Introduction

Companies, after selling their shares to investors, distribute dividends that announce the success of a company. Investors earn their profit by buying shares and the ownership of the company by getting dividends. Dividends are distributed by taking money from the company’s overall earnings. They can be distributed either in the form of cash or more stocks or shares of the company. Either way, it is of benefit to the investor. The amount paid in the form of dividends to every shareholder depends upon the shares he has bought.

Usually, they are taken out only if the company is earning a good profit. A few companies, out of sheer generosity, keep on distributing dividends even if they do not make more profit. Every investor loves to earn profit consistently. This helps the company in earning the solid trust of investors. Investments increase, and likely; the company becomes financially stable. Every company follows a particular scheme or program for distributing dividends. They are an embodiment of how a company is functioning financially.

Dividends play a crucial role in the lives of all the people associated with a firm. For investors, they prove to be a financial source. They are a way of earning for them in response to the shares they bought. Moreover, they let them know if the company is capable of providing them their expected profit or not. Dividends are paid from the profit a company makes. If it can pay a good amount of dividends to its investors, it can generate cash for their earnings, too, and is known to be financially stable.

How do Dividends Affect Stock Prices?

How do dividends affect stock prices? Dividends affect companies and their stock prices in a number of ways. For example,

- When companies start distributing or giving out more dividends, the investors feel attracted, and a number of them start to invest. This makes the company financially stable, and hence the shares become strong. This causes prices to rise. On the contrary, if a company spends less money on dividends, the investors and the whole market assume it is seeing a drop in profits. This can cause investors to back out and withdraw their investments, causing an actual drop in share prices due to damage to the company’s financial stability.

- Whenever a dividend is given out, stock prices see a dip. The value of stock reduces for sure. When cash dividends are distributed, a reduction in cash happens from the company’s earnings happens. On the other hand, giving out dividends in the form of stocks causes a redistribution of shares and hence affects the price in a less harmful way. It kind of rearranges the funds distributed by the company.

- Companies having very small or almost no financial growth can expect a direct relation between dividends and their stock prices. This can, in turn, cause a noticeable change in the company’s financial stability.

- When investors start buying shares and stocks, the company devises a plan of what amount it is going to give out as dividends and on what date. As soon as the date approaches, more and more investors feel inclined towards investing in the company and buying more stocks. This increases the overall earnings of the company leading to an increase in dividend amount, causing an increase in stock prices.

Dividend Yield and Payout Ratio

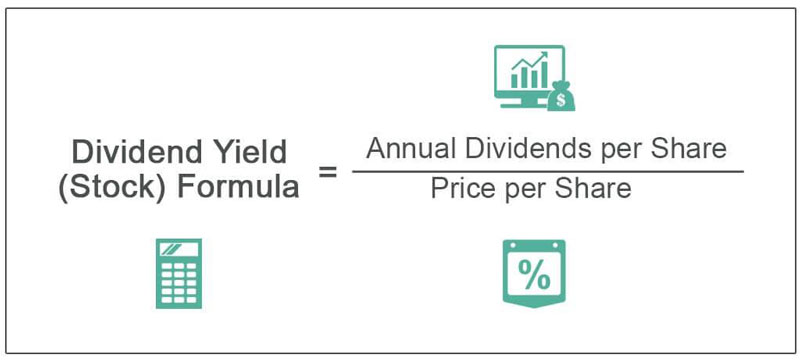

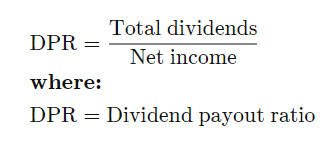

Dividend Yield and Payout Ratio; are two major relations used by experts to analyze the financial progress of a company and how much is it capable of providing to its investors.

- The dividend yield shows the total output an investor earns per share depending upon his investment. It can be found by calculating the ratio of how much dividends per share are given out and what is the price of every share. An increase in the price of shares shows a decrease in overall yield.

- The payout ratio is a much better tool for estimating a company’s success. It can help an analyst evaluate the overall financial progress made by a company depending on the dividends it distributes. It is a ratio and sometimes a percentage found by dividing the total dividend distributed by the total income earned by a company.

Conclusion

Dividend yield and payout ratio prove to be easy tools to analyze how a company is performing financially and its stability too. This analysis made by experts resulted in outputs that showed different effects of dividends on stock prices and correspondingly on the company’s stability.