Taking on a small amount of debt probably won't hurt. It all begins with that. Credit card debt can quickly spiral out of control with just one careless purchase. But why is it a bad thing to have some debt? As a starting point, consider the following nine issues that can arise as a result of being in debt.

You'll be tempted to make unnecessary purchases when you have debt. Something about being in debt makes it tempting to keep spending, even though you know you won't be able to keep up with the payments. The temptation to incur debt often stems from the desire to experience the rush of possessing something new without experiencing the pang of loss that comes with having to part with the cash.

It may seem as if you are getting a bonus at no cost. However, all that spending will come back to haunt you, and you won't feel so good.

Financial Costs Are Associated With Debt

It's easy to believe you're debt-free when you swipe your card or sign loan agreements. A person typically has to pay back the money they borrow. Interest is the mechanism by which this cost is incurred. To a greater extent, interest rates determine how much you will ultimately spend to settle a debt. The greater your debt and the longer it takes to pay it off, the more interest you will pay overall.

The only possible exception to this is a loan or credit card promotion with no interest or a very low-interest rate, but even these have limits and can be canceled if you fail to make your payments. You can avoid paying interest on a credit card balance if you make timely, full payments each month.

Debt is a Loan Against Your Future Earnings

When you use a credit card or take out a loan, you effectively use the money you expect to receive in the future. What's the use in shelling out cash for a product or service you've long since exhausted? The best course of action is to not put your financial destiny in the hands of a bank because of the possibility of fluctuating revenue.

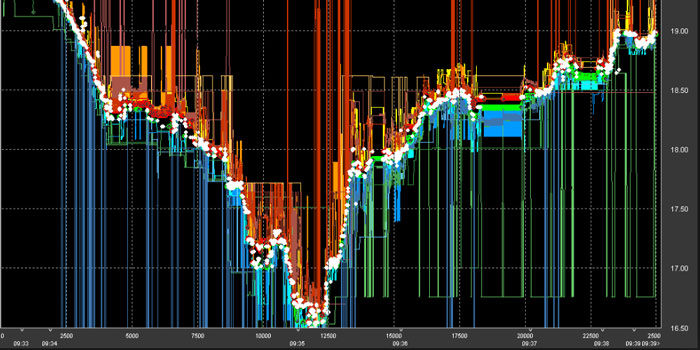

When you take on debt with a high-interest rate, you pay more overall—interest rates in a financial document, up close and personal.

If you buy a $2,000 sofa on credit at 11% interest and make the minimum payment each month, it will take you over three years to pay off the balance, costing you almost $3,600. That's an increase of $1,600 above the furniture's original price. If you doubled your payment to $100 per month and paid off the amount, you would still spend over $220 more than the furniture was worth. However, if you set away $150 per month for 14 months, you will have paid in full with no interest.

You can't get ahead financially if you carry a lot of debt. You won't have as much spare cash for retirement savings, that dream vacation, or holiday gifts for your loved ones if you have to make monthly debt payments instead. The more you borrow, the more money you'll have to pay back each month, cutting into your discretionary income.

Afford a Home is Impeded By Debt, Generally speaking, many lenders prefer a lower rate. Until you settle some of your other bills, your only option will be to continue making payments on your present mortgage or rent. 1

Stress from Debt Can Cause Serious Health Issues

It's natural to stress out about making debt payments and avoiding taking on more debt when you're already struggling to make ends meet. Debt stress has been linked to a wide range of medical issues, from the relatively minor (ulcers, migraines, depression) to the very serious (heart attacks, strokes). 2 The more indebted you are, the more likely you are to experience health problems.

A marriage with debt can suffer. The added stress of debt on the family budget means less money to provide a cushion for your loved ones. Arguments about spending patterns, who is accumulating more debt, and how much debt is too much can arise when both couples feel stressed. A marriage can end in tragedy if arguments like these are allowed.

Where may I find assistance for my financial woes?

Credit-counseling groups and debt-relief agencies are just two of the many programs and services available to assist you in getting a handle on your debt. It's important to look into your options thoroughly before committing to any debt reduction or counseling program, as some of them may demand excessive fees that could be put toward reducing or eliminating your debt. The FTC recommended contacting your state's consumer protection office or attorney general to verify their legitimacy.