The Forex Market hours refer to the hours in which market participants can purchase and sell, exchange, and speculate about currencies from all across the globe. The forex market is open 24/7 during the week, but it closes on weekends. As time zones shift, however, weekends are the only reduced time.

The forex market begins trading on Sundays at five p.m. Local time for New York City. The market closes on Fridays at five p.m. and then resumes trading after 48 hours to begin the new week. When the market is in operation and traders from all over the globe can trade in the forex market; however, the trading conditions can be different.

The international currency market comprises commercial firms, banks, central banks management companies, hedge funds, and traders and investors across the globe. Since this market is operated in different time zones, the market can be accessed at any moment other than on weekends.

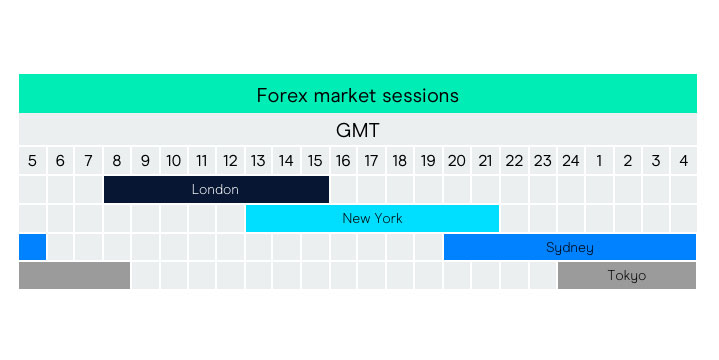

The global currency market isn't controlled by one market exchange but is the world's largest network of brokers and exchanges worldwide. The hours of trading in the Forex market are determined by when trading is allowed in each country participating. Even though time frames often overlap, it's generally recognized that the following periods are the busiest of all regions:

- New York: 8 a.m. to 5 p.m. (EST)

- Tokyo: 7 p.m. to 4 a.m. (EST)

- Sydney: 3 p.m. to 12 a.m. (EST)

- London: 3 a.m. to 11 a.m. (EST}

The two most crowded time zones comprise London as well as New York. The time that these two trading hours coincide (London after-hours and New York morning) is the most active and accounts for the largest portion of trade volume during the daytime, with trillions of dollars shifting hands. This is when the benchmark spot Reuters/WWM foreign exchange rate is established. The rate was established around 4 p.m. London local time is used for daily valuation and pricing of many pension funds and money managers.

Special Considerations

Although the forex market indeed operates as a 24/7 market, some currencies from various emerging markets aren't traded 24/7. Traders typically trade in pairs that cross the seven currencies across the globe, but they tend to trade at times when there are more volumes. When the trading volume is at its highest and forex brokers, offer lower spreads (bid and ask prices are closer to one another) and reduce the transactions' costs for traders. Additionally, institutional traders prefer times of more trading activity. However, they might be willing to pay for higher spreads to trade as quickly as possible in response to the latest information they've got. Despite the distributed nature of the market for forex, however, it's still an effective transfer mechanism for all players. It provides a wide-ranging access method for those looking to invest from anywhere on the planet.

Price Swings in the Forex

Political instability, economic and political instability, and endless other changes impact the currency market. Central banks attempt to stabilize their currency by trading with the market and preserving a value to other currencies. Companies that have operations in several nations seek to reduce the risks associated with doing business on foreign markets and hedge risks associated with currency.

Companies enter into currency swaps to protect themselves from risks, giving them the ability, but not necessarily the obligation to purchase the specified quantity of currency at an agreed price in another currency at a certain date. They're taking a step back from large fluctuations in currency valuation by using this method.

Around-the-Clock Trading

The capacity for the market in forex to be able to exchange during 24 hours is due in large part to the different time zones around the world as well as the fact that trades are conducted through the internet of computers instead of a single physical exchange that shuts down at a certain time. For instance, if you read that you heard that the U.S. dollar closed at an exact rate, it is simply indicating it was the rate that was in effect at the time of market closing in New York. It's because currencies continue to be traded worldwide even after New York's closing and are not the same as securities.

Securities like stocks in the U.S and bonds as well as commodities aren't as important or required to be traded internationally and therefore aren't required to trade outside of the typical business day in the issuer's home country. The need for trading on these markets isn't sufficient to warrant opening at all hours of the day because of the emphasis on the local market. This means that it is highly likely that a small number of shares will be traded at 3.30 a.m. within the U.S.