Are you wondering about how to fill a deposit slip? The filling in deposit slips differs depending on the deposit type you're using. For instance, the cash and checks are placed in separate sections, and getting money returned from your deposit is another step.

Steps on How to Fill Out a Bank Deposit Slip

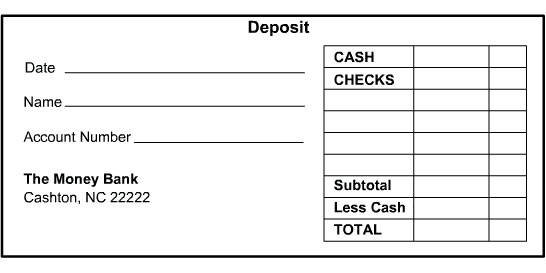

- Give your details, along with your name and bank account number.

- Add additional information like the date.

- If you intend to cash the check or any portion of it, you must also ensure that you get a signature on the line.

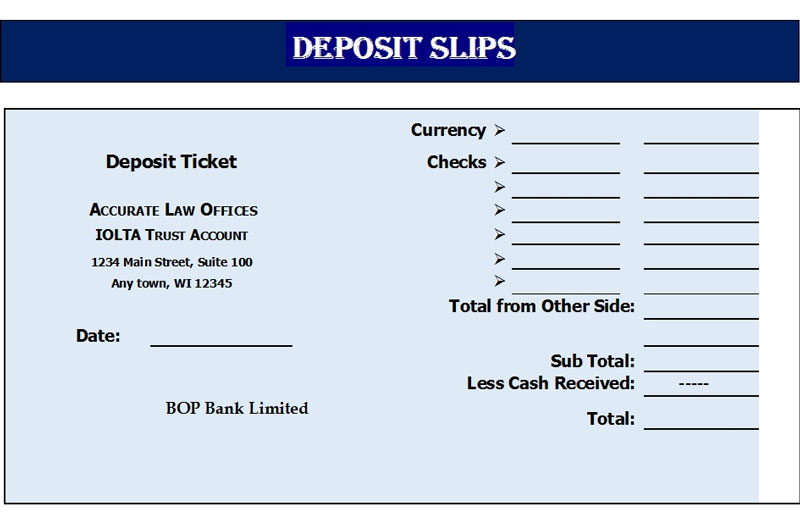

- Check the cash value that you have deposited into your account if you have any. The total is the value of cash you've used in your account for deposit. There will be separate boxes for every transaction. The box to the right is the cent portion, and the box next to the left contains the total dollar amount. If you never own any checks to deposit, you can leave this area blank.

- Checks are listed separately, along with the check number and the quantity for each one. Each check has an individual line. There's room to write the check's number alongside the dollar value of each check. This assists you and your bank in keeping a record of each check. If you require more space or have multiple checks, you can add this information to the reverse of your slip. If you do not have cash, leave this section blank.

- If you're depositing cash, but you would also like to get some cashback, make a list of the cashback you would like to get in the Less Cash Received portion.

- Make sure you add up the deposits for the subtotal. This is the sum of checks and cash you would like to deposit.

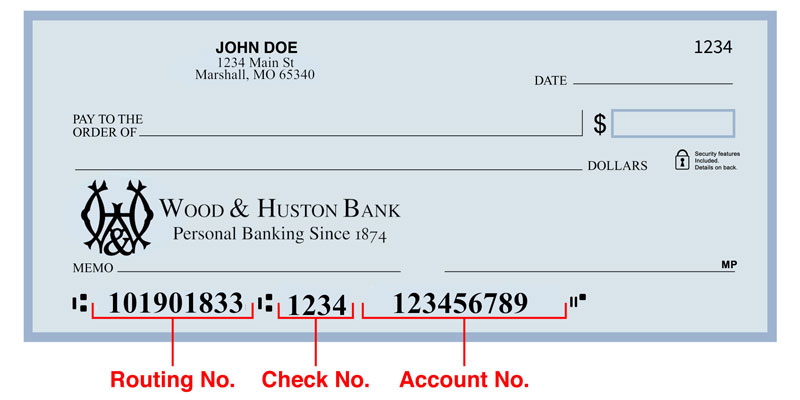

The Routing Number On The Deposit Slip

The routing number will be on the lower-left corner of your deposit slip. Your bank account number is also likely to appear on the deposit slip if utilizing a pre-printed deposit slip. Remember that the routing numbers on the deposit slip might differ from those you're using to make direct deposits. Ensure that you're using the proper routing number by contacting your bank.

First Time Information

Personal Information

If you've got deposit slips that you own, your details will probably already be included on the deposit slip. If you're using an ordinary deposit slip, you'll have to enter the date that you make the deposit and the name of the account and the number for the account you want to transfer money into on the lines they belong to. If you don't remember the account number, a bank employee will be in a position to locate it by using your ID or debit card.

Total Cash Amount

To deposit cash, it is necessary to input the amount you want to be deposited on the line marked "cash". Cash comprises the total value of all paper currency and coins that you would like to deposit.

Total Check Amount

If you're depositing checks, you can write the amount of each check on the line below the "Cash" line. If you're running out of space in the deposit slip's front, additional lines will be at the back. Make sure you list your total number of the checks on the back of your deposit slip, in the section that is labelled "total from the other side".

Less Cash Received

In certain instances, it is possible to earn cashback on your deposit. For instance, however, if you deposit checks and cash, you may wish to get your cashback in an amount or a different denomination. In this case, $50 in a bill for fifty dollars is required, so the amount is added to the "less cash received" line. If you want to request the cashback from your account, you must write your name along the sign-in line.

Total Deposit Amount

After you've entered all the cash and checks into the deposit slip, you're ready to input the total amount of the deposit. Add the sum of cash, the check listed on the front, and the total from the opposite side. After that, subtract any cash received, and then enter the resultant amount in the "total" line.

Conclusion

If you have your bank's details and an account, it can pay or transfer money to you or not after verifying whether a chequebook has been issued and the payment is processed through the institution.