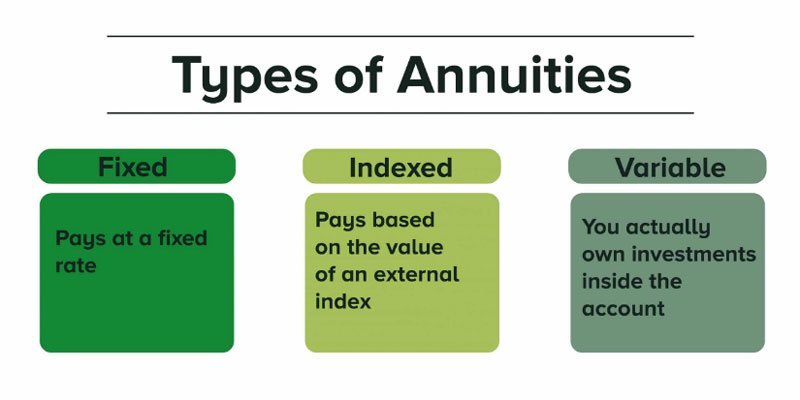

Fixed annuities, fixed indexed annuities, and variable annuities are the most common types of annuities, and they can all be either immediate or postponed. The classifications of "immediate" and "delayed" show when annuity payments begin. Your financial goals will help you determine which annuity is best for your situation.

Annuities: What are They?

When it comes to annuities, the idea is to offer a continuous flow of income, often throughout retirement. Money grows tax-deferred and can be withdrawn penalty-free after age 5912, just like 401(k) contributions.

You can customize an annuity in various ways to meet the purchaser's individual needs. Additionally, you have the option of annuitizing your donations, which means you can begin receiving payments at a predetermined time. Unlike a delayed annuity, which begins payments at a future date, an immediate annuity begins payments immediately.

Disbursements can be made for a variety of lengths of time. Payouts can be deferred for a set number of years, such as 25 years, or the duration of your natural life. You have the option. Although securing payments for the rest of your life can reduce the size of each check, one of the key selling features of annuities is the assurance that you won't outlive your assets.

Different Types of Annuities

Fixed, variable, and indexed annuities are the most common types. Each category has a different level of risk and reward. A deferred annuity is a standard structure for any of these scenarios.

Fixed

A guaranteed amount of money is paid out in fixed annuities. Fixed immediate annuities that pay a fixed rate immediately, and fixed delayed annuities, which pay you later, are two types of this annuity. Annual returns are only marginally better than bank certificates of deposit (CDs), but this certainty comes at a price.

Variable

The larger the return, the greater the risk that comes with variable annuities. Your "sub-account" comprises mutual funds that you can choose from. Retirement payouts are based on the performance of your sub-investments. account's

Indexed

Indexed annuities are in the middle of the spectrum regarding risk and reward. If the S&''P 500 goes up, you get a guaranteed minimum dividend, but a percentage of your return is related to that of a market index like that.

Variable and indexed annuities are typically criticized for their complexity and high fees, despite their potential for higher returns. In many cases, annuitants face substantial surrender charges if they need to cash out early in the contract.

Purpose of Annuities

Annuities are typically purchased as a supplement to pensions and Social Security. Even if their other assets are depleted, they will continue to have a steady income, thanks to a life-long annuity.

Comparison of Fixed and Variable Annuities

Fixed Annuities

A fixed annuity guarantees the buyer a specific payment at some point in the future, which could be decades in the future or immediately now, depending on the type of annuity purchased. Safe investments like U.S. treasury securities and highly rated corporate bonds help the insurance meet its financial goals.

These investments are safe and reliable but don't offer exceptionally high returns. A fixed annuity's value may decline due to inflation, so paying a higher premium for a product that includes inflation protection is essential. In any case, fixed annuities may be a decent option for those who are wary of taking risks with their regular monthly income and have a low-risk tolerance.

Variable Annuities

Each year, the insurance company invests in various mutual funds chosen by the policyholder. The growth of the account and the size of the buyer's payoff will be determined by the success of those funds.

There are two options for variable annuity payouts: fixed or varying, depending on the account's performance. Variable annuities are popular among investors willing to risk in the hopes of making more money. Variable annuities are best suited to seasoned investors aware of mutual fund kinds and the dangers they carry."

Comparison of Deferred and Immediate Annuities

When it comes to the start of payments, annuities can be either immediate or postponed. The most important consideration for buyers is whether or not they are looking for a steady stream of income now or at some point in the future. There are advantages and disadvantages to both fixed and variable annuities.

An account with a deferred payment has more time to grow. There is no tax on the annuity's earnings as long as it is held till the money is taken. That might grow into a sizable sum and lead to larger payments over time. The accumulation phase or accumulation period is an annuity jargon for this stage.

Exactly what it sounds like, an immediate annuity. The benefits commence once the buyer has made a one-time payment to the insurance company. Fixed and variable annuities are available for both deferred and immediate annuities.