What is Webull?

Webull is an extremely new online dealer that was just established in 2017. The firm is wholly owned by Chinese investors and has its head offices in New York. It has just expanded its services to Shanghai and Hong Kong. The first portable release occurred in May 2018 and reflected Webull's most significant target demographic, millennials. Webull is targeting itself to represent newer and more active distributors and those attracted to a forum that offers a broad range of services for unlimited access. These free services include no minimum account requirements, commission-free marketing of equities and their alternatives, and multiple cryptocurrencies.

Webull is more geared toward the do-it-yourself investor and has fewer features than its full-service rivals. Despite this, Webull's clients need a lot of value for their money because of the platform's attractive design, extensive set of useful features, and reasonable margin rates. To assist you in determining if Webull is the ideal trader for your investment, we'll take a close look at the company.

Accessibility of Webull

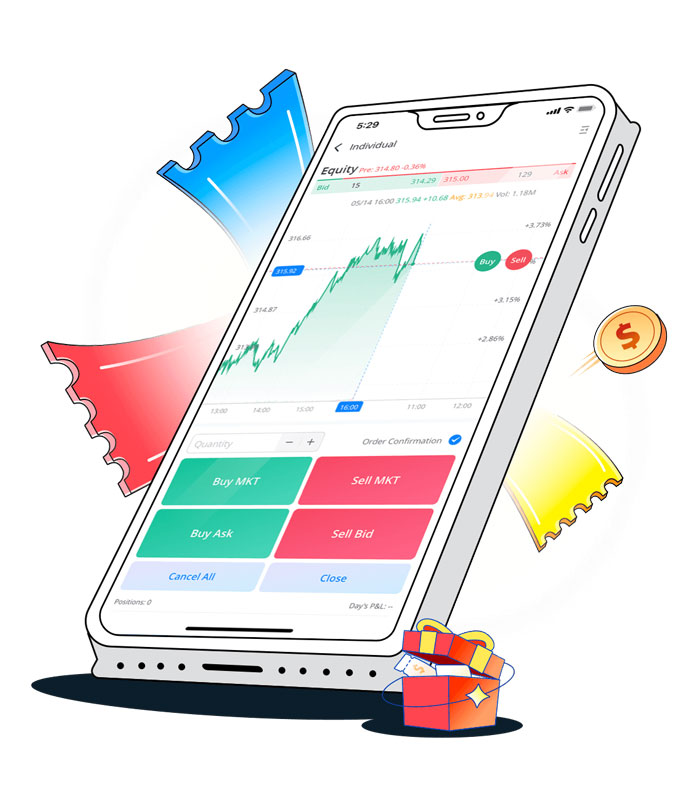

According to Webull Review, Webull’s interface is streamlined and straightforward. Webull offers a desktop portal, website, and mobile app. Every version has specific top-notch designs in terms of quality. As a result of the platforms' relatively recent construction, they all have a contemporary appearance and atmosphere.

Desktop computers and web pages have a navigation menu and window layout that concentrates on a significant set of buttons. These two interfaces are virtually indistinguishable from one another. These buttons bring up panels that can be customized and a stock page that provides various details on a single investment or ETF. There are a few distinctions between the online and the console, the most notable of which is that the website only offers options for a single leg.

The major functionalities of the mobile app are implemented, like how these components are integrated on the webpage and the workstation; however, the mobile app's appearance differs to accommodate the smaller displays it is utilized on. The buttons that make up the app's navigation menu move around so that they are always relevant to the material that is currently being displayed on the screen. For instance, a choice in the form of a button labeled "options" is seen at the bottom of the trading screen that displays a particular stock or ETF.

Stock screener findings can be used as the basis for a watchlist that can be accessed from any device. There's no need to duplicate your watchlists across the desktop, online, and mobile app because they're all synchronized. An easy-to-use interface makes it simple to place orders, and individual traders may even set their own preferences for the order type, share quantity, and other aspects of their trading tickets.

Trade Exposure of Webull

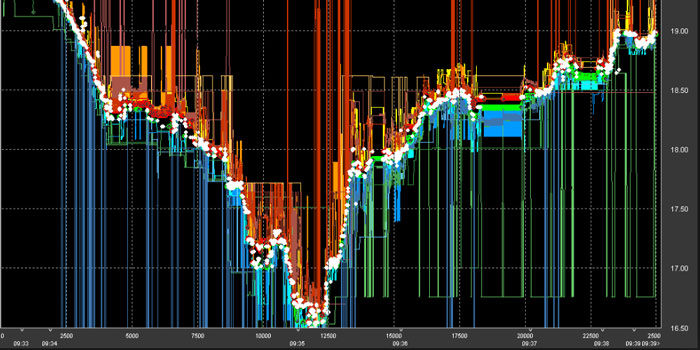

The workstation that Webull provides is very adaptable, and templates are accessible for day trading cryptocurrencies and trading equities and ETFs. Traders can toggle between these several template pages and construct their landing pages using custom widgets.

The widgets each hold a variety of information, including order input, time and sales, essentials, news, and options, amongst other things. It is possible to blend the gadgets in order to save screen space, and the various widgets may be accessed through the tabs.

A highly personalized user experience is also possible with the trading configuration thanks to features like hotkeys, a home page that loads automatically when the program begins, preset stock, and commonly used stock numbers. The workstation offers the most incredible adaptability and personalization of any other area.

When necessary, the system will direct you to a separate page, such as moving you to the equities window so that you may examine stock-specific statistics, news, alternatives, charts, and an overview of analyst evaluations. It is also essential to remember that the platform does not permit trading in multiple legs of options at this time.

Webull Pros and Cons

Advantages of Webull

- There are no commissions charged on equities, exchange-traded funds (ETFs), derivatives, or digital currencies: Webull gives out free stuff, which everyone desires, and they deliver on that promise. The ability to trade stocks, ETFs, options, and cryptocurrencies without paying a fee is particularly enticing to investors who don't want constant guidance. It is much simpler for traders to earn money off a trading technique when the implementation expenses are lower.

- Simple account signup and acceptance of available alternatives, in addition to the absence of fees or minimums: Establishing an account takes only a few minutes to complete. You will gain clearance for your trader and possibilities trading pretty quickly. Adding your financial institution and setting up a complimentary ACH transfer takes no more than a few extra minutes of your time.

- Real-time streaming estimates are also available in their free versions of Webull. The service in question is called Nasdaq total estimate. It gives users access to information displaying market depth in addition to a more significant depth of bidding and requests on securities.

- Now offering fractional shares, Webull expanded its product offerings over the past year to include fractional shares. This enables investors to buy a percentage of a unit based on the amount of money they have available to invest in the company.

Disadvantages of Webull

- Customers who have cash balances on their Webull accounts do not earn interest on their cash and do not receive any revenue from it. Customers of Webull cannot proactively invest any unused cash they have in a money fund since the brokerage does not facilitate the trading of mutual funds. It's possible that this won't be a significant issue given the current climate of meager short-term interest rates; however, if rates were to rise, the opportunity cost of missing out on earning interest on surplus cash would likely become more apparent.

- Webull can provide access to free trade and all its additional services since it is getting compensation for (PFOF). Because of this, the quality of Webull's price execution may suffer. While the speed and accuracy with which orders are typically completed today mitigate this concern for most traders, day distributors and those employing techniques that are particularly sensitive to an existing structure may be disadvantaged.