Although it didn't take on its current proportions (or name) until 1957, the Standard & Poor's 500 Index had its roots in the 1920s. In 1926, it was transformed into a composite index that followed the performance of 90 different companies. 1 The yearly return has been 10.49 percent on average since the company was established in 1926 and will continue through the end of 2021. 2 Since the inclusion of 500 companies in the index in 1957, investors have enjoyed an annualized return of 10.67 percent on average up through the end of 2021.

The Evolution of the S&P 500 Index

- The value of the index increased to just over 800 in the first decade after it was introduced in 1957. This reflected the economic growth that occurred in the United States in the years after World War II.

- From 1969 to 1981, the index steadily went down, and by 1981, it had reached a level lower than 360, indicating high inflation.

- From October 2007 to March 2009, the S&P 500 index saw a decline of 46.13 percent due to the Great Recession and the financial crisis that occurred in 2008.

- The S&P 500 had recovered from the financial crisis by March 2013 and was well on its way to finishing its 10-year bull run with a gain of more than 250 percent by the end of 2019.

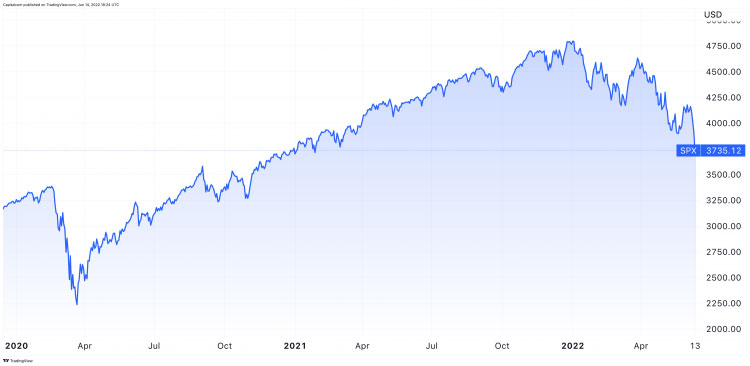

- The pandemic induced by COVID-19 in 2020 and the recession that followed both contributed to a decline of approximately 20 percent in the S&P 500.

- The recovery of the S&P 500 began in the second part of 2020 and continued into 2021 when it reached a series of new all-time highs.

Inflation Affects the Returns of the S&P 500

Inflation is one of the most significant challenges for an investor seeking to consistently replicate that 10.67 percent annualized return. Whose numbers some analysts believe vastly understate the true inflation rate?

How Timing the Market Affects Returns on The S&P 500

When an investor decides to join the annual return market, another significant aspect is the yearly returns the investor receives from the S&P 500. For instance, an investor who purchased SPDR S&P 500 ETF Trust (SPY), which effectively replicates the index, had relatively positive returns on their investment between 1996 and 2000. Still, they saw a continuous decline in value from 2000 to 2002.

If an investor purchases securities at a time when the market is at a low point and then either holds on to them or sells them when the market is at high energy, they will enjoy greater returns than investors who purchase securities when the market is at high power and then sells when the market is at a lower point. This is especially true if. It should be no surprise that the timing of a stock purchase might affect the profits of that investment. Dollar-cost averaging is a strategy that may be used by those interested in minimizing their exposure to market volatility but who do not want to take on the risks associated with active trading.

What Does It Mean to Be in The S&P 500 Index?

The companies included in the S&P 500 Index are selected to represent the general return characteristics of the stock market as a whole. The companies whose shares are included in the S&P 500 are chosen based on their market size, liquidity, and industry. Standard & Poor employs a committee known as the S&P 500 Index Committee to make decisions on whether companies should be included in the S&P. The committee makes these decisions. The index's performance is largely reflective of that of large-cap stocks as a whole. Financial experts regard the Standard & Poor's 500 Index as a key economic indicator for both the stock market and the economy of the United States.

Purchasing

Because doing so would require purchasing each of the 500 individual companies that make up the S&P 500, most individual investors find it challenging to invest their own money in the index. However, investors may replicate the index's performance by purchasing shares in an exchange-traded fund that tracks the S&P 500 Index. Because these funds replicate the index's assets in their portfolios, their returns and yields are identical to those of the index.

A stockbroker is essential for making investments of this kind in financial assets. There is room for the price, feature, and purpose differentiation among brokers. While some brokers may focus on more complex trading strategies, others may be more suited for newcomers to the market.