Introduction

The fact that the property wasn't even eligible for a short sale is a significant factor in their failure. A quick deal is not necessarily what it seems to be on the surface. Buying a short sale requires communicating with the listing agent. Get in touch with the listing agent before making an offer. Real estate agents come with a wide range of expertise and academic backgrounds. No two of them are alike at all. What should I ask a Short Sale Agent?

What Is Your Level of Short Sale Experience?

If the agent hears an accusing tone in your voice, they will be less likely to answer this query and your subsequent requests for clarification. You must avoid making the agent feel threatened or defensive.

How Many Lenders Are Involved in This Short Sale?

A short sale with only one loan might not be the most straightforward option if the loan is subject to mortgage insurance. When two loans are on a short sale, there will likely be no MI and no MI approval. As the MI is obligated to cover a set percentage of the lender's loss, some mortgage insurance companies have gone out of business, while others require substantial seller contributions.

What Can You Tell Me About the Lender(s)?

If you're wondering what kind of sale this is, a Wachovia short sale is the most accurate description. Because the average turnaround time for a quick sale approval at Wachovia is under two weeks. Many financial institutions now use the Equator and similar online software to conduct short sales, speeding up the transaction process and reducing the risk of missing documents.

What Type of Documentation Do You Have From the Seller?

Ideally, you'd learn that the seller is experiencing financial difficulties, but a savvy short-sale listing agent won't tell you that. However, you should ensure that the Short Sale Agent has the following documents in addition to the hardship letter: tax returns, bank statements, salary stubs, and W-2s.

What Is Your Procedure After the Seller Accepts an Offer?

The best action is for the realtor to promptly submit the offer, HUD, and short sale package to the bank. You should probably pass on this short sale if the Short Sale Agent needs to consult a manager or has no idea what to do next.

How Many Offers Do You Send to the Bank?

You can't go wrong with the best offer, which is the only valid response to this question. Financial institutions are averse to receiving multiple bids. A bank may reject an initial offer in favour of a second one. If the seller wants out of the short-sale contract, find out how they can do so.

How Long Do You Estimate for Short Sale Approval?

Except for HAFA-approved short sales, no assurances are provided. While no broker can promise a specific time frame, many will be able to give a ballpark figure based on experience with comparable short sales. Timeframe for fast sale approval should be established in advance.

What Are Your Expectations From a Buyer?

For instance, the buyer must pay earnest money into escrow with my short sales. My sellers have also requested (and received in writing) a pledge from the purchaser and purchaser's agent not to submit multiple offers. A buyer who doesn't want to play by the rules isn't a buyer in my eyes. However, as I've already mentioned, every broker is unique. Find out what is required of you and decide if it is something you can accept.

Conclusion

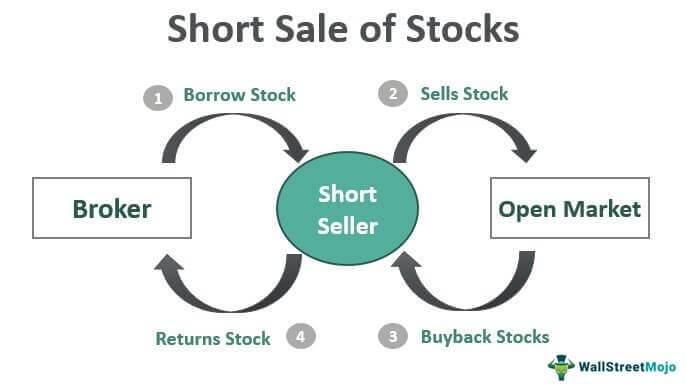

In real estate, a short sale occurs when a buyer offers less than the amount still owed on a mortgage. When a homeowner resorts to a short sale, it's usually because they're in dire financial straits and need to get rid of their home quickly to avoid foreclosure. In a quick deal, the lender receives all of the money. The lender may then choose to write off the outstanding sum or pursue a deficiency judgement to collect the difference from the previous owner. It is the law of several states to waive this pricing discrepancy.