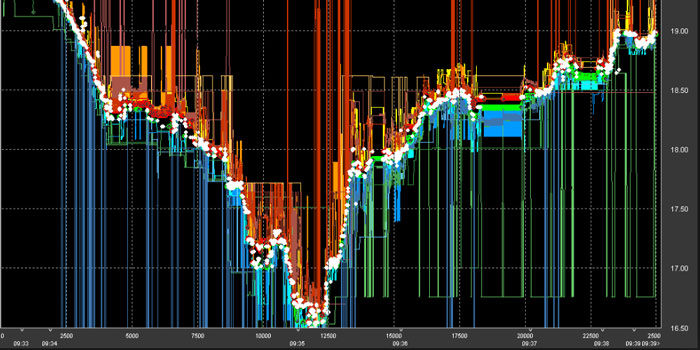

Location is essential if you want to save a few dollars in income taxes. From 0% to more than 13%, state tax rates are expected to be in place by 2021. Some of the highest state income tax rates are in California, Hawaii, New York, New Jersey, and Oregon, while eight states do not tax earned income.

Another ten states have a flat tax, which means that you'll pay the same proportion no matter how much money you make. You can find out which states have the highest tax rates and a comprehensive list of tax rates for every state in the United States here.

State-by-State Income Tax Rates in 2021

With a 12.3 per cent top tax rate and an extra tax on income above $1 million, California has the nation's highest effective tax rate of 13.3 per cent, making it the nation's highest overall tax rate.

2 Similarly, millionaires in New Jersey and New York are subject to a "millionaires tax." 34 Other states have a top tax rate, although not all states have the same number of income bands leading up to the highest rate in all cases.

While Iowa has a top tax rate of 8.53 per cent, Hawaii has a maximum tax rate of 11 per cent, and there are 12 income bands in both states. 5 Even though the District of Columbia is not a state, it has its tax rate.

The Tax-Free States

Alaska, Florida, Nevada, South Dakota; Tennessee; Texas; Washington; and Wyoming do not levy an income tax. The state of New Hampshire is debatable. Earned income is not taxed in this country, but interest and dividends are.

States that don't collect income taxes find alternative methods to raise money for their budgets. The combined state and local sales tax rate in Tennessee is one of the highest in the country.

How To Decrease Your Tax Rate

Tax credits and deductions are the two primary methods available to the average American for reducing their taxable income. Tax credits reduce your taxable income dollar for dollar. If you owe $2,000 in taxes but are eligible for $500 in tax credits, your payment is reduced to $1,500.

Various tax credits are available to the general public in the United States, some of which can save you more money in taxes than other deductions. The federal government provides tax incentives for purchasing solar panels for your home and the adoption of a child. Additionally, Americans may take advantage of a slew of tax breaks, including paying for school, child care, and even starting a family.

States That Don't Charge Taxes

It's a universal desire to pay less in taxes. That might be done by moving to a place with no income tax. Now, seven states do not charge any state income tax—Alaska, Florida, Nevada, South Dakota, Tennessee, Wyoming, and the District of Columbia. Only a select group of high-earners in Washington state are subject to an income tax on investment income and capital gains.

Alaska

State income and sales taxes are not imposed in Alaska. The state and local tax burden on Alaskans is the lowest of the 50 states, at approximately 5.10 per cent of personal income. Revenue and investment returns from mineral lease rents and royalties are distributed each year to all Alaskans by the Alaska Permanent Fund Corp.

In 2021, each citizen received $1,114 in dividends. Due to Alaska's isolated location and the expense of living, the state has a high cost of living.

With a beer tax of $1.07 a gallon, Alaska is the second most expensive state in the U.S., behind only Tennessee. 9 According to U.S. News & World Report's "Best States to Live in," the state ranked 45th out of 50 in affordability and 47th out of 50 in quality of life.

Florida

The mild weather and the huge number of seniors make this state a favourite destination for snowbirds. Even though the state's sales and excise taxes are higher than the national average, Florida's overall tax burden is only 6.97 per cent—the nation's sixth-lowest. Due to its higher-than-average housing expenses, Florida ranks 31st in affordability.

Despite this, Florida was ranked 10th on the "Best States to Live In" list by U.S. News & World Report. At $9,645 per student in 2019, Florida was one of the lowest spending states in the nation. As of 2021, Florida's infrastructure was rated C by the ASCE.

Florida obtained the same failing score when the Education Law Center graded each state's fairness in allocating public school funds six years earlier. In 2014, it spent $8,076, $31 more than the national average on healthcare per person.

Nevada

The state of Nevada is highly reliant on the hefty sales taxes it imposes on everything from groceries to clothing and the sin taxes levied on alcoholic beverages and gaming. As a result, Nevadans face a state tax burden of 8.23% of their income.

State-by-state, it has the second-highest tax burden of any state on this list, yet it is still a respectable 22 out of 50. In terms of affordability, Nevada ranks 41st due to its high cost of living and housing. "Best States to Live in" rankings by U.S. News & World Report put it 37th.

In 2019, education spending in Nevada was $9,344 per pupil, ranking it as the fourth-lowest in the Western U.S. The ASCE had given Nevada's infrastructure a C grade a year earlier, in 2018.