Your credit card's credit limit is the maximum amount of money that may be carried over from one billing cycle to the next on your account. Your ability to make purchases with your credit card is directly correlated to the amount of your available credit limit; the higher it is, the more you will be able to charge to your card. After you have spent up to your credit limit, your creditor will not allow you to make any more purchases until you have paid back part of the money you owe to them. The credit limits of credit cards are determined by the issuers based on several different variables; however, the issuers cannot provide you with a definitive credit limit until they have examined all of these elements.

Considerations That Go Into Determining Your Credit Limit

The Kind of Credit Card That You Have

Consider a credit card to be a product with a set of inherent characteristics. Credit limitations are another predetermined aspect, similar to the interest rate and the fees. The credit card issuer decides how the credit limit should be established.

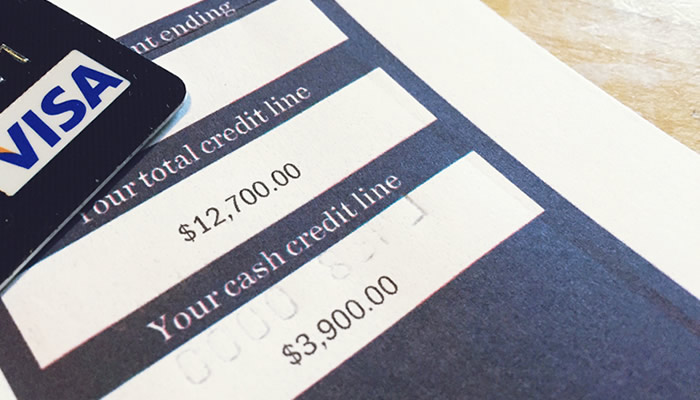

Certain credit cards come with a predetermined credit limit, such as $1,000, given to every authorized cardholder regardless of other circumstances. Other credit cards have a rate for their credit limits, and those authorized for the card are given a credit limit that falls within that range. For instance, one card's credit limit may be between $5,000 and $10,000, depending on the terms of the card's agreement. The applications judged to have the highest likelihood of being granted will have their credit limits set at the upper end of the range.

Your Take-Home Pay

In most cases, the amount you can afford to pay is directly proportional to the amount you bring in each month. There is no assurance that a high credit limit will be granted to you just because you have a high salary, even though having a high income will increase your chances of being accepted for a larger credit limit. There are also further considerations, such as the kind of credit card used.

Your Proportion of Income to Debt

The credit card issuer will use the information included in your credit report and your credit card application to formulate an educated guess on your debt ratio to income ratio. The credit limit that is placed on your credit card may change as a result of this ratio. This implies that if you have a high income but also make large monthly payments on your debt, your credit limit can be lower than it would be if you made smaller payments but had a higher income.

Your Credit History

How you have dealt with the credit limitations of your previous credit cards will not only determine whether or not you are approved for a new credit card, but it will also determine the credit limit you are approved for. You will be less likely to be authorized for a high credit limit if you have a history of making late payments, having large balances, or other bad information.

Limits on Other Credit Cards

Issuers of credit cards may base their decisions on the other credit cards you have in your possession. You have a greater chance of getting accepted for a high credit limit on a new credit card if your credit report indicates that you already have high credit limits on previous credit cards. On the other hand, if the highest credit limits you've ever had in the past have been $500 or $1,000, it's quite improbable that you'll be authorized for a credit limit of $10,000 immediately.

When Did You First Realize How Far You Could Go?

Even the precise moment you are informed of your credit limit is entirely at the credit card issuer's discretion. You may discover your credit limit at the same moment that you are authorized for the card, or it is also possible that you may not learn your limit until you get your new card in the mail. Because of this, you won't be able to make any definite arrangements about using your credit card for making purchases or transferring balances until you have a clear idea of your credit limit.