The current world requires superior investors if one is to succeed. The route forward isn't always clear, though. You will be able to learn how to make better investment selections if you can find a specific fit for your financial objectives, investment strategies, and money management solutions.

Tools for drafting better investment strategies

There are several options for investing to make money. For instance, you might buy a stock at a lower price and sell it later at a higher one. You might also put money in a retirement account to take advantage of any tax breaks in the future.

Which investing platforms and methods work best for you?

You may find investment advice everywhere you look, from Hollywood financial blockbusters to lifestyle blogs. Differentiating between experts and novices is crucial. Use reliable investment websites, and stay in the better investing portions of the web when searching for user reviews. Pay particular attention to those that briefly and objectively outline each platform's characteristics and capabilities.

Financial News Of Late

Current events and news websites frequently provide people with fresh viewpoints to inform their financial strategy. You may use them, for instance, to keep an eye on market volatility and find safe investing opportunities. Several platforms offer news notifications sent directly to your mobile device to keep you updated on the most recent financial developments.

Even investment strategy professionals agree that to become a better investor, and one must consider all the online information available. The finest strategies for certain investors may not be the best for you. Your investment performance might increase if you can locate a superior investing platform.

How can I invest more profitably today?

Eight ways to boost your investing results

Research alone won't create a sound investment strategy. Your ability to apply theory to practical problems will determine how successful your financial goals are. Here are some recommendations that you can use.

Invest as much as you can as soon as you can.

Many investors aim to achieve target returns by gaining expertise in specific markets or investment strategies. Success rarely happens overnight, regardless of how your financial system evolves or what techniques you employ to generate income. By making earlier and more regular investments, equity can be built. Now that your portfolio has greater momentum, it can provide the desired results.

Make a goal-oriented investment strategy.

Everyone has financial objectives, but successful investors stand out from the crowd by having more precise expectations. To decide how much you are willing to give up to attain your goals, you must consider your long-term financial objectives and investment risk tolerance.

Consider your investment decisions.

Though you surely recognize the importance of research, you might not be aware of it. To ensure that your financial goals are backed by trustworthy information, you must practice due diligence, just as you would when reading reviews or other sources.

Comparing products is an effective tactic for becoming familiar with the market. Compare the success of your investments to theoretical frameworks from investment literature, blog articles, idealized tables, and risk-free rates.

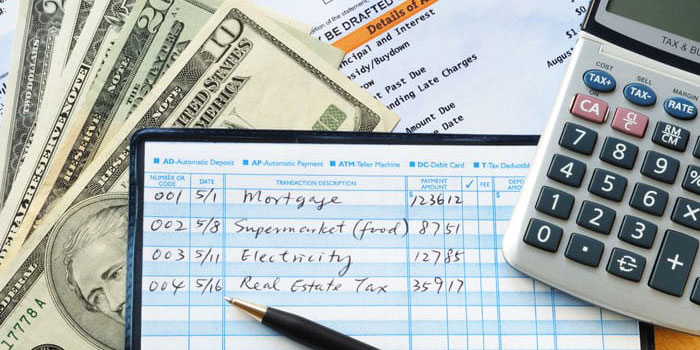

Utilize the dollar cost averaging method.

Making scheduled, recurring investments is what dollar cost averaging requires. For instance, you may set up an automatic transfer from your bank account to a portfolio management app. This strategy may help you manage the market risks linked with investing. Your ability to support may be enhanced by ensuring you stick to your financial plan.

Make a variety of investments and seek out those that are tax-efficient.

Some investing options have more expensive costs and tax requirements. For instance, you will owe the IRS additional money if you take certain prohibited withdrawals from your early retirement fund. When investing in stocks through a broker, you incur expenses that you wouldn't incur if you used a free investment app.

Manage your portfolio efficiently.

Not all investment methods are trustworthy. To improve the effectiveness of your plan, think about how you may manage your assets differently.

To keep their assets profitable, better investors utilize several tools, including portfolio rebalancing software and automated deposit schedulers. Take care not to commit mistakes like hasty buying and taking too much risk.

Make investments that will last.

Investing for short-term benefits could be challenging. While it is accurate to say that some short-term investments carry greater risk than others, this does not provide the whole picture. Even if you focus on short-term gains, your portfolio needs to be well-balanced with long-term opportunities that offer moderate returns.

Review and evaluate your performance.

Investing advice rarely performs as predicted. By routinely analyzing and reviewing the results, you may determine the efficacy of the strategies you learn from investment websites, financial advisors, and market index trackers.