We've created this post to help you understand The Free Asset Ratio – FAR. With a basic understanding, you'll be able to make more informed decisions about your own financial future and that of your family.

At first glance, FAR may seem like a confusing concept or rate. But, once we break it down for you and show the real-world examples of how FAR is used in investments and banking, you'll see that it's actually an easy-to-understand benchmark for evaluating risk levels within portfolios. In fact - due to its simplicity - many financial professionals rely on it as their primary method for deciding what types of securities are worth investing in or securing with loans.

So... what exactly is FAR?

FAR is short for free asset ratio. It's a simple, yet seemingly complex number that helps us understand the level of risk associated with a particular investment or type of investment.

It's actually quite simple once you understand that in order to achieve the goal of investing in stocks or bonds – which will ultimately give us a return on our investments – we need to consider how much risk we're willing to take on. The Free Asset Ratio – FAR based on Return On Equity (ROE) is used to help us find out how much risk we're taking on when investing in an investment or securing a loan with a bank.

The total value of funds that a particular investment or lending source is willing to invest or lend to us is referred to as free capital, which usually comes from the initial investment required to open up a particular type of investment account or bank account.

In order to compare the level of risk associated with various investments and loans, we can use the Free Asset Ratio – FAR based on return on equity, which gives us a simple way of comparing different investment accounts and types of loans.

FAR (based on ROE) measures the overall financial health of a company. It represents the percentage of assets that are not being used to finance debt. For example, if a company has $1 million in assets and $800,000 in liabilities, the remaining $200,000 could be considered free assets that could be used to support shareholders by paying dividends and increasing the value of their equity stake.

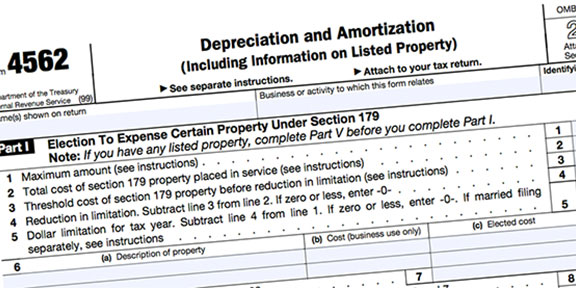

Calculating Free Asset Ratio using Equity and Debt Ratios

There are three basic ratios used to determine FAR: debt ratio; fixed asset ratio; and equity ratio. These three ratios combined quantify the overall strength of a company.

There are two different ways to calculate the free asset ratio, which we'll be covering in more detail below:

One that uses fixed assets and one that uses equity. The fixed asset ratio is usually used as an early-warning signal for whether a company is on its way out of business or if it's on the brink of bankruptcy. The equity-based free asset ratio is used when assessing the financial health of a company so that we can decide if it's healthy enough to invest in or secure a loan with.

The free asset ratio is calculated as follows:

Free Asset Ratio = Assets – Liabilities; where Assets = Fixed Assets + Current Assets and Liabilities = Debt + Equity

Why is it important to know?

You should consider how much risk you're willing to take on when investing in an investment or securing a loan with a bank. The Free Asset Ratio – FAR based on ROE is used to help us find out how much risk we're taking on when investing in an investment or securing a loan with a bank.

For example, if you are an individual investor and you have a loan that has an interest rate of 10%, it means that you would have to earn an 8.9% return on your investment in order to be able to pay the monthly interest on your loan. In this example, the Free Asset Ratio – FAR based on ROE shows us that we are taking on a lot of risk (since we need to earn 9.4% return to be able to pay the amount of interest we're paying). This is a good indication that these types of investments should probably not be considered since the default is high and may make us vulnerable if our investments decrease in value or end up losing money in the future.

On the other hand, if you are looking to borrow money, the Free Asset Ratio – FAR based on ROE should show you what type of risks and interest rates banks are likely to charge for these loans. If you see that a bank is willing to lend you money using an interest rate of 10%, this is an indication that it's highly likely these types of investments are safe and that banks feel comfortable loaning you this kind of money.

What happens if I use a different formula?

If we use a different formula to calculate the free asset ratio, then we will have to make some modifications when calculating the equity. The modification is simply adjusting the fixed asset ratio in order to make sure that it is an accurate measure of the amount of equity available for lending.

The following formula will give us a percentage that represents the "Free Asset Ratio – FAR" based on ROE using fixed assets:

Where: Fixed Asset Ratio = Fixed Assets / (Debt + Equity)

Equity = Assets / (Debt + Equity)

Is Free Asset Ratio – FAR useful?

Yes! Free Asset Ratio – FAR based on ROE is a very useful tool when analyzing investments and loans made with a bank or other financial institution. Free Asset Ratio – FAR is a ratio that you can use to determine how risky an investment or loan is based on the amount of equity used to make the investment or secure the loan.

If you see that a particular investment or type of loan has a low Free Asset Ratio – FAR, there is less risk associated with it. In fact, it's often good practice to ask banks or other financial institutions to provide you with the "Free Asset Ratio – FAR" in order to better understand their perceptions of your risk level.