The worth of a life insurance plan when it starts paying you is an important consideration if you want to use it as a retirement income source. If you're looking for a way to save money when you retire, universal life insurance is indeed a better option than whole life insurance since it gives more investment options. The Value of Universal Life In Retirement is explained in this blog:

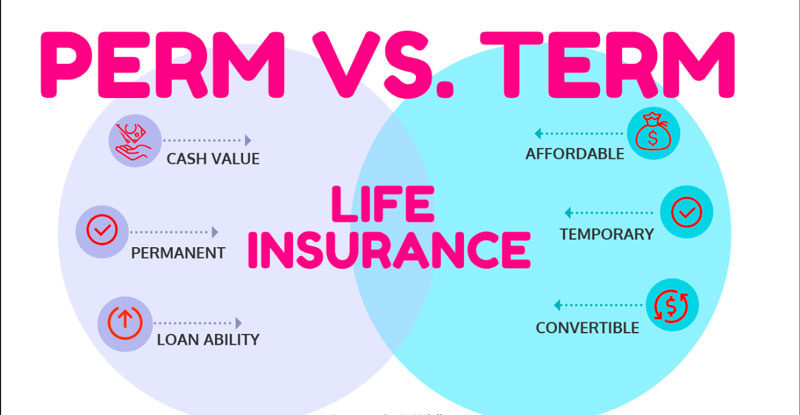

Permanent Life V / S Term Life

An employee's family may be protected by a term life insurance policy while they are still employed. An individual life insurance policy pays out a death payment to the heirs named by the policyholder if he or she dies, even if the policy may be renewed. When it comes to the concept of permanent life insurance, it's also known as cash-value insurance since it doesn't have an expiration date. Some policies do automatically expire once the insured person reaches the age of 100. Like the term, a policyholder's premiums build a savings benefit that may be used in the event of their death. As a result, permanent life insurance plans cost more than term life policies.

Recognizing the Two Sorts of Permanent Life

When purchasing life insurance, you may choose between a "term" and a "permanent" option. Permanent, as previously said, may be either universal or whole life. The premiums for whole life insurance are fixed, and the cash value will grow over time. In exchange, the premiums will be substantially more than they would be for term insurance coverage, but the payment is guaranteed. The only dangers are spending too much on fees or the firm going bankrupt.

Because the plans enable policyholders to reap the benefits of a booming stock market, universal life gives greater flexibility in premium rates, death payments, and savings. When they were originally launched in the mid-1980s, universal life insurance plans were quite popular as a source of retirement income. Because of this, the financial worth of the universal plans purchased during the period of low interest rates was considerably devalued.

The Truth of Universal Life Investment Gains

In the beginning, universal life insurance plans were established with rates of return ranging from 11% to 15%. They failed to account for the fact that interest rates would fall to single digits by the end of the twentieth century, therefore hurting the development of a plan's cash value. Policyholders were left with little choice but to foot the bill for their insurance premiums. Their policies lost all meaning if they could not manage to pay. These plans' primary selling point was undermined when they were hit with a substantial tax payment on whatever money they had withdrawn over the years.

Even more tempting than its insurance &'' savings aspects is its ability for policyholders to transfer cash between them. This flexibility is what makes it a viable option for whole-life coverage. You may be able to choose and select how the savings component funds are distributed in certain plans, similar to how you could choose between several mutual funds for the 401(k).

What Actually Occurs When You Retire

You may also use your universal life plan to supplement your retirement income after you have retired, which is a significant advantage over traditional term life insurance. An insurance plan's cash-value account does not have to be taxed as it grows. Cash value in life insurance policies can be used to bridge the gap between retirement and the age at which they are eligible for maximum Social Security advantages, as a few people do," he explains "According to David Wilken, a retired Voya Financial executive who served as chairman of Individual Life Sales. Others wait for the insurance to mature and then cash it out to get the most out of it. When it comes to cash-value life insurance, "the longer time you let your policy to develop, the better," says Wilken. "Plan to wait fifteen years after purchasing insurance before accepting dividends.

How Might Life Insurance Help Your Retirement?

Universal life insurance is a wonderful option if you need money in your later years, since you may draw from it when you retire. An insurance policy's cash-value account does not have to be taxed as it grows. Retirees may utilize this money to extend their Social Security benefits beyond the age of 70. Some people wait for their insurance to mature before cashing it out in order to get the most out of it. The most tax-efficient approach to utilize this money is to take out a loan against their cash worth.

The Conclusion

Every life insurance policy has its advantages and disadvantages. Defining your objectives is the greatest method to discover which is ideal for you. Term life insurance is perhaps the most cost-effective alternative if your main objective is to ensure that your relatives are financially secure following your death. While term life insurance may be used to supplement your retirement savings, permanent life insurance is the best choice. Whole life insurance or universal life insurance relies heavily on your own financial condition and risk tolerance. Any time you've had an extensive evaluation of your life insurance coverage in the last few years, you may want to get in touch with your insurance agent.