The interest rates on short-term and long-term bonds each provide more information than one other. If you purchase Treasury notes, often known as "T-notes," for example, you are eligible to receive interest payments since the United States government is selling you a debt instrument or, to put it another way, borrowing money from you. In general, the interest rate on a loan will increase in proportion to the length of the loan. Because of this, you should anticipate that purchasing short-term bonds will be less expensive than purchasing long-term bonds, and you will probably get a larger return.

This is not always the case, but as a concept, it may be used to gauge many other elements that impact the economy, such as investor confidence. One example of this is: That is exactly what a yield spread accomplishes. It does this by comparing the yields on two different bonds, such as the two-year Treasury note and the ten-year Treasury note, which indicates how much money each bond earned over a certain period. The difference in yields between the two securities is one of the factors that may be used to forecast whether or not the economy will enter a recession within the next year or if it will begin to recover.

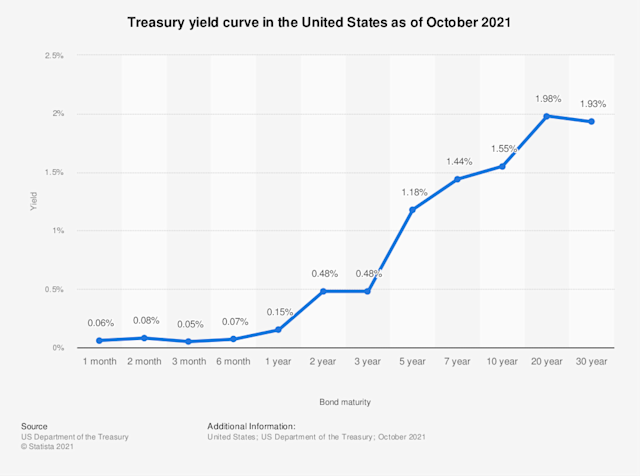

For example, the difference in rates between the two-year and ten-year United States Treasury notes is a significant measure for determining the "shape" of the yield curve at present. The yield curve is a graph with plotted dots that stand for the yields over a particular period on bonds of variable lengths. It is used to compare the returns on different maturities of bonds. Most of them are short-term and long-term bonds, with maturities ranging from three months to thirty years.

Taking a Look at the Curve

When trying to forecast what the economy will be like in the not-too-distant future, investors look at the shape of the yield curve and change the shape of the yield curve. When investors anticipate specific economic changes, the yield curve will steepen. These include a pick-up in economic growth, a rise in overall inflation, and a move by the Federal Reserve to raise interest rates. The word "steepening" refers to the phenomenon in which the yields on bonds with longer maturities increase significantly more than those with shorter maturities.

On the other side, the yield curve tends to flatten when investors anticipate weaker or slower growth, a lower rate of inflation, and lower interest rates from the Fed. In this particular scenario, the decline in rates on long-term bonds is greater than the decline in yields on short-term issues. When attempting to quantify these shifts, one of the methods used most often is examining the difference in yields between two-year and ten-year Treasury notes.

Sluggish Growth of the 1970s

The movement of the 2-year to 10-year yield spread into a deep inversion on the left side of the graph represents the sluggish growth in the late 1970s. The recovery that occurred in the 1980s may be seen if one looks at the following line and notices that it has an upward slope.

Warnings Regarding Future Economic Declines

At three important junctures in history, the yield curve turned inverted just before a recession: immediately before the economic downturn that began in the early 1990s, just before the collapse of the technology stock bubble in 2000-2001, and just before the financial crisis that began in 2007-2008. An early warning from the yield curve indicated that the stock market was about to experience a serious weakening in each instance.

Post-2008 Era

The Federal Reserve has maintained short-term interest rates at or near zero since the financial crisis, which has resulted in a decrease in the yield on the 2-year note. The rises and falls in the yield on the 10-year note have been nearly entirely responsible for the fluctuations in the yield gap between the 2-year and 10-year bonds. The line's unpredictability during this period illustrates the dynamic character of the economic climate in the period after the crisis.

Remember that many market dynamics are operating at any moment and that the yield curve does not reflect the whole story. It is not a survey but rather a single metric. Therefore, while the yield curve may provide clues about the current status of the economy or about the state that it will be in the future, it is not an entirely foolproof indicator. For example, in the late 1990s, a decrease in the United States debt led to a fall in the gap between 2-year and 10-year Treasury yields, even though the economy was doing well at that period. This was the case even though the spread decreased.