Although the piggy bank is a fantastic idea, children lack a picture. They can watch the money expanding when you use a clear container. They had a $1 bill and five dimes yesterday. They have a quarter, five dimes, and a $1 account today. Please discuss this with them and emphasize how it's expanding!

Be A Role Model.

Little eyes are observing you. Eventually, someone will notice if you always put down plastic when you go to the grocery store or out to eat. They will also see if you and your partner are fighting over money. When they get older, they will be far more likely to follow your healthy example if you set one.

Show Them That Things Are Expensive.

You must do more than the only remark, "Son, that pack of toy cars costs $5." Help them take a few dollars from their jar, carry it to the register, and personally deliver the money to the cashier. A five-minute talk won't have the same effect as this straightforward action.

Display the opportunity cost.

Simply put, that is another way of expressing, "If you buy this video game, then you won't have the money to buy that pair of shoes." Your children need to be capable of weighing options and comprehending potential outcomes at this age.

Give commissions rather than grants.

Give your children more than just money to breathePaying kids' commissions for domestic chores like mowing the yard, taking out the trash, or cleaning their room is a good idea. The Smart Money Smart Kids system is extensively covered by Dave and his daughter Rachel Cruze in their book. This concept will teach your kids that money is earned and isn't just handed to them.

Avoid making impulsive purchases.

Mom, I just discovered this adorable clothing. It's beautiful and perfect! Please let us purchase it. This may sound familiar to you. This age group is highly skilled at making the most of impulse purchases, especially when made with someone else's funds.

Emphasize the value of giving.

Be sure to teach children the value of giving back as soon as they start earning money. They can pick a church, a good cause, or even a friend who could need some help. They will quickly understand that giving affects both the giver and the beneficiaries.

Teach them how to be happy.

Your teen spends a significant portion of their free time scrolling through social media on a screen. And while they're online, they watch the highlight reel of their friends, relatives, and sometimes even strangers! This is the easiest way to fall into the comparison trap. For example, "Dad, Mark's parents just got him a brand-new automobile! Why must I operate this 1993 Subaru?

"Mom, this kid at school received a $10,000 budget for her Sweet 16 celebration. And I want to do that!

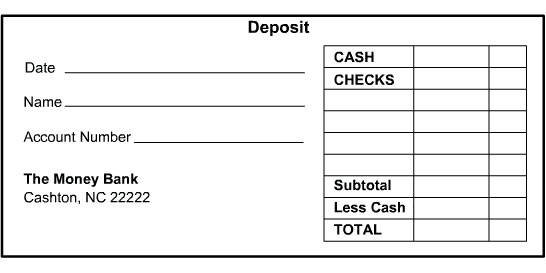

Give them control over a bank account.

By the time your child is a teenager, you should be able to open a simple bank account for them if you have been carrying out some of the tasks mentioned earlier along the way. This advances the concept of money management and should equip them to handle a much larger account when they get older.

Start them off with college savings.

There is no better time than now for your kid to begin saving for college. Are they going to have a summer job? Perfect! Put some of that money—or more—into a college savings account. Your teen will feel invested in the outcome as they contribute to their education.

Teach children about the perils of using credit cards.

Your child will start receiving credit card offers as soon as they become 18—especially once they start college. They'll use their credit cards the same way everyone else if you haven't addressed why going into debt is wrong. Remember that you must pick the right time to share these concepts with them.

Introduce The Wonders Of Compound Interest To Them.

We are aware of your thoughts. When can't you get your children to brush their hair? How on earth are they supposed to become savvy investors? It's ideal if your child can start investing right away. Compound interest is a great idea! Early exposure to it will give your adolescent a jump start in preparing for the future.

Educate them on how to get income.

When you stop to think about it, teenagers have a lot of free time—fall, summer, winter, and spring breaks. Help your teen obtain employment if they want money (and what teen doesn't?). Better still, assist them in starting their own business! It's simpler than ever for your adolescent to launch their own company today and make a profit.