When you are first starting, investing can be somewhat scary; nonetheless, it is an essential component of accumulating wealth and saving money for various financial goals. Don't get too caught up in whether or not the current market climate is the right moment to start investing since you will meet many different market settings throughout your investment life.

However, novice investors should choose how much risk they are willing to take before investing. It's important to understand that different types of investments carry varying degrees of danger to avoid unpleasant surprises after making a high-risk investment.

Consider how long you can go without the money you plan to invest and whether or not you are happy with the idea of not being able to access it for several years or even longer. Before putting your money anywhere, let's examine some things you should consider.

How Can You Identify Your Investor Type: The Important Considerations

The Justification For Investing

It's important first to consider why you want to invest. The truth is that investments are the key to a secure financial future, but it's important to remember that not all investment vehicles are created equal.

There are benefits and drawbacks to every investing strategy, as well as varying goals, to consider. You can't choose the right course of action until you know what you're trying to accomplish with your investments.

To put it another way, the financial instruments created to help you reach goals in the far future will be different from the techniques of investing that are accessible if you are interested in obtaining a goal shortly. If you know where you're going with your investment money, you'll be better equipped to choose the vehicle that will get you there.

Conducting Market Analysis

The choice to invest is a big one, and the results of this decision can have a huge impact on your future. Therefore, before making an investment decision, it is usually recommended to carry out extensive market research.

If you do this, you will better understand the present market, giving you a better concept of the firms in which you should consider investing. You can make investment selections that are particularly fit for you. It helps you succeed if you have a thorough grasp of the market and are also aware of your investment objective and the investment you want to make.

Relative Duration of an Investment

Your monetary objectives should be time-bound, indicating that your chosen assets should have a predetermined maturity period. The longer you continue to make purchases of a certain instrument, the larger of a corpus you will eventually be able to amass for yourself.

You improve your profit odds if you hold onto your investment for longer. However, all investments do not necessarily ensure a favorable return on investment. It would help if you chose the duration of your investment based on your long-term financial objective and the reason you are investing in the first place.

Recognizes Risk Levels

Almost every possible vehicle for financial investment exposes investors to at least some danger. Before becoming engaged with the investment, it is essential to have a solid understanding of its risks.

It would be helpful to base your decisions on the amount of risk you are prepared to accept to get the most out of your investments. To ensure that your primary investment is always protected, you should look for lower-risk assets.

Even if the profits on those investments won't be as great, your portfolio of assets will take on a somewhat different appearance if you have the goal of large returns and are willing to tolerate some risk.

Liquidate The Investment

When deciding about an investment, you should consider the possibility that you will have to sell that investment to satisfy other unanticipated needs. The potential for your investment's value to rise over time is an important consideration.

If the investment you choose has long-term potential and high liquidity, then as an investor. If that's the case, you'll be able to quickly and conveniently sell your investment whenever you choose, taking advantage of any price increases or decreases in the market experience.

Understand The Taxes Regulations

Evaluating the tax regulations and potential tax ramifications is vital before making investment decisions. It is because various investments result in varying amounts of taxes, which can impact the returns on your assets.

Before deciding to invest, you must understand the tax rules and regulations. A solid understanding of tax regulations enables you to make informed decisions about investments, which may help you safeguard your financial future.

When Should You First Consider Investing?

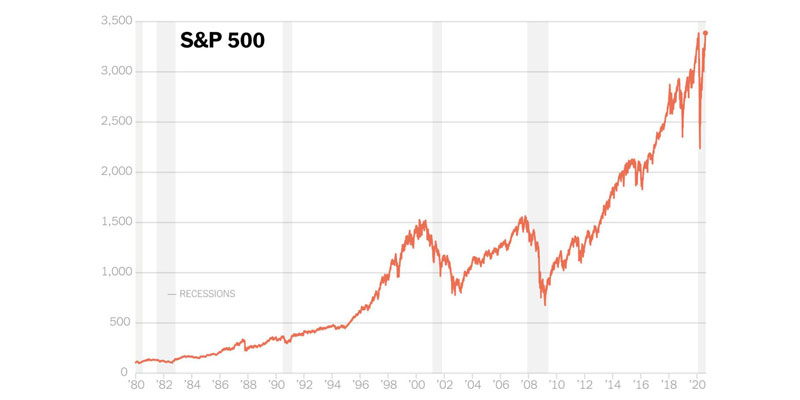

Investing is necessary for reaching long-term financial goals like retirement or creating wealth and maintaining the buying power of money. If you leave your money to sit in a standard bank account that pays little to no interest, inflation will gradually erode its buying value over time. By allocating some of your savings into investments like stocks and bonds, you can guarantee that your money grows at a rate at least as fast as inflation.

While preparing for a significant purchase such as a car or a house, short-term investments can assist you in achieving a greater return on your cash. Long-term goals, such as retirement, are best served by the stock market and exchange-traded funds (ETFs), despite the higher volatility and uncertainty they introduce.

Conclusion:

We understand the significance of diversifying one's wealth. However, the best approach to invest your money might change significantly based on a variety of factors, including both your personal and professional circumstances. Inflation, fluctuations in the stock market, and an economic climate that is always shifting can all put your portfolio in danger.

Your investment portfolio is vulnerable to a wide variety of external factors. Therefore, it is essential to determine the type of investor that you are. Depending on your personality type and the conditions of your life right now, you will have different objectives to pursue.