The IRS limits how much you can save in a 401(k) every year, accounting for inflation each year. Traditional 401(k) plans limit how much an employer and employee can put into the plan together. Employees who don't work for a company can also save for pension through 403(b) plans, 457 plans, and the Thrift Savings Plan.