Within the realm of technical analysis, the MACD divergence is often used by traders. The objective is to seek out new avenues for making money. Before trading based on this signal, you need have a thorough knowledge of the MACD divergence concept.This post will cover the MACD divergence and how you can utilize it to help locate potential trades. The MACD divergence will be discussed in relation to other technical analysis tools, including moving averages and Bollinger bands. Avoid making any MACD divergence-based trades until you've finished reading this piece.

What Is MACD Divergence?

Technical analysis uses the MACD divergence to predict possible changes in the market. The MACD indicator is said to be diverging when the MACD line and the signal line start going in different directions. This indicates that the price is no longer following the momentum and will most likely continue moving in a new direction.Indicators like the MACD divergence may help you determine whether or not now is a good time to purchase or sell. It would be best if you did all in your power to not depend solely on it and utilize it simply as a supplement.

How Do You Trade MACD Divergence?

In order to use MACD divergence in trading, you must first notice that the prices of the underlying investment and the MACD are different. This is essential before engaging in MACD divergence-based trading. A market divergence occurs when a security's price moves in one direction while the MACD moves in the other.When you see a price discrepancy, you can purchase or sell the associated stocks. To put it simply, right now is the best moment to buy. If you want to sell, wait for the MACD to make a bearish crossing below the signal line.

The Problems With Trading MACD Divergence

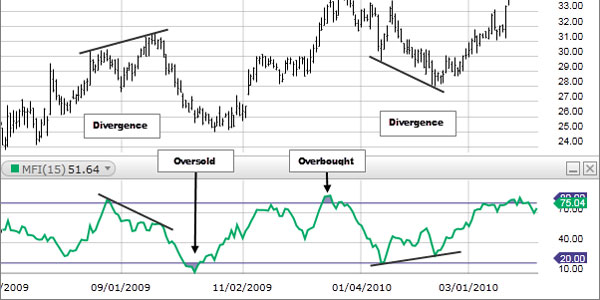

If you know what you're doing, MACD divergence trading could be profitable for you. First, a price divergence might signal that a trend is set to shift, although this is not always the case. Second, MACD divergence may also give out misleading signals, so you must be extremely cautious while trading. Divergence may be used to illustrate overbought and oversold levels, although it is not the only indicator that can accomplish this.

The convergence-divergence indicator based on moving averages is another tool that could be used for this purpose. If you want to trade based on MACD divergence, you need to know a lot about the problems and have a sound strategy for dealing with them.

A Better Way to Trade MACD Divergence

There is a more fruitful technique to trade that does not use MACD divergence, but that is not the topic of this post. You may find that volume-based indicators help you optimize your trade settings and maximize your profits.Conversely, volume indicators look at the total number of trades rather than the market's overall trend. They are more dependable than the MACD divergence indicator since price changes do not influence them. Volume-based indicators may help traders avoid losing money on transactions and boost their returns on average.

How to Use MACD Divergence in Your Trading

Here's how to use MACD divergence in your trading:We can see this discrepancy between the price and MACD lines. There is a loss of momentum when the price reaches a new high, but the MACD line does not. The price movement can reverse as a result of this. In contrast, a new low in price and a new high in the MACD line indicates that momentum is increasing. This may indicate that the current trend will continue.Use divergence as a method of verification. In order to use divergence as a trading signal, you must first wait for the price to break out of the pattern it has been forming in.

How to Spot a Fake MACD?

If the divergence signal from the MACD is bullish, you could be inclined to trade based on it. You risk losing money if you rely on your trading choices on a divergence that turns out to be a false indication.Reviewing the chart's price movements might reveal a fakeout if you know what to look for. A price movement following the divergence in the other direction is likely a false indication. Extra caution should be used when trading on divergence indicators to ensure the signals are real and not simply false alarms.

Steps to Trading MACD Divergence Successfully

Using MACD divergence effectively requires that you take specific steps. Identify the instant when the two routes begin to diverge from one another. The direction the divergence is heading in will tell you the next step. You'll inevitably have to attend to matters over there.Generally speaking, this occurs often. Use the internet as a learning tool to teach yourself everything. Do your homework thoroughly before starting any new venture.

Conclusion:

Profitability in trading is directly proportional to one's familiarity with MACD divergence and the methods by which it may be used to one's advantage. Just because the MACD divergence seems simple to use does not mean you should start using it right now. This indication might have a significant impact if applied properly. To make more lucrative selections, you need to understand when this signal indicates that the market is not suitable for trading and when it indicates that trading is appropriate.Despite the time and effort required to master the MACD divergence, the payoff is well worth it. This indicator may assist traders with even a small amount of expertise in the market make more informed judgments, which can be the difference between profits and losses.