You’ve just passed your driver’s test or conquered your fear of driving and bought your first car. Everything is set for you to get on the road. You have most likely been told by your car dealer that you’ll need auto insurance for your car. Some dealers will even provide it for you and factor these costs into the price you pay for your vehicle. We outline all you need to know about getting first-time car insurance so you don’t have to hassle.

Who is considered a first-time driver that needs car insurance?

- A teenager who just got their driver’s license.

- An immigrant who has just purchased a vehicle.

- Drivers with a gap in obtaining insurance or even driving.

- Adults who are driving for the first time.

Necessary information you need to get car insurance for a first-time driver

Car insurance is a legally binding contract that allows you to pass on the burden of car accidents to your insurance company. Car insurance is essential in dealing with liability. Therefore, obtaining car insurance will need important details such as:

- Your driver’s license

- Home address

- Date of birth

- Marital status

- Occupation

- Driving history

- Education History

- Your car’s year, model, and make.

- Any other safe driving courses you have taken, and grades.

Ensure that these details are factual and correct. Carry copies of documents you may need to the insurance company. It would be best if you also researched the different types of insurance coverage, such as liability, collision, and comprehensive.

You may also enlist an insurance agent to get you the best insurance at the best rates. Consider online insurance rate comparison tools as well.

Factors to consider when selecting car insurance for a first-time driver

As a first-time driver, obtaining auto insurance may be a daunting process. Deciding on which insurance is most affordable and most competent is not easy. You will compare personal opinions from people you know or from the internet, or you will approach the market head-on and choose the first one you hear.

The following factors affect car insurance for first-time drivers:

Cost

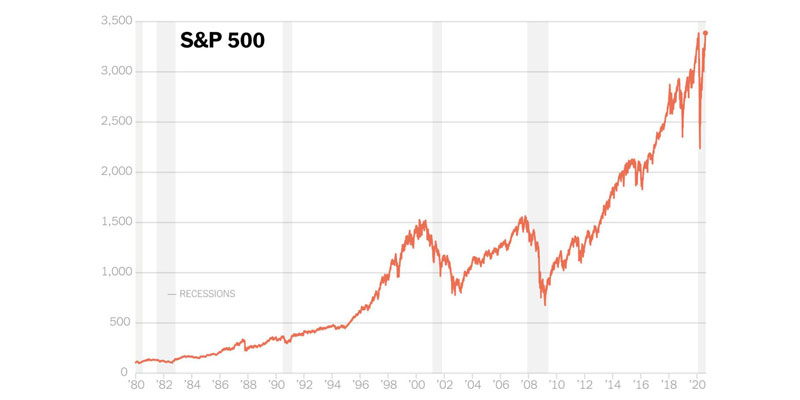

In America, a first-time driver will pay more for auto insurance than experienced drivers. Like credit bureaus consider credit history before deciding on your creditworthiness and limits, auto insurance companies look at driving records. In this case, since you have none, you must build your history from the ground up and incur higher premiums.

It could be a stereotype, but one that has been avidly used by auto insurance companies, that first-time drivers, primarily young drivers, are more inexperienced and may cause more accidents than experienced drivers. This means that first-time drivers are more likely to file insurance claims than their counterparts. The validity of that statement is abstract.

The average cost of auto insurance for liability insurance is $644, collision insurance is $378, and comprehensive insurance is $168. Ask for discounts that come with buying insurance for the first time, bundling discounts, or multi-policy discounts.

You can do the following to ensure you obtain the most affordable insurance options:

- Compare car insurance rates.

- Search for discounts and take advantage of them.

- Raise the deductible amount.

- Maintain a good credit score.

- Have a clean driving record.

- Compare insurance rates again biannually or when you intend to renew your contract.

- Pay insurance premiums in total. It shows trust in the insurance company, so your premiums may be lower the next time.

Age

On average, first-time drivers of age 18 will pay $288 monthly in America. For 30-year-olds obtaining the same insurance, they will pay $93 monthly. The difference is gaping. State Farm offers $1,533 for an 18-year-old first-time driver, 56% less than the national average. For a 30-year-old, the price goes down to $566 per year.

Driving without insurance will bring financial and legal consequences. Your license could be revoked, and you will have to pay fines and penalties. While a percentage of young first-time drivers may want to live carefree because ‘You Only Live Once,’ the ramifications of driving without auto insurance are definitely not worth it.

Credit

While it is not a requisite, some insurance companies will check your credit score before offering you auto insurance, even though you are a first-time driver. Poor credit is disfavoring as it will cause more expensive premiums. Always maintain good credit to get lower premiums as auto insurance companies review premiums.

Gender

This may sound weird, but gender is also a factor. Women generally pay less than men below a certain age. From this age, both genders pay equal insurance. It is safe to say that age affects gender in terms of auto insurance.

Insurance companies assume that men are more likely to get involved in car crashes, DUIs, speeding, and other careless habits than women. Women are considered multitaskers and can concentrate on the road with cars coming from all directions.

All these assumptions are stereotypes, and while some have been proven to be accurate, there remains the chance they could be wrong. Due to these disparities, some states, such as Pennsylvania, do not allow gender to be used as a consideration.

Type of vehicle

A first-time driver of a Honda or a Jeep Wrangler will not pay the same insurance premiums as the owner of a Lexus. The difference could be as much as $500. Cars with advanced software and technology may have more expensive insurance than those without because repairing these systems will also be costly.

Marital status

First-time married individuals are considered safer drivers and usually pay fewer car insurance premiums. Also, insurance companies often assume that spouses may use the exact vehicle.

A point to note is that while these factors, such as gender and marital status, may be considered by insurance companies, they only affect the rate of premiums and not eligibility. You cannot be denied insurance because you are not married or are divorced.