If you're in the market for insurance for your car, it's crucial to know the type of insurance you're looking for and what coverage you must purchase. The majority of states require insurance to be purchased before driving an automobile. Although the minimum requirements for coverage vary from state to state, they typically contain liability insurance and coverage for uninsured or underinsured motorists. If you're looking for more security, you might be looking into full-coverage insurance. It's not a specific kind of insurance policy but rather a mix of insurance such as collision, liability, or comprehensive.

In addition to standard options for car insurance, it also has mechanical breakdown coverage. It will cover repairs to any mechanical component of a brand new vehicle that is less than fifteen months old and less than 15,000 miles. This excludes issues that are caused by wear and tear. There is an annual deductible of $250. It is renewable for 7 years, or up to 100,000 miles or the latter, as the case maybe it does not cover routine maintenance like tune-ups.

Geico Customer Service

In our Best Insurance Provider to Customer Service sub ranking, Geico is tied with Farmers in fourth place. We rank first about auto insurance companies in this regard, and State Farm and Nationwide hold an edge over Geico in terms of customer satisfaction. The mid-pack rankings don't reveal the full story people who took part in the survey were generally satisfied with their experience. Of those who didn't claim car insurance with Geico, 53% stated total satisfaction in the convenience of getting in touch with Geico's customer care. If they filed an insurance claim, the percentage was 70 percent.

Geico Claims Handling

While respondents to our survey have high satisfaction with Geico car insurance in general, there are some areas of weakness. In terms of handling claims, Geico loses some ground against its major competitors who have middle-of-the-pack performance. From the survey of respondents who have submitted a claim, 74 percent report satisfaction with the filing process and 66% express complete satisfaction with the status updates throughout the process of filing a claim, and 70% are 100% satisfied with the resolution to the claims.

Geico Car Insurance Cost

Based on our Geico rates, 35-year-old people with good credit with a good driving record pay $1,352 a year on average for full-coverage insurance on their car. This is 22% less than the average national rate of $1,732 annually, making it one of the lowest car insurance companies for many drivers.

Discounts

Are you five years without an accident? This is a bargain. Do you have an anti-theft device? It's a great discount. Are you a member of the military or an ex-military veteran? There are discounts in exchange. Geico offers a broad array of discounts that could help reduce your premiums. Add these discounts to already affordable costs, and you'll likely save money while getting the protection you need when traveling.

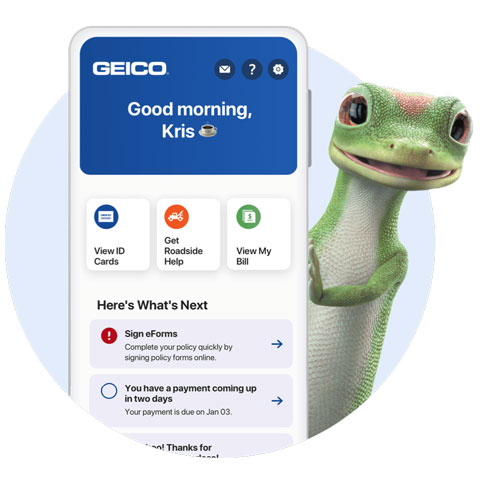

Geico Mobile App

Geico's mobile apps manage all aspects of their auto insurance, from requesting a quote to making claims. Geico customers who are insured through Geico can utilize the Amazon service, Alexa, to pay for their insurance costs. If you're looking for an insurance company that isn't will require you to go to an insurance agent or rings the phone to handle your insurance coverage for your vehicle, if so, Geico is a good choice. Although this isn't the only application to manage your car insurance, it's certainly among the top.

Advantages

The affordable rates are paired with excellent support and services and award-winning digital features that make Geico an excellent insurance provider. Geico's wide array of discounts could make your policy cheaper. While its list doesn't have to be as extensive as other major insurance companies, Geico is more transparent about what you can save on every discount. Geico provides all of the most popular kinds of insurance you'll need to consider when choosing an insurance policy. You can add the home and life insurance, and you'll be able to have a one-stop shop to meet all of your insurance requirements.

Cons

Geico does not, in fact, underwrite its own life and home insurance policies but instead collaborates with non-affiliated partners to provide life and home policies. Therefore, the company's life and home insurance policies don't appear on Geico's mobile application, which reduces its appeal as a one-stop shop. Although you can avail of discounts for bundling the insurance for your vehicle and home through Geico, the life insurance policy isn't qualified for a bundle discount.

In addition, although Geico provides almost all major types of car insurance, it doesn't provide the gap insurance that you could need if financing your car. Gap insurance will help you pay for the cost of an accident that causes your vehicle to be severely damaged or destroyed by covering the gap between what the vehicle's actual value would be and what you owe for it.