Introduction

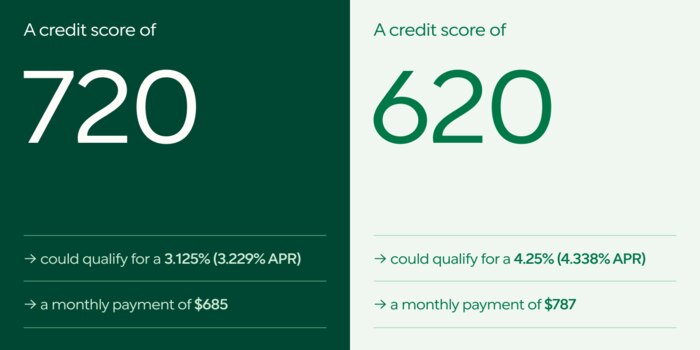

How credit score affects your mortgage rate? It's common knowledge that a person's credit score plays a role in whether or not they're approved for a mortgage. The specific effect on your interest rate has yet to be widely known. Traditional wisdom is that a 720 FICO credit score is necessary to qualify for the best mortgage rates. That, alas, is no longer the case. Lenders will have more faith that you will pay your mortgage on time if you have a higher credit score, which might mean reduced interest and fees for your mortgage. The down payment requirements of some lenders can even be lowered if you have a good credit score.

How Does Your Credit History Affect Getting A Mortgage?

how your credit score affects your mortgage rate? Lenders use credit reports to learn about a person's track record of paying back loans. Pay stubs, P60s, and bank statements showing your income and the amount you expect to spend monthly are required when applying for a mortgage. This demonstrates your present financial status, but creditors will also check your credit report to foretell your future actions. Your credit history may influence the interest rate you're offered for a mortgage. This is because the type of mortgage you're provided will depend on how responsibly you've handled debt in the past. Mortgage applicants who meet specific credit requirements may be eligible for preferential introductory rates and other perks.

You Need an Excellent Credit Score for the Best Rates

And what does it all mean? Indeed, it would be best to examine your credit rating before going house hunting. Checking your credit reports for inaccuracies, reducing your debt usage rate by paying off your credit card bills in full every month, and completing all of your payments on time will help enhance your score before applying for a loan.

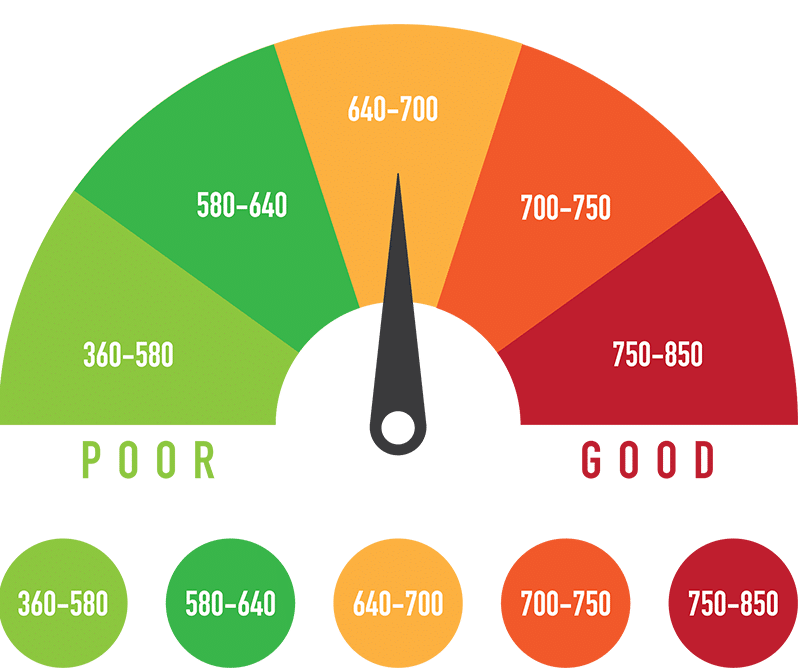

Your credit score needs at least 760 to qualify for the best mortgage and PMI rates if you plan to pay less than 20% down on your new home. The best mortgage rates and terms are often available to those with a credit score of 740 or higher and a down payment of 20% or more. If you are still looking for a perfect score, even a slight increase in your score can move you into a reduced pricing tier. Even that slight adjustment might save you a lot of money in the long run.

What Is the Minimum Credit Score to Qualify for a Mortgage?

Lenders may and often do look at various other variables when deciding whether or not to grant a mortgage application. Therefore there is no "official" minimum credit score. For instance, if you have a sizable down payment or a manageable amount of other debt, you can get a mortgage with a lower credit score. Many mortgage lenders consider your credit score to be only one factor when deciding, so having a poor score does not automatically rule out a mortgage loan.

How To Raise Your Credit Score Quickly

Here are a few suggestions to get you started on the path to a higher credit score quickly:

Ask For A Credit Line Increase

If you already use credit cards, you have been given a specific spending limit or "credit line." This proportion, known as credit use, represents 35% of your total credit score. The better your credit score, the lower your credit utilization ratio should be. If you've recently earned a raise in salary, updating your income on your credit report may qualify you for a higher credit limit, or you may phone your credit card issuer and request a higher limit.

Check Your Credit Report For Errors Or Evidence Of Paid Off Accounts

It's a good idea to periodically verify your credit report for accuracy because there is always a potential that it could contain mistakes. About a quarter of Americans have found an inaccuracy on their credit report, usually in the form of fake or duplicate accounts; if you discover anything suspicious, contact the credit bureau you accessed your report via to get it removed or corrected immediately. You can also request the removal of any collections or court judgments that have been paid off, such as medical bills.

Conclusion

It is vital to develop an understanding how your credit score affects your mortgage rate. Consider fixing your credit and financial history before applying for a mortgage to increase your chances of being accepted by a lender. Numerous variables can impact your credit score. Making your monthly loan, credit card, and utility payments on time is a great way to boost your credit score. Lenders will need to see your residence on the voter roll. A credit application will appear as a "credit search" on your credit report. Frequent credit application activity may be indicative of an addiction to borrowing money. Selective application for a mortgage may be helpful.