Tax professionals are bombarded with questions regarding when tax filers can file tax returns and when they'll receive an annual tax refund as the calendar turns to January. The answers are contingent upon several aspects, like when you get important tax forms, and filing early does not necessarily mean you'll get your tax refund sooner. Some dates are in the same way. They are announced by the Internal Revenue Services (IRS) usually announces these dates no later than the second week of January to prepare for the filing period. Still, they could be adjusted as the year progresses.

When Does Tax Filing and Processing Begin?

You can begin making your tax returns when you've got all the required paperwork to begin the process. The IRS begins accepting tax returns and processing them at the end of January. In 2022, that day is January 24. In 2021, the date was changed to February 15 to ensure that the IRS could consider tax-related changes brought on by the pandemic that has spread across the globe. Tax professionals and software applications, including those using The IRS Free File program, can prepare your tax return right away if you have all of your income documentation in order.

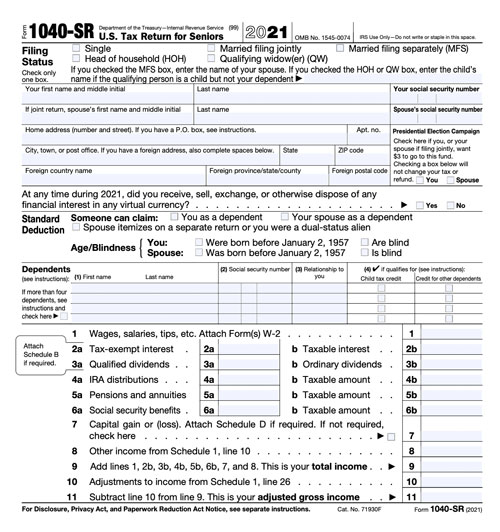

Collect Your Income Documents

The employer you work for has till January 31st, 2022, to mail you a W-2 form that reports your earnings for 2021. The majority of 1099 forms have to be sent out to independent contractors by this time too. You may fill out IRS Form 4852, a W-2 replacement if the tax deadline is approaching and you're still not able to get your W-2. However, this could be quite a trouble. It is necessary to accurately determine your withholding amount and earnings based on your last pay stub from the entire year. You may want to speak to a tax expert if you're in this position.

Stimulus Payment

The IRS announced in May of 2020 that economic impact payments offered for Americans in the Coronavirus Aid, Relief, and Economic Security (CARES) Act and other legislation are not tax-deductible. Two stimulus funds were which were administered in the year 2020 and another in 2021. There is no requirement to pay the cash to the government, and it will not affect the amount of your refund if there is one due to you. The stimulus payments don't count as income for other purposes, for instance, if they are eligible to receive government assistance or benefits. Like New Jersey and Massachusetts, numerous state governments have stated that they aren't taxing these payments as well. You don't have to file the money you got on your tax return for the state; however, you should check your state's official website or consult an accountant in your local area to make sure.

The third stimulus money was distributed to those who qualify to begin the month of March in 2021. The amount is not taxed. However, those who were not eligible or did not receive the full amount might be qualified to receive a Recovery Rebate Credit based on their income and tax circumstances. If you're eligible to receive credit and do not have any outstanding taxes, the credit will be the tax refund.

When Do You Get Your Tax Refund?

The exact date you receive my tax refund varies on the year. The IRS had stated that around 90 percent of refunds are made within 21 days from when the return was filed. You can track what's happening with your refund by visiting the IRS website.

How to Get A Speedier Tax Refund

If you're looking to get your refund as fast as possible, you should choose to file your tax returns online, using an e-file service or program. So, your refund will be processed through the system immediately instead of fighting for it via mail and the inefficiency of the hands-on process of processing your refund. The IRS states it is one of the "best and fastest way" to receive your tax refund as quickly as possible is to enroll for electronic deposits that are free into your account at a bank. "The IRS program is called a direct deposit," they note and add that you can utilize direct deposit to transfer your tax refund into three bank accounts. If you're concerned about losing your refund due to direct deposit, do not be. The IRS states that it's the same method used to distribute funds to 98 percent of beneficiaries from Social Security and Veterans Affairs benefits.