People put their money in banks because they know the money will be safe and will increase with interest. However, like any other business, banks can experience financial difficulties and even fail. Your financial security may be in danger if your bank goes under. Find out what to look for at a bank and what you can do to keep your money safe if you suspect financial trouble.

Safety Measures for Financial Institutions

You may take precautions to ensure that your money is secure at every bank or credit union you deal with.

Coverage For Accidents and Injuries

The Federal Deposit Insurance Corporation and the National Credit Union Administration cover deposits at certain banks and credit unions.

Mind The Cap

You may be sure your money is safe, but there is a $250,000 limit on how much can be insured for any customer. To further protect your money, you can place it in CDs or deposit it in a different bank with FDIC insurance.

Keep Up With The News

Keep an eye out for stories that suggest your bank may be sold or purchased. That's a sure symptom of some financial trouble.

Do Bank Research

Weiss Ratings' Bank Safety Ratings are comparable to the FDIC's secret problem bank list. Look up your bank's letter grade and see how it stacks up against others. The Texas Ratio is another indicator that may be used to gauge the health of your financial institution.

Possible Warning Signs of Financial Crisis

There are several warning indicators you may look out for if you're worried about the stability of your local bank. There may be trouble at your bank if it.

- Shuts down several locations

- Retrenches

- Eliminates fee-free accounts

- Fee hikes

These signals usually indicate that a bank is having financial troubles and trying to cut costs wherever possible. You may also search your bank on the FDIC website to look for warning indicators like a decline in deposits this year compared to the previous.

If a bank has been slow to produce financial statistics like results, it may be grappling with a fluctuating valuation. A bank with financial difficulties may not have the resources to fulfill all withdrawal requests immediately.

It's because banks provide loans to other people. Thankfully, banks also have measures to protect your money, at least up to a point. To make sure your money is secure; you only need to do a little research.

What Exactly Is Federal Deposit Insurance?

American government-backed insurance provides a tremendous safety net. Insurance from the FDIC is a must for financial institutions like banks. NCUSIF provides insurance to credit unions.

Your money might still be at risk if you put all of it in one bank, even if they offer federal deposit protection. Insurance protects deposits up to $250,000 per customer per institution.

If you have more than $250,000 in a single account, you must split it into many versions at other financial institutions.

This safeguards your savings against losing everything a single bank fails.21 You won't have to worry about getting caught up in a bank run or having to withdraw your money from a bankrupt institution.

Bank Rankings

Don't deal with weak banks if you want to keep your money safe against bank runs. See what a third-party agency rates your bank or credit union to help you spot the poor ones.

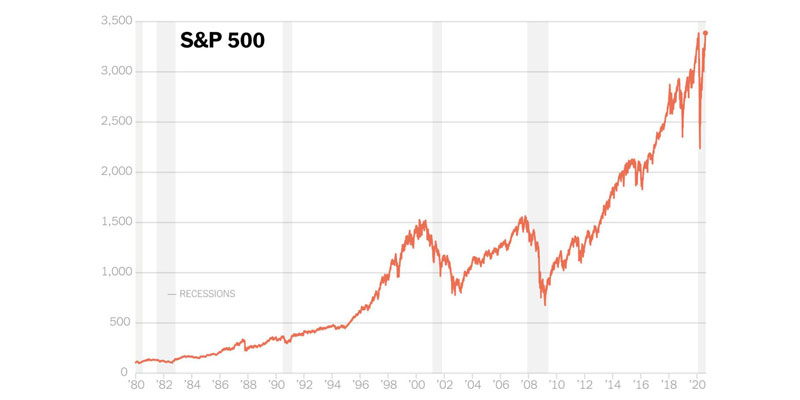

Nearly 900 institutions were on the FDIC's "trouble bank list"3 following the 2009 financial crisis. This list is confidential and is based on an analysis of statistics that reflect a bank's financial health and stability, such as:

- Loan balances

- Amounts due or lost

- Bank-charged-off loans

- Assets of banks

- Net interest margins

As a result of significant shifts in the banking industry, the number of institutions included on the FDIC's list dropped below 60.4.

The FDIC takes over troubled banks by selling them to a healthier institution or by liquidating their assets and returning depositors' money if the bank cannot recover on its own.

Consult the News

Do your best to keep up with the latest financial news if you're concerned about the security of your savings. Banks regularly subject to unexpected or inadequate press coverage may be on their last legs.

If you have sufficient insurance coverage, you may safely disregard the rumors and keep your funds where they are. Another financial institution will purchase the assets, and your regular banking services will continue in most situations.