American Express credit cards may now be used in small or locally-owned shops, so if you've been putting them away when shopping, you may want to start pulling them out again.

According to a spokesman from American Express, 99 percent of retailers who take credit cards also accept American Express in the United States.

Why Did American Express Lag?

Along with Visa, Mastercard, and Discover, American Express is a significant payment network in the United States. When it comes to merchant acceptance, AmEx has underperformed compared to the other major credit cards.

You've probably heard the statement, "I'm sorry, but we don't accept American Express", when out and about. The primary reason behind this is America has a history of charging merchants more interchange fees (sometimes known as "swipe fees") than the competition.

The retailer pays a fee to ensure that you are charged, and the store is paid for the sale when you use a credit card. The credit card issuer receives a portion of the cost, called an "interchange," which usually runs from 1% to 3% of the transaction.

What Locations Accept American Express Cards?

Until recently, consumers had a more challenging time finding businesses that accepted American Express cards than any other network. Only in the United States does this apply. Only 1% less than Visa, Mastercard, and Discover accept American Express cards among the 10.6 million U.S. merchants.

When traveling, it's always a good idea to have a backup credit card if you come across a store that doesn't accept American Express. As mentioned above, American Express is still widely accepted by millions of businesses. You'll be more likely to locate American Express-accepting businesses if you reside in a big city or near a popular tourist site.

Where Is American Express Not Accepted?

American Express cardholders may have visited stores that accept other credit cards but not their AmEx card. Interchange fees, such as those imposed by Visa, Mastercard, Discover, and American Express, are blamed.

Merchants must pay a percentage of each credit card transaction to the payment network to avoid these charges. In some instances, retailers refuse to take American Express cards because of the additional fees it charges.

Why American Express Costs More for Businesses

As a result, why does American Express charge a higher fee to retailers than Visa and MasterCard? American Express is a significant credit card provider and a payment network. Interest charges and a part of interchange fees are the primary sources of revenue for credit card issuers.

There are many American Express credit cards that are charge cards. In other words, the cardholder must pay the whole monthly bill balance in full. Hence Amex does typically not get interest charges from these products.

Why a Second Credit Card Is Always a Good Idea

If you often use an American Express card, you may want to carry a backup card from a different payment network if you find a business that does not take American Express.

You should, however, always keep a backup credit card on hand, regardless of which card you use. For example, if your primary card is stolen, lost, or somehow compromised, you will be without a credit card until a replacement is obtained.

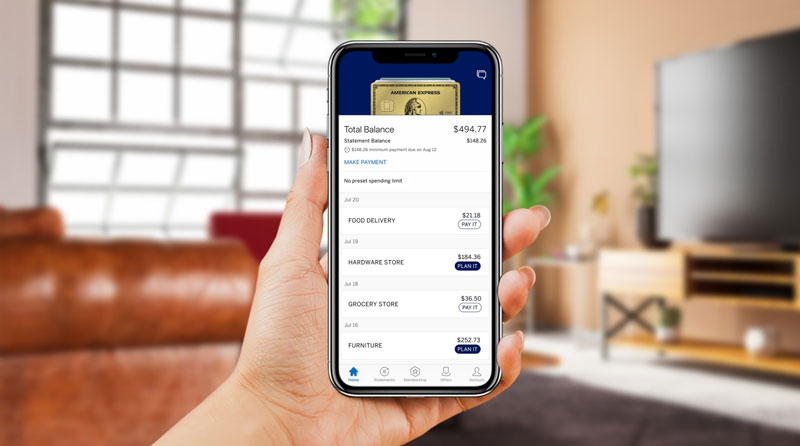

American Express Card Types

Both retail and business clients can benefit from American Express credit cards and pre-paid debit cards. As a significant provider of charge cards, it is also a significant player in the business.

Credit and debit cards issued by American Express are subject to normal underwriting processes. A credit score of at least 670 is required to apply for a loan from the organization, which is not a subprime lender.

Partnerships, co-branded credit cards

Many American Express credit cards are issued directly to customers, but the company also has joint ventures with other banks. Although new applications will be halted by April 2021, current cardholders will not be affected; Wells Fargo in the United States and Banco Santander in Mexico provide American Express cards. 1415 American Express has also teamed up with other firms to promote credit card applications.

The American Express Card: Pros and Cons

Pros

- There are no spending caps on the American Express Green, Gold, or Platinum cards.

- J.D. Power's 2020 U.S. Credit Card Satisfaction Study ranks American Express as the best customer service provider.

- American Express credit cards have many benefits, like points, miles, and even money back on purchases.

- You must pay off your American Express credit card amount in full each month to avoid accruing interest.

Cons

- Some businesses refuse to take American Express cards because of the increased transaction costs.

- To be eligible for an Amex card, you must have a credit score of at least 670.

- It's possible to pay hefty annual fees for Amex cards.

- Because American Express charge cards must be paid in full each month, you can't use them as a "loan" from your bank account.

Conclusion

Let go of any lingering doubts about American Express's ease of use. Just be aware that some of the items you pick up at the corner store may not be able to take it. Consider having a non-American Express credit card in your wallet as a backup if this situation applies. However, you don't have to wait for admission to start earning points.