The Mobile Check Deposit is a portable banking application that lets you transfer checks into your bank account on your mobile phone. Instead of depositing your checks at an ATM or your bank's drive-through windows, or a teller located in an office, it is possible to deposit checks to your account from wherever you are, whether at the office, at home, or even on vacation. The kinds of checks you could deposit into your account with mobile check deposits are personal checks, cashier's checks for business, and government-issued checks. These include tax refunds and stimulus checks like the ones provided through the CARES Act. Your credit union or bank might or may not permit you to use mobile checks for deposits to pay for foreign checks, checks issued by third-party companies and money orders, and traveler's checks. You should confirm your financial institution's policy before you make a decision.

The Bank You Work With Can Limit the Amount You Can Deposit

Banks typically limit the total amount of mobile deposits made and limit the amount customers can make deposits daily or monthly. The maximum amount can vary by bank. Mobile check deposits are subject to constraints to lessen the likelihood that fraudulent checks may be accepted. If you are required to deposit checks that are more than bank limits set by the bank, you can visit an ATM or branch to make the transaction easier."

Checks That Are Deposited Can Bounce After Confirmation

Checks are still able to be returned after depositing them using a smartphone. It is possible for checks to bounce, just as it would be the case if you had deposited them at the branch of your local bank. The bank could reissue the deposit if the issuer's funds are insufficient. If you deposit your money via mobile, the institution can notify you that the check has been processed. However, the bank can return the money even if the confirmation has been received. It may take several weeks for the transactions to become completed; it might shock younger individuals who are used to their financial transactions being completed instantly.

Banks May Put an Order to Hold Funds That Are Mobile-Deposited

Like a traditional check, banks can put a hold on money deposited via smartphone. The most common reason for delayed access to funds is that the money was placed at the wrong time of the daytime. If a particular cutoff time is set for depositing checks, the depositor could be required to wait another business day to have the check cleared and for the money to be accessible.

Check That Images Aren't Saved To Your Phone

It's possible to wonder who will be able to access the confidential information on your check; however, images of checks aren't saved on your smartphone. Instead, banking apps save deposit data and images on a secure server, protecting the individual customer and the security of their financial data.

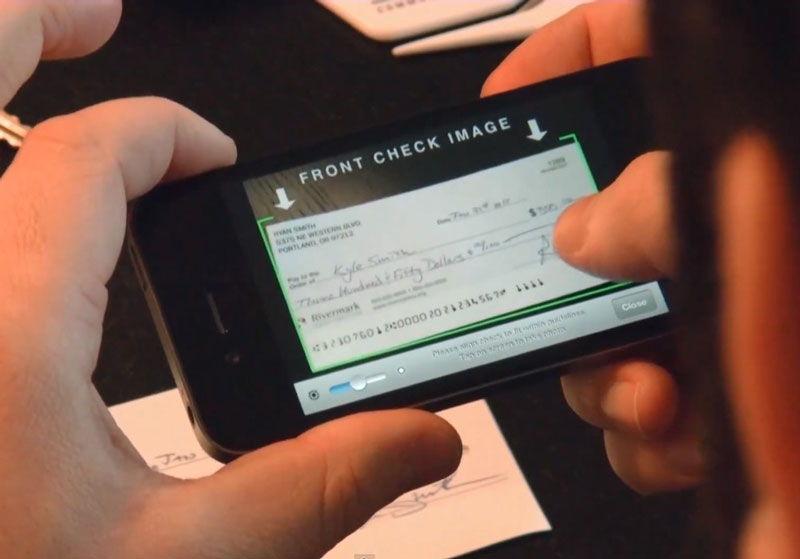

The Best Way to Take the Perfect Photo Is Easy With an App

It's not easy to master taking the proper photo for mobile deposits; however, banks have smart apps to help you. The most useful feature is available in the automatic snapshot feature, which takes the image immediately when the picture box is drawn over the deposit. The dark background in front of the check will help enhance the photo's quality. When the check is placed within the screen frame, it will then automatically snap or ask users to take a photo. This process is the same for both sides.

Mobile Deposit Limits

There is usually an amount that you can deposit for each day or month, and there could be limits on the number of checks you can deposit. The limit on dollars differs from bank to bank, but, in general, you can deposit up to a thousand dollars each month. You will usually be able to see your deposit limits within the application. For instance, the Wells Fargo mobile app shows your deposit limit on mobile after selecting an account and entering the amount you want to deposit. The limit can be increased if your account has been open for several years with no issues.

Is Mobile Check Deposit Safe?

If you're worried about safeguarding your bank account data online, you might wonder if the mobile deposit function is secure to use. The simple response is yes, mobile checking deposit is just as secure as other banking online or mobile functions. This means that if your credit union or bank has taken steps to protect your personal information, such as using encryption or more secure security measures and encryption, then mobile check deposits are protected by the same methods. The primary dangers to mobile banking security are the same as for mobile and online banking generally. However, mobile banking can be a target for fraudsters.