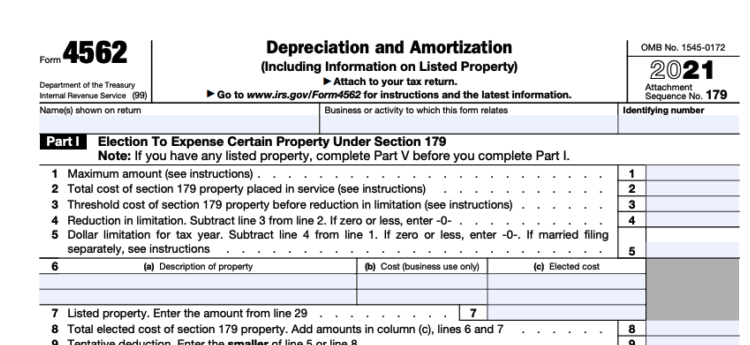

When claiming deductions for depreciation and amortization, utilize Form 4562 from the Internal Revenue Service. In addition, it may be used to write off the cost of certain kinds of property by claiming an accelerated depreciation deduction under Internal Revenue Code section 179.

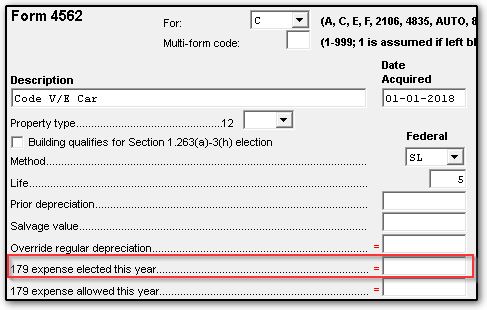

The third function of this form is to provide information on the commercial usage of automobiles and other forms of property, collectively referred to as "listed property," that may be used for personal and professional reasons.

Listed Property

A property is considered to be listed when it has the potential to serve either personal or commercial needs. Although passenger cars are by far the most prevalent sort, this category also includes other transportation types. Only the use of a car for commercial purposes is tax deductible; not its usage for personal or commuter purposes. To be eligible for depreciation deductions on the listed property, you must demonstrate that the vehicle is utilized more than fifty percent of the time for business purposes.

The Calculations Behind Depreciation and Amortization

Both depreciation and amortization are specialized kinds of corporate expenditures that, as opposed to being written off all at once, must be spread out over many years. These expenditures relate to a company's significant assets and are used over many years.

The depreciation process is applied to tangible assets that have a physical form, such as buildings, automobiles, and other equipment and furnishings. On the other hand, amortization is applied to intangible assets, which are assets that do not have a physical form and include things like patents, trademarks, trade secrets, and software. As can be seen in the table that follows, the computation for depreciation and amortization are identical:

- Locate the property's worth, often known as its base.

- Determine the total number of years that it can be put to good use.

- The useful life of an asset, which is subject to depreciation, varies greatly depending on the kind of asset in question. The is typically set at 15 years for properties whose costs are amortized.

- To calculate the amount of depreciation or amortization that should be taken each year, take the basis and divide it by the number of years that the asset will be serviceable. The method of splitting the whole cost into equal portions for each year is referred to as "straight-line depreciation," This technique has its name.

Accelerated Depreciation on Form 4562

If you fulfill the conditions, your small company may be eligible to accelerate its depreciation deductions, increasing the amount of money that might be deducted in earlier years.

MACRs Depreciation System

The method of accelerated depreciation, known as the modified accelerated cost recovery system (MACRS), is used to recover the cost of commercial and investment property. It has a general depreciation system (GDS) and an alternate depreciation system as part of its structure. In most situations, you will use the GDS procedure, but for some kinds of commercial real estate, you will follow the ADS procedure instead.

Section 179 Deductions

A section 179 deduction is an extra depreciation deduction that allows you to deduct all or part of the depreciation on certain business property in the first year you own and utilize the property. It is only accessible for tangible property, such as machinery and equipment, computer software, and some listed property; however, it is not available for real estate or structures. Deductions under Section 179 are capped at $1,040,000 for qualified property, with a total cap of $2,590,000 for all section 179 property. The highest allowable deduction for sport utility vehicles is $25,900.

How to File Form 4562

Most personal tax returns filed by small businesses with Form 1040 contain Schedule C to report the business's income. To record the amortization and depreciation of your company, you'll have to file Form 4562 using this form. In addition, you'll have to provide details from Form 4562 in Schedule C, which can be used as the tax return for sole proprietors and self-employed entrepreneurs.

Schedule K-1 is sent to partners in partnerships, and members of Schedule K-1 that are sent to partnership partners or members (owners) of multiple-member limited liability companies outlines each member's share of the total business's revenue as well as deductions, credits, and credits as well as amortization and depreciation. They must include the details on the form in their tax returns. This includes information about amortization, depreciation, specific deductions, and listed properties (Form 1040).