When you purchase or sell securities through a brokerage firm, are you curious about what occurs next? While making a trade is as easy as pressing a mouse button, the process of trading itself is rather intricate behind the curtains. You may be trading with another individual through an exchange when you submit an equity transaction on your desktop or through your broker.

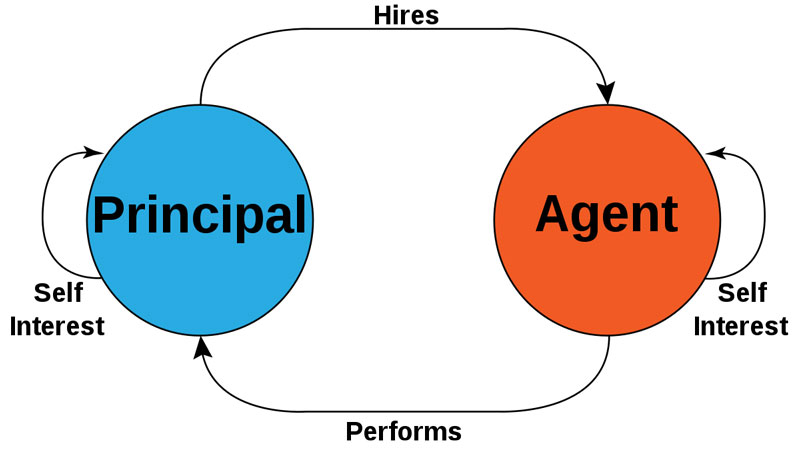

This may be the case, depending on the nature of the exchange. At other times, you are just conducting a deal with your broker. Principal transactions and agent transactions are the two primary categories of trades that can take place. Principal trades include transactions involving the firm's portfolio of securities, whereas agency trades involve an additional investor, who may be located at a different brokerage.

What is Principal Trading vs. Agency Trading?

To know the difference between Principal Trading and Agency Trading, we have to study both terms thoroughly.

Principal Trading

When a brokerage firm purchases assets in the resale market, hangs onto those securities for a certain amount of time, and then sells those securities, this is an example of principal trading. The businesses that engage in principle trading, also known as dealers, generate gains for their holdings by taking advantage of price increases.

Therefore, when an investor purchases and sells stock through a brokerage company that operates as the main, the business will utilize its items in stock to complete the task on time for the customer. This ensures that the transaction is processed as quickly as possible. By utilizing this strategy, brokerage houses can generate additional cash in addition to the charges charged by profiting from the spread between the bid and the asking price.

For reference, we are going to discuss an illustration. If you wanted to buy one hundred stocks of ABC for ten dollars each, the primary business would first examine its capital to determine if the shares were able to purchase for you. If they were, they would then proceed to fulfill your purchase order. If the shares were available, the company would sell them to you and subsequently record the trade to the appropriate exchange once it had completed the sale. It is a requirement of the Financial Services Authority (SEC) and the exchanges that brokerage companies execute deals at prices equivalent to those of the sector.

Agency Trading: Buying and Selling

The other common way a client's requests are carried out is through an agency transaction. These trades are more involved than conventional transactions since they entail discovering and sharing certificates between clients of various brokerages. Additionally, these deals are more lucrative. The rising number of people who participate in the securities market, together with the requirement for highly precise recordkeeping, settlement, clearance, and reconciliation, makes it a challenging responsibility to ensure that the securities markets continue to function without any hiccups.

Transactions involving an agency can be broken down into two different elements. Your brokerage must first convey your request to the relevant market to discover a party interested in assuming the opposite position. Therefore, if you want to purchase something at a particular price, the broker will have to locate someone else interested in selling at the same price and vice versa. Once both parties have been located, the transaction will be recorded on the ticker tape of the exchange, and on the settlement, both parties will trade money and securities with one another.

After the deal has been finished and has been correctly documented on the exchange, the second part of the agency transaction will take place. The term "clearing" is typically used to refer to this section. Although every broker has accounts in which they record the total amount of selling and buying orders that their customers make, the actual work of completing these transactions is taken care of by a more prominent organization. The National Trust & Clearing Association is the organization that is responsible for the great bulk of the clearing and safekeeping responsibilities in the North American market (DTCC).

The process of coordinating buys and bids is the foundational component of the clearing. Following the completion of the trades on the exchange, the relevant information on the transactions is then transmitted to the National Securities Brokerage Company, a branch of the DTCC. There, the information is recorded and checked to ensure accuracy. The DTCC notifies all member companies of their related duties and then facilitates the exchange of the relevant monies and securities after all of the trades made to it by member firms have been verified for buys and sells.

Therefore, rather than creating separate brokers to negotiate with each other again after trading on a capital market, the DTCC functions as an intermediary, gathering all transactions and simplifying the transfer of equities and cash. This eliminates the need for individual brokers to communicate with one another. This shortens the number of years necessary for the efficient and effective delivery of obligations and gives brokerages more freedom in picking their trading partners. The entire clearing procedure will typically take two full business days to finish.

It is essential to remember that perhaps the DTCC not just simplifies the delivery process but also ensures its success.

The DTCC will move in and satisfy the failed party's responsibilities if one party fails to reach the commodities or cash to another party.

Taking into Account Particulars

Now, you might be capable of differentiating between Principal Trading vs. Agency Trading. Even though you cannot dictate to your real estate agent how you would like the transaction to be executed, you have the obligation as a customer to be informed of the specifics of how the deal was finalized. You are entitled to know from your broker whether or not a completed deal was conducted as an administrative or primary transaction. 5 In most cases, the information will be included in the transaction confirmation mailed to you or given to you online.

Investors need to have a thorough understanding of the process of order fulfillment, even though it is possible that having this information may not result in any additional financial gain. These two methods of processing orders assist in lowering the risk that investors are exposed to and provide brokerage clients with a reasonably liquid and efficient method of placing transactions and carrying them out.