People need a budget if they want to keep track of their spending and achieve their financial objectives.

A personal budget is a record of your earnings and expenses for a certain time period, generally a month. Whereas "budget" is often associated with spending restrictions, it is not necessary for a budget to be successfully accomplished as per the plans.

A budget will show what amount someone is expecting to earn and compare it to their obligatory bills (such as electricity bills and newspaper bills) and ability to spend (such as shopping, travelling, etc). Instead of viewing a budget as a restriction, consider it to be a medium for achieving your financial desires.

How to Make a Budget in Some Simple Steps

To design a budget that works for you and allows you to live a comfortable and happy life, you must first determine what you are presently spending, how much you can afford to pay, and what your priorities are.

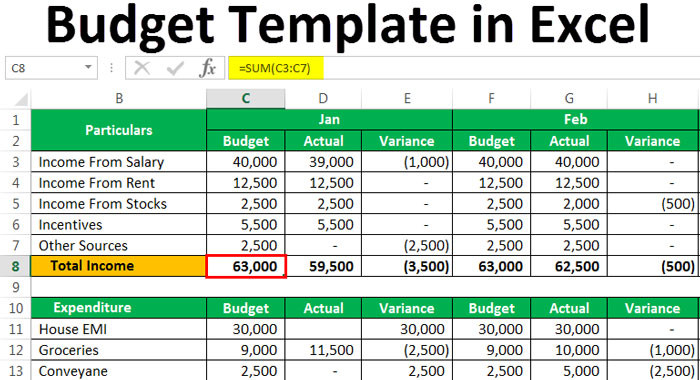

Find a budget template to put in the data for your costs and income before you start creating a budget. While you can budget using pen and paper, utilizing a monthly budget template or budgeting software is faster and more effective. These will have defined fields for income and spending in several categories, as well as built-in algorithms to assist you in calculating your budget surplus or shortfall.

Compile Your Financial Statement

Before you can begin working on your personal budget, you must first gather your financial information. You may be able to obtain all of the information you want by logging into your bank account, or you may need to acquire hardcopy statements. Obtain 12 months of records if possible. If you don't have records that far back, do what you can.

Make note of each of your income sources.

Examine your documentation and make a list of all sources of revenue. You can't build a budget until you know how much money you bring in each month. Make a note of your net compensation, not your gross income.

Your net salary is also known as your "take-home pay." It is the amount of money deposited into your bank account after taxes, perks, and any 401K contributions have been deducted by your company. Remember to indicate any recurring source of income.

Include a side job that earns you money every month if you have one. If your income is only intermittent, leave it out. If you work a job where you are given commissions or if your salary is not consistent from month to month, you should go over your records and figure out your average monthly income.

Make a list of Your Monthly Expenses.

List all of your monthly costs and other financial responsibilities, such as rent, cell phone bills, vehicle payments, student loan payments, clothes purchases, medical expenses, and so on. Going out to dinner, going out with your loved ones, and other minors, irregular costs may be classified as "miscellaneous." You should pay special attention to their cost. The cost may add up, and many individuals are unaware of how much they are paying for such items.

Evaluate Fixed and Variable Expenses

Fixed costs are those expenses for which you must pay the same amount each time. Include mortgage or rent payments, auto payments, fixed-fee internet subscription, trash collection, and regular child care. Include any routine credit card payments as well as any other critical spending that tends to be consistent from month to month.

If you anticipate saving a certain amount or paying off a certain amount of debt each month, consider savings and debt repayment to be fixed expenditures.

Variable costs are those that vary from month to month, such as groceries, gasoline, entertainment, eating out, gifts, and so on.

Begin by allocating a spending value to each category, starting with your fixed costs. Then, calculate how much you'll need to spend on variable costs each month.

If you're unclear about the amount you spend in each area, look through your transactions of credit card or bank transactions to get a ballpark figure.

Add Up Your Monthly Earnings and Expenses.

If your revenue surpasses your costs, you're on the right route. This extra money allows you to use it towards other parts of your budget, such as retirement savings or debt payments.

If your expenses surpass your income, you are overspending and should make some adjustments.

Aim for an equitable split between your revenue and spending sections. This equal balance showcase that all of your money has been accounted for and assigned to a specific spending or saving purpose.

EndNote

Now that you know how to make a personal budget keeping a check on it is also essential. After you've established your budget, you must watch and keep monitoring your spending in each area, ideally daily throughout the month. You may track your income and spending using the same budget template or application that you used to make your budget.

Keeping track of your expenditures over the course of the month will help you prevent overspending and identify unneeded charges or spending patterns. In place of waiting until the end of the month, take a few minutes every day to record your costs.

As you move through your budget, keep a record of your expenditures. If you go over your monthly spending limit in a category, you must either cease spending in that area for the month or transfer money from another category to cover the extra costs.

The purpose of budgeting is to maintain monthly spending equal to or less than monthly revenue.