Since it started offering student loans in 2015, Earnest has been the best place to refinance them. In 2019, the company added private student loans to its list of services. Today, the company has many different personal student loans to choose from. Earnest gives loans to students and parents in almost every state, but people who live in Kentucky and Nevada can't get refinance loans. Earnest doesn't provide private student loans to people in Nevada either. Borrowers can choose between four main ways to pay back their loans, and while they are paying back their loans, they may be able to use many forbearance and deferment programs. So here, we will perform a complete earnest student loans review.

Pros

- Nine months of grace

- There are loans for undergrads, grads, parents, and professionals

- There are no fees for paying early, being late or starting the loan

Cons

- A credit score of at least 650 is needed

- There is no way to refinance student loans with a co-signer

- For private student loans, there is no way to get a co-signer off the loan

Earnest Undergraduate Student Loan Specifics

Amounts and Conditions of Loans

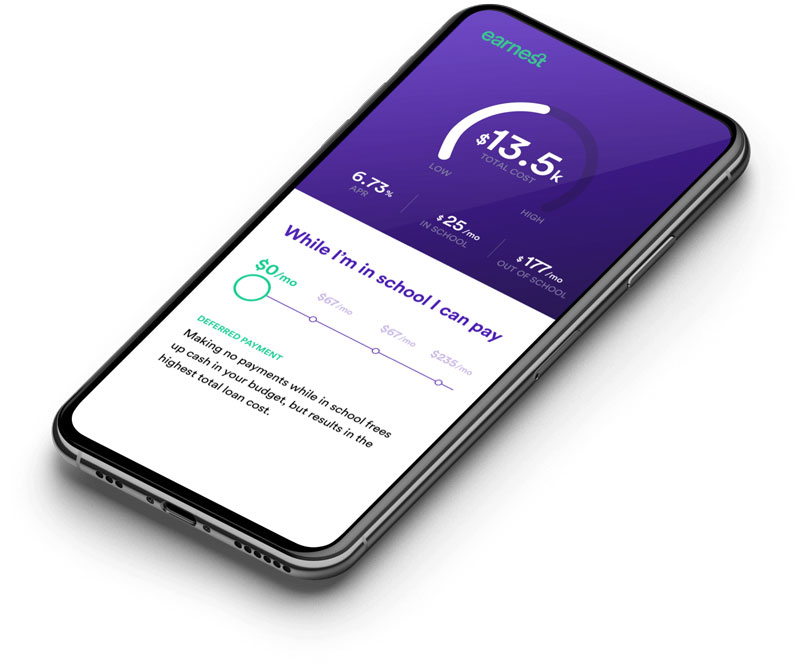

Undergraduates can avail at least $1,000 and as much as the full cost of going to school. When you choose your loan and are approved for it, you can also decide how long it will take you to pay it back. This can be anywhere from five to fifteen years. Private student loans from Earnest are not available to people who live in Nevada. Earnest is different because you don't have to choose from a set of terms for paying back your loan. Most private lenders give you a set amount of time to pay back a loan, like five, ten, or fifteen years. Earnest has "precision pricing," which lets you choose exactly how many months you want to pay back your loan based on how much you want to pay each month. You don't have to choose between 10 and 15 years.

Charges for a loan

As of April 29, 2022, the fixed interest rates for Earnest student loans range from 3.49 percent to 13.03 percent, and variable interest rates range from 1.19 percent to 11.69 percent. Rates can be found on Earnest's website. Earnest also stands out because it doesn't charge any fees. Borrowers won't have to pay any fees for being late, starting the loan, or paying it back early. If your loan payment can't be made, the company will charge you an $8 returned payment fee.

Details about an Earnest Refinance Loan

Amounts and Conditions of Loans

Loans as small as $5,000 (or even $10,000 in California) can be refinanced by Earnest. You can refinance up to $500,000 worth of debt. Before you finish the paperwork for your loan, you'll choose a repayment term between 5 and 20 years. Like with Earnest's private student loans, you can select the exact number of months for when you pay back the loan. Earnest does not offer to refinance loans to people in Kentucky or Nevada.

Charges for a loan

As of April 29, 2022, Earnest's variable APRs range from 1.74 percent to 7.99 percent, and its fixed APRs range from 2.74 percent to 7.99 percent. On refinanced loans, Earnest does not impose origination, late, or prepayment penalties. This is the same as with their private student loans. If you can't make your loan, you'll have to pay an $8 returned payment fee.

How to Apply for a Student Loan from Earnest

Using the prequalification tool, you can find out if you can get an Earnest loan. To see whether you're qualified as well as what interest rates you might expect, you'll have to provide some basic information regarding yourself. If you want to keep going, you'll have to fill out a full application. You'll need the following information for an application:

- Permanent address

- Information about the school and when they expect to graduate

- How much money do you need

- Information about jobs and income

Once your application is complete, Earnest will send your information to your school so you can get certified. This makes sure that all of the information on your application is correct. It might take a few weeks to make sure your data is accurate.

Final Verdict

Earnest has competitive interest rates, no fees, and a longer-than-average grace period for paying back private and refinanced student loans. Borrowers can also choose how to pay back the loan. For example, they can skip a payment, pick their due date, or set their repayment schedule, right down to the number of months. With clearer eligibility requirements than most lenders and a prequalification tool, it's easy to see if you might get a loan from it and what terms you might be able to get.