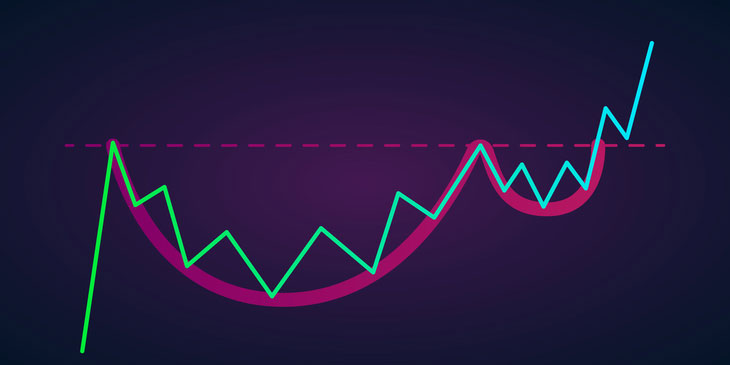

A typical shape pattern occurs when the price of an asset moves in a manner that appears like a familiar form, such as the shape of a triangle, the shape of a rectangle, or the shape of a head and shoulders pattern, among others. These patterns are a technique to make money by trading with your vision. A decent position to start, a stop-loss location to keep your risk under control, and a price objective to use when you want to close out a lucrative trade are all provided by these trading indicators. Let us see how to trade the cup and handle the chart pattern.

1. Cup and Handle

A cup and handle pattern is visible on a one-minute chart as well as on larger charts, such as daily and weekly charts, which are more complex. When a price wave declines, there is a time of stability, which is when the price wave rises again. Prices then increase to a level equal to the amount of the prior decline before falling again. Essentially, it creates a U-shape or the "cup" in the phrase "cup and handle." The price then travels sideways or downward in a channel, which causes the handle to form.

2. Getting into the Cup and Handle Trade

Wait for a handle to display on the screen. In many cases, the handle is in the form of something like a channel that runs up and down to the side, or it is a triangular shape. When the price breaks above the top of the channel or the triangle, you should consider buying. This is the time to make a purchase. When the price goes away from the handle, this is a pattern. The pattern has been completed, and it is expected that the price will rise. There's a significant likelihood that the price may rise shortly.

3. Setting a "Stop-Loss" Amount

After prices have broken out of a cup and handle shape, this order allows the trader to pull out of the trade if prices fall instead of rising. To protect the trade from danger, the stop-loss sells the position if the price drops enough to render the pattern incorrect and the transaction is no longer profitable. Make careful to place a stop-loss order just below the point at which the handle begins to flex. If the price moved up and down a lot within the handle, a stop-loss might be placed below the low of the previous swing period.

To improve the risk/reward ratio, the handle and stop-loss should be placed in the top 3rd / top half of the cup, depending on the situation. The risk component of the trade is represented by the stop-loss, and the profit component is represented by the target.

4. Profitable Exit or A Target to Choose

The height of the cup should be measured from the point where the handle emerges. That is the desired outcome. A cup might form between $100 and $99 in value. For example, if the breakout point is $100, the target price is $101. Each side of a cup might have a different height from the other. Please use the shorter height and incorporate it into the breakout point to create a secure starting point.

One method of using this indication is using a Fibonacci extension indicator. Draw the extension tool from the bottom of the cup to the top of the cup on the right. Then, by pushing it down, could you attach it to the low handle? Using day trading as an example, if your objective is not fulfilled by the end of the day, you may close your position early to get out of the trade.

Considerations

A rounded bottom or a sideways movement of the price occurs at the bottom of the cup's bottom. This is referred to as a "pause." It can be seen in this image that the price was unable to go below a particular threshold. When the price breaks out, it increases the likelihood that the price will increase. The same people who experience a V-bottom, in which the price decreases and then rapidly increases, may also see cups. It is true that some traders like using these mugs, but others do not.