Introduction

Wealthfront is a well-known brand in the world of self-driving, and it has always been rated as one of the main sites for new investors. Here, new investors can find tools and services to help them keep track of their investments. The fact that it can fully automate the process of investing money is its best feature. There are no fees for making withdrawals or trades, but new users must keep at least $500 in their accounts. Most accounts also have a small 0.25 percent fee.

Wealthfront is usually the best platform for planning long-term goals because it has many options and services for setting goals, as well as digital personal finance tools and advancement trackers. On the other hand, you can't trade in fractions, there's no live human adviser, and communication and customer service aren't as good as they could be.

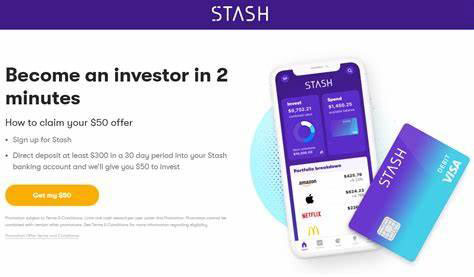

Stash is yet another self-driving service that helps people new to investing learn the ropes. Thousands of people don't have bank accounts because they don't have enough money or bad credit. That is why CEO Brandon Krieg started the service. There is no takes numerical needed to open a Stash account, and the monthly charge ranges from $1 to $9, depending on the type of account.

Goal Setting

Wealthfront had also set the standard for goal-making plans at Robo-advisors, but Stash deserves credit for trying a new approach geared toward younger investors. Stash's planning tools, called "Stash Coach," are set up like a game. You earn points and move up levels when you finish investment and learning challenges. Different problems and portfolio suggestions can help investors learn about new funds each week. You can also earn points by doing certain things in your account, like turning on Auto-Stash, which makes regular deposit accounts into your investment account. This method should attract younger investors who would like to make investing more like a game, but large shareholders may not like the interface, especially if they want quick advice.

The goal-setting tools on Wealthfront were among the best of all the self - driving we looked at. Wealthfront's planning tools include web collaborators and calculators to help clients reach their goals. For example, you can connect to Redfin to get an idea of how much a house will price in the area you want. College savings plans estimate how much tuition, room and panel, and other costs will be at many universities in the U.S. There is a bridal goal and a data system that informs you how much your dream car will cost. You can even figure out how long users could quit functioning and travel while making progress on other goals. The console gives you a quick look at your assets and debts, as well as how likely it is that you will reach your goals.

Features and Accessibility

When it comes to features, both Wealthfront and Stash have a lot to offer. When you use Wealthfront, the provider grows with the amount of money under management, so investors get more even though their balance grows. On the other hand, Stash is built around its unique Stock-Back feature, which helps new investors. Regarding features and ease of use, you should choose the two based on which ones you are more likely to use. In this case, it may also depend on where you are in life. The features of Stash are meant to help you get started in the stock market. Wealthfront, on the other hand, rewards you once you have built up a nest egg.

Fees

For advisory services, Stash charges 0.25 percent per year, with a minimum of $1 per month for cash savings and $2 per month for private pensions. But that minimum could be a problem since $1 a month on the small total value is a higher percentage of the total value than 0.25 percent. As your portfolio grows, this problem goes away, and Stash's fees are competitive at much higher levels. Customers of Stash can also access UGMA or 1-ton accounts for $9 per month for child custody savings.

Wealthfront only has one plan, and the advisory fee for that plan is 0.25 percent per year. There are no fees for cash balances, and facilities like stock-level tax-loss post-harvest and the Smart Beta program are added based on asset levels at no extra cost.

Conclusion

Stash vs Wealthfron: Which is best for you? When it first came out, Stash was only for mobile phones. Even though you can now manage your account through the web, the desktop version isn't as full-featured as the smartphone app. It could be a plus for investors who know how to use their phones. Almost everyone who has heard of Robo-advisors has also heard of Wealthfront. This robot is one of the market's biggest independent digital investment advisors. It is currently in charge of $20 billion (AUM)