When money is lent, borrowed, or invested, interest is paid on that money regardless of spending or how long it takes to repay the loan or investment. Simple interest is a sort of interest computation that does not consider how the interest accrues over time as it is calculated. Compounding is the process through which you earn interest, add the amount of that interest to your balance, and then earn even more interest due to the increased size of your balance.

Knowing Simple Interest

When you make a payment on a simple interest loan, your money is immediately applied to the interest due for that particular month. The remainder is used to reduce the principal balance of your loan. Each month's interest is paid in full, ensuring that it does not accumulate and does not increase in size again. Compound interest, on the other hand, reinvests a portion of the monthly interest into the loan.

Consider the following scenario: you have a $14,999 principle debt on a vehicle loan with a simple interest rate of 5 percent per year. You want to learn how simple interest works. The deadline for making your payment is May 1. If you pay it on time, the financing firm will calculate how much interest you'll owe for the 30 days in April based on your payment history.

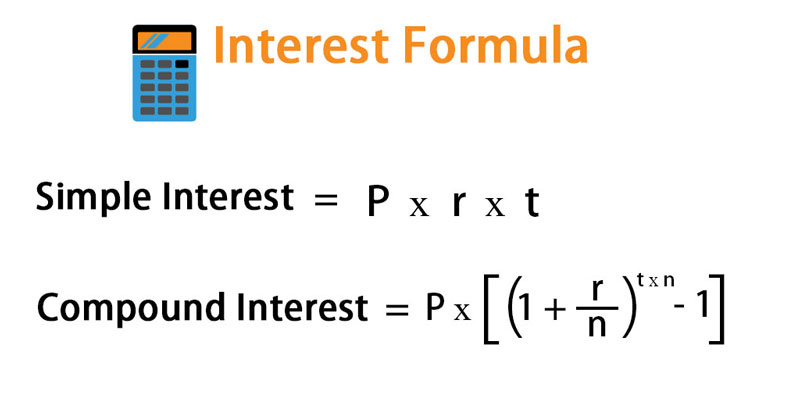

How Is Simple Interest Calculated?

The equation is the quickest and most straightforward method of calculating how much interest you owe. When you learn how simple interest is calculated, you may go on to more complex calculations, such as APR (annual percentage rate), APY (annual percentage yield), or compound interest, if you have mastered simple interest. If you want to analyze simple interest, you have to multiply the amount of money you start with by the rate of interest and the length of time you want to calculate it over.

Using Calculators

Alternatively, you may utilize a calculator or ask Google to do the calculations if you do not wish to do the calculations yourself. Google makes it simple to locate the formula. Enter the formula into a search box and press the return key. For example, searching for "5/100" will accomplish the same objective (the result should be .05).

Who Gets Benefit of a Simple Interest Loan?

Because of this, simple interest is often beneficial to consumers who pay their bills or loans on time every month. If you made a payment of $299 on your student loan on May 1, the money would be applied to the principal. If you make the same payment on April 20 as you did on April 19, $259 will be applied to the loan principal. If you can make your payments on time every month, your principal amount will decrease more quickly, and you will pay off the loan sooner than you anticipated.

If you pay off your loan late, a more significant portion of your payment is applied to interest than if you pay off your debt early. Your payment is due on May 1, and if you pay it on May 16. You will be charged $92.26 in interest due to the delay. Thus, only $207.34 of your $299 payment goes toward principal, which is the total amount you owe on your loan.

Compound Interest vs Simple Interest

Said, interest may be simple or compounded, but it can also be both simple and compounded simultaneously. Said, simple interest is calculated by taking the initial amount of a loan or deposit and dividing it by the amount of money earned. When it comes to compound interest, it is calculated on the amount of money you start with as well as the interest that accumulates on that money over time.

In real life, compound interest is often a consideration in commercial transactions, investments, and financial goods intended to be held for an extended period. To do rapid computations, simple interest is the most efficient method. These are generally computations that are completed in less than a calendar year. Simple interest may also be used when there is no end in sight, such as credit card debt.

What Makes This "Simple" in Your Opinion?

"Simple" interest states to a simple crediting of cash flows that result from an investment or a bank account. Consider the following example: a basic interest rate of one percent per year would provide you one dollar for every one hundred dollars you put in, year after year. After one year, the 1 percent interest generated on a balance of $100 would amount to $1 since interest-on-interest does not consider the power of compounding.