The world is smaller now than it was 50 years ago in many ways. This is because of changes in how people talk and how things work. This is most obvious in investing, where new technologies have completely changed how money is made and spent. Regulatory changes that have taken place over the last several decades have made it more difficult to differentiate between banks and brokerages. Since the 1980s, investors have had more chances to make money because of these changes and the growth of globalization. But there are also more risks when there are more chances. So what are stocks then and now: the 1950s and 1970s? Let us find out.

The 1950s Investing

In 1952, when the first survey of people who owned shares was done by the NYSE (New York Stock Exchange), only 6.5 million Americans owned common stock. Most people didn't buy stocks in the 1950s because they remembered the crash of the stock market in 1929 and the Great Depression of the 1930s. The DJIA (Dow Jones Industrial Average) didn't pass its 1929 peak until 1954, 25 years after the crash. Investing in the 1950s also took more time and cost more money than now. It was against the law for commercial banks to do business on Wall Street after the Glass-Steagall Act was passed in 1933. This meant that stock brokerages and commercial banks were not the same.

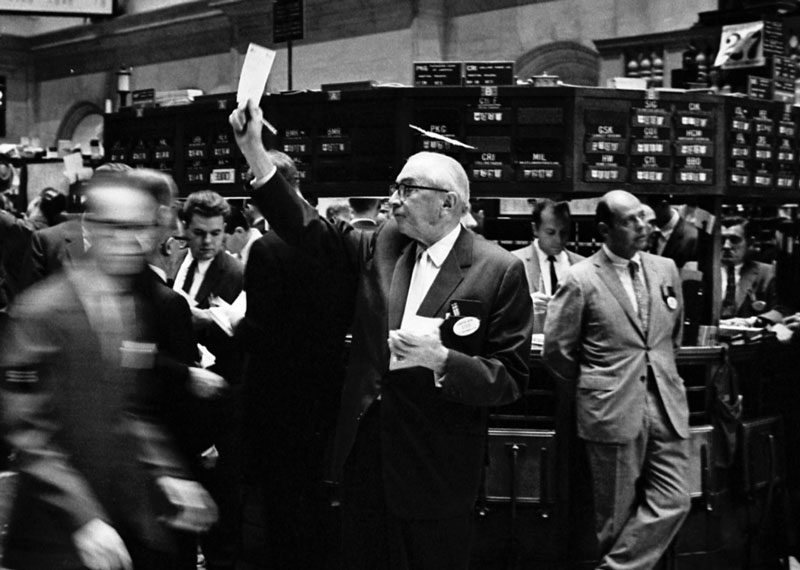

Fixed commissions were the norm, and they were high and couldn't be changed because there wasn't much competition. Back when technology wasn't as advanced, it took a long time to make a stock trade happen, from the first time an investor talked to a broker until the trade ticket was made and the trade was made. Even though there weren't many trades because investing in stocks was still new, by the middle of the 1950s, things were already beginning to change. In 1953, less than one million shares were traded each day on the NYSE (New York Stock Exchange).

The 1970s Investing

Even though the U.S. stock market moved slowly during this decade of stagflation, the pace of change in investing sped up. The DJIA was just above 800 at the start of the 1970s. By the end of the decade, it had only gone up to about 839, a gain of about 5%. For investors, the biggest change may have been that more and more stock trades were settled online instead of in person. In 1968, the Central Certificate Service was created to deal with the increasing number of trades. In 1973, it was replaced by the Depository Trust Company. This meant that investors were more likely to keep their stocks electronically at a central depository than in the form of physical stock certificates.

The 2000s Investing

It's much easier to invest now than it was in the past. With the click of a mouse, investors can buy and sell rare securities on markets in other countries. There are so many ways to invest that it can be scary and hard to figure out for people who have never done it before. Most of the new way of investing is because of changes in technology, but other things have also changed in the last 20 years.

First, cheap personal computers and the internet made it possible for almost any investor to be in charge of daily investing. Second, because online brokerages are so popular, investors can buy and sell stocks with lower commissions than they would at full-service brokerages. Because trading went faster when commissions were lower, some people now do day trading as their full-time job.

Third, since all stock prices were changed to decimals in 2001, the difference between the bid price and the asking price has shrunk. Last, ETFs (Exchange-Traded Funds) have made it easy for investors to trade securities, commodities, and currencies on local and international markets. These ETFs have also made it easier for investors to use advanced strategies like short sales.

Conclusion

Even though there are more ways for investors to put their money to work, there are also more risks. The "tech wreck" of the early 2000s and the "credit crisis" of the late 2000s happened at the same time all over the world. This shows that globalization has brought world markets closer together. This means there might not be anywhere safe to go if there is a global storm. As 2022 begins, the market will change because of new ways to invest, like Robo advisors, algorithmic trading, platforms with no fees, and "socially responsible investing."