In most cases, you'll need to sign the back of a check before you can deposit the money into your account. "Endorsing the cheque" refers to signing the back of it. To correctly endorse the check, you need to know what you want to do with it and how it is written. Your bank and you or a third party can settle the check's money if you endorse it.

How to Accommodate a Check

You may endorse a check-in in various ways based on the purpose of the money and how the check is filled out. To begin, a few words on security and avoiding check fraud. Wait as long as you can before signing the cheque, if feasible. Sign the cheque before you get in line at the bank or make a mobile deposit.

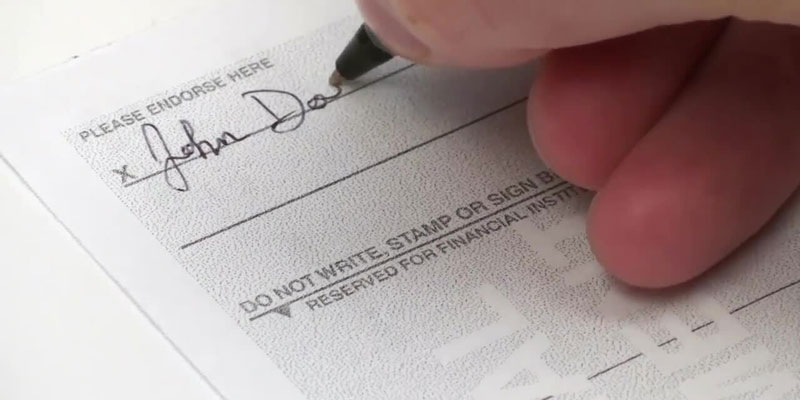

A thief might steal the cheque after you have signed and endorsed it and change the endorsement. On the reverse of a check, you sign your name. "Endorse Here" might be a single line or a checkbox on the form. "Do not write, stamp, or sign below this line" is generally written in another line. The check's endorsement area usually is 1.5" long and spans the whole check's width.

Methods of Endorsement

Identical Names

Having the same name on both sides of a check is required to be properly endorsed. Be sure to sign again with the correct spelling if it was spelt wrong the first time you signed it.

Where To Endorse

You may write on the reverse of most checks in a 1.5-inch space. "Do not write, stamp, or sign below this line." These lines and instructions are found in the "endorsement area." Back of the check, as shown in the image above. Keep all of your instructions for the bank and your signature in that one spot.

Endorsement Form with No Signature

To endorse, all you have to do is sign the check and do not put any conditions. Sign your name in the endorsement section if you want to employ this technique, also known as a blank endorsement. (The sample shows a "Blank endorsement.") But only if you're going to deposit or cash the check right after you sign it should you take this step. For example, a blank endorsement would make sense if you're in a bank lobby or making a remote deposit at home.

Shipping, ATM deposits and other methods

Use a different method if you intend to send the check to your bank, deposit it at an ATM, or keep it on you for some time. As an alternative to signing the cheque, put a limitation on the endorsement. If someone steals an endorsed check and uses it to cash or deposit it into a separate account, the danger is great.

What's the Purpose of Endorsing a Check?

When you receive a check, the money is yours to spend as you see fit. Only you have the authority to withdraw funds from the checkwriter's bank account. It is, however, the quickest and most convenient way to cash a check (or deposit money into your checking account) by handing it over to your bank.

You give the bank permission to collect money by signing a check. The bank can then negotiate the cheque on your behalf. You may be able to deposit a check without signing it. If the check isn't from an insurance company or another institution requiring an endorsement, and you deposit it into an account with the same name as the payee, this may be possible.

Problems Associated with Signing a Check

Endorsing a check may appear uncomplicated, but complications might occur. Due to these issues, if your bank processes a check, it may take longer, or it may not process the check at all.

Misspellings

A typical occurrence is ending a check and finding that the individual who wrote it has misspelled your name. An issue arises when the front of the check is misspelt, and your bank refuses to accept it because of this discrepancy in spelling. Unfortunately, the only solution at this point is to duplicate the check writer's inaccurate spelling into your endorsement, which is the only option.

Multiple Payees

Multiple payees may be listed on a single cheque. It's common for checks to be written out to "John and Jane Smith" to be presented as wedding gifts. However, many banks will require that both parties must sign the check, even if money is being deposited into a joint account, because of this simple form of words.

If you receive such a check, check with your bank to see how they handle it. If you're writing a check to a married couple, write "John or Jane Smith."

The Verdict

Adding an endorsement to a check is easy to boost your financial security. Most checks require a signature on the backside of the check to establish that you are the legal owner of the cash it represents, regardless of the check. Make sure you understand how the check-endorsement process works before you attempt it.