What's a Momo?

The five-minute momo seeks the possibility of momentum and a "momo" burst on short-term charts. Traders use two indicators of technical significance, accessible on many platforms and software for charting, including the 20-period exponential average (EMA) and MACD. EMA is preferred over the more simple moving average due to its greater emphasis on recent developments, which is essential to make it easier for traders to trade quickly.

A moving average can be employed to establish the trend, and the MACD histogram, which can help us gauge the momentum, can be used as a secondary indicator. These settings of the MACD histogram are those employed by most software for charting: EMA = 12, second EMA = 26 the signal lines EMA = 9, all based on closing prices.

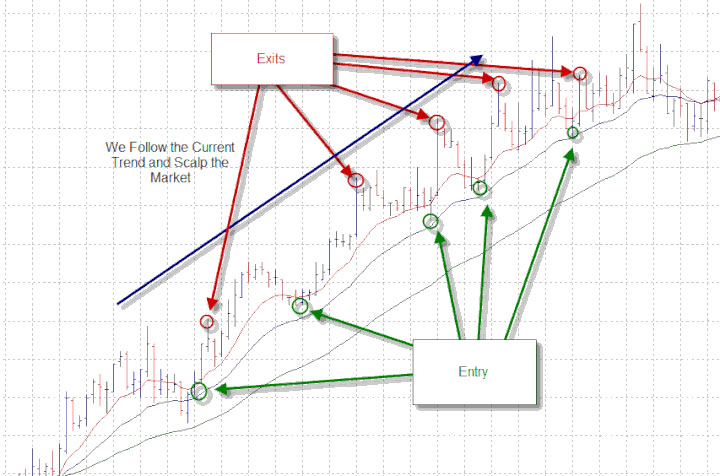

This strategy awaits the possibility of a reversal; however, it only makes use of it when the market momentum favors the reversal in enough ways to cause an extended burst. The trade is closed in two distinct segments: the first allows us to lock in gains. The second part lets us try to spot what could be an enormous move, but without risk since the stop is already relocated to break even. This is how it works:

Rules for a Long Trade

- Watch for price to cross over the 20-period EMA. Then, make sure that MACD is on the verge of crossing or is crossing into positive territory in the past twenty-five minutes (five bars or smaller on a 5-minute chart).

- You can buy ten pips higher than that 20-period EMA.

- To make an aggressive trade put a stop on the low of the swing for the chart of five minutes. To make a conservative trade, you should place the stop 20 pip below that 20 period EMA.

- The position is sold at half price at the entry point, plus the risk amount to move the stop in the second part to break even.

- Stop the trade by breaking even or 20 periods of the EMA less 15 pip or more, whichever is greater.

Rules for a Short Trade

- Watch for the price to be lower than the 20-period EMA Make sure MACD is moving from negative to positive or has crossed into negative territory less than five bars.

- Short ten pips lower than the 20-period EMA.

- To make an aggressive trade put the stop at the high of the swing on a 5-minute chart. If you want to trade conservatively, put the stop 20 pip above 20-period EMA.

- Repurchase the first half of the position at the price of entry, less the risk, and shift the stop on the second portion to break even.

- The stop is trailed by either the breakeven or an interval of 20 periods EMA plus 15 pip, whichever is less.

Learning the Risks

Momo's trading strategy is very useful in finding opportunities to trade on momentum. However, just like every different strategy comes with several risks that are significant and do not always function in the way we would expect it to. So, it is important to examine the potential scenarios that could happen and learn how we can manage these in the near future.

This issue can be caused by pricing. If you are using the 5-minute Momo strategy, it is important to recognize the price range that's too narrow or wide. If the market is quiet and the price is low, it typically fluctuates within that 20 MACD and EMA as the histogram is prone to swings which means there's a chance of lots of false signals. However, when the strategy is applied in a market with an exchange range that's too broad, there's a good chance that the stop is activated before the goal is achieved.

Trading Breakouts

Alongside pullback and breakout trades, breakout trades are also an important part of active trading. In these situations, it is important to look for stocks that are gaining significantly during the pre-market or have volumes immediately off the open. Then, you must ensure they have little or no resistance to overhead. If you're open to greater risk and want to earn more, you should focus on stocks with a low float. If you want to play things more secure, you should look at stocks that have a float in excess hundred million shares. Whatever your level of risk tolerance, the most important thing to do is to cut out your loser and let the winners win.