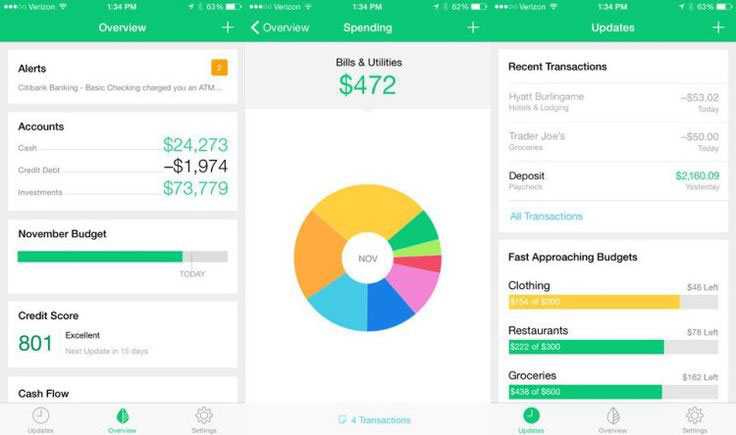

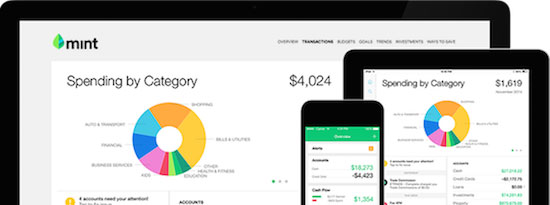

In a world that is increasingly reliant on the internet, Mint's technology has been praised for its user-friendly applications and straightforward yet instructive visualizations of an individual's financial situation. Thanks to money management tools, consumers can pay their bills on time, save money for more expensive purchases, and check their credit scores in one location.

Using Mint is a very easy and uncomplicated process. Mint, like many other applications and programs, needs additional actions to be taken initially while logging on and linking your accounts. Mint works by organizing your financial information and giving you an overview of the big picture. Therefore, syncing accounts such as checking, credit cards, and bills is essential for the program to function properly.

Creating a Link between Your Accounts

To get started, visit their website or download their app and establish an account by registering with your email address. The next step is to sync your accounts and follow the on-screen directions. You'll find that Mint already has links with most banks and offers a dropdown search function for those institutions.

- Additionally, Mint monitors how investments are doing and notifies users of any potentially questionable behavior.

- Other accounts can also be linked. The security measures used by Mint to protect its users' financial data are on par with those used by traditional financial institutions.

Mint will provide you with a comprehensive perspective of your financial situation as soon as all your accounts have been linked. The creation of a budget is the next step to take. Mint will provide you with a suggested budget based on your current financial situation, but you can modify this budget. You can raise or lower a line item in the budget, such as "Auto & Transport: Gas & Fuel."

How to Make a Financial Plan with the Help of Mint

You may use Mint to analyze your spending patterns and track how well you are sticking to your budget. You will be able to evaluate how you spend money over time and determine how to make your finances stronger. The following are three ways that you may utilize Mint to assist you in managing your finances and credit more effectively.

You've found the proper place to be, whether you've just chosen to update your budgeting spreadsheet to something more automatic or just got your first job out of college and realize you need to become more serious about your money. Make sure that all of your accounts, particularly those you use daily, are connected to Mint before you begin creating a budget. This can be done by logging into Mint and making the necessary adjustments (ahem, credit cards included). After connecting these accounts, go to the budgets section of Mint, and it will immediately glimpse how your current spending appears when represented in the budget form.

The Purchasing Groups Available

According to the website, Mint has more than 25 million users because it is easy to use. However, it also contains more complicated capabilities. A more realistic picture of the user's financial situation may be created by dividing purchases into several categories, which is one of Mint's many useful features.

Transactions Are Broken Up Into Pieces

Customers who make several purchases at Target, for instance, may find it convenient to divide their orders into distinct categories, such as "home improvement" and "groceries," respectively. Choose "change information" and then the "split transaction" option on the right side of the screen to separate your purchases. If you want a more realistic picture of your financial situation, enter the amount you wish to spend in each area. Users can keep tabs on their cash expenditures if they manually enter their transactions. This will prevent the same amount from being debited from your cash balance more than once.

Customize Notifications

Users of Mint may tailor various alerts to match their requirements. You can set up alerts that will notify you daily, weekly, or monthly if you go over your budget, if there is a change in your credit score, or if you incur an unexpected cost. You can also add recipients to the notifications, such as partners or spouses.

In addition to categories, a tagging tool allows customers to see their financial information grouped differently. You may, for instance, put another label atop the categories, such as "fixed costs," to see what proportion of your budget is going toward set expenses such as your monthly payments.

Mint gives you several options when creating a budget and managing it. It is notable for being easy to use and providing a useful snapshot of your financial situation, and you can test it out at no cost.