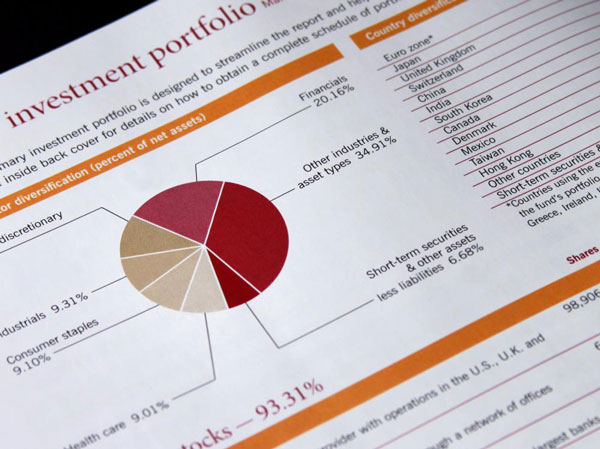

There are a lot of other strategies to diversify. It is up to you to decide how to go about doing it. Your plans for the future, your comfort level with taking chances, and your personality are all elements to consider. The following article will provide an overview of five primary categories of investment portfolios, as well as some pointers on how to get started with each category. Your requirements will most likely be satisfied by either one of these options or a combination of many.

The Aggressive Investment

An aggressive portfolio targets substantial returns and is willing to take on the risks that come along with that strategy. A high beta, also known as market sensitivity, is characteristic of the stocks that should be included in this investment portfolio. Stocks with a high beta have price swings that are more extreme than those of the market. If a stock's beta is 2.0, that stock's price will normally fluctuate in either direction twice as much as the broader market. Active investors look for businesses still in the beginning phases of their expansion and have a distinct value proposition to make their investments. The majority of them are not yet well-known names in regular use.

Watch For Rapid Expansion

Look for firms that have quickly rising profits growth but have not yet been found by the ordinary investor. These are the companies you want to invest in. Although the technology industry is the most common place to look for them, you may also find them in various other fields. Effective risk management is essential when constructing and maintaining an aggressive investment strategy. The keys to success in this investment are limiting losses to a minimum and capturing profit when available.

The Conservative Investment

The beta of defensive equities is often lower than that of more risky companies. They are comparatively insulated from the broader swings of the market. Defensive equities perform well not just in prosperous but also in challenging economic environments, in contrast to cyclical companies, which are highly susceptible to the underlying economic business cycle. Companies that manufacture goods necessary for day-to-day living will always be able to thrive, regardless of how terrible the economy may be.

Consider the things necessary for you to function daily, then investigate the businesses that manufacture the consumer goods that satisfy these requirements. In addition, many of these firms pay dividends, which is an additional perk that helps cushion the blow of any capital losses. The majority of investors should consider adopting a defensive portfolio strategy.

The Income Investment Portfolio

An income portfolio emphasizes assets that generate revenue through dividends or other forms of payments to shareholders and other stakeholders. The equities that make up the income portfolio are also candidates for inclusion in the defensive portfolio; nevertheless, the primary reason they were chosen for this portfolio was their high yields.

A portfolio geared toward income should have a net positive cash flow. Examples of assets that provide income include real estate investment trusts (also known as REITs) and master limited partnerships (also known as MLPs). These businesses give a significant portion of their income back to their shareholders in exchange for a more advantageous tax position. Specifically, real estate investment trusts (REITs) provide a means to invest in real estate without having to deal with the responsibilities of owning property.

Look For High Dividends

Investors need to keep an eye out for firms that have seen a decline in popularity but have maintained a strong dividend payout policy. These are the kind of businesses that may both bolster one's income and provide for gains in capital. Your search should begin with slow-growing sectors like utilities and other service-oriented businesses.

Speculative Portfolio

The speculative portfolio is the one that comes the closest to being like gambling among these alternatives. It requires taking on greater danger than any other options that have been brought forth thus far.

Initial public offerings (IPOs) and equities speculated to be takeover targets are examples of potential speculative bets. Companies in the health care or technology industries that are now working on creating a single ground-breaking product are examples of companies that would fit into this category. It would be considered a speculative move to invest in a developing oil business on the verge of releasing its first production figures. It is common practice for financial advisers to advise their clients to allocate no more than ten percent of their total assets to the funding of a speculative portfolio.

The Composite Investment Portfolio

To construct a hybrid portfolio, you will need to diversify your holdings into various asset classes, including bonds, commodities, real estate, and even art. The hybrid portfolio strategy allows for many latitudes in terms of customization and adaptability.